Earned Income Tax Credit, EIC or EITC

Beaver Dam, Wisconsin

D. Hoefler @johnwestrock

The Earned Income Tax Credit, EITC or EIC - is a refundable tax credit for taxpayers who earn low or moderate incomes. This credit is meant to supplement your earned income you earned through either working for an organization (W-2 income, for example) or working for yourself - self-employed.

To qualify, you must meet specific income limits and filing requirements, and the amount of the credit varies based on your income, filing status, and number of qualifying children.

Earned Income Tax Credit: An Overview

The EIC and the Child Tax Credit are two of the most beneficial tax credits for taxpayers. The EIC is fully refundable, the Child Tax Credit is partially refundable, and you can claim both if you qualify in the same year. These credits can lower your taxes due or even add to your tax refund.

Use the EITCucator

As a quick reference, refer to the updated EITC table below to see if you may qualify for the Earned Income Credit. You can also launch the EITCucator to get a more accurate answer. The table below is organized by filing status and AGI criteria based on the number of dependents*.

Earned Income Credit Limits, Criteria etc. for Tax Year 2024

AGI Minimum for all Filing Statuses

$8,260

$12,390

$17,400

$17,400

AGI Threshold Phaseout for Filing Status: Single, Head of Household, or Widowed

$10,330

$22,720

$22,720

$22,720

AGI Limit for Filing Status: Single, Head of Household, or Widowed

$18,591

$49,084

$55,768

$59,899

AGI Threshold Phaseout for Filing Status: Married Filing Jointly

$17,250

$29,640

$29,640

$29,640

AGI Limit for Filing Status: Married Filing Jointly

$25,511

$56,004

$62,688

$66,819

Maximum EITC Amounts

$621

$4,213

$6,960

$7,830

Investment income limit: $11,600 or less.

*Qualifying Children/Persons must meet the following:

- Age criteria: less than 19 OR less than 24 and a student as of December 31 of the tax year

- Relationship criteria: son, daughter, stepchild, foster child, or descendant of any of them (e.g., grandchild), brother or sister (half or step), niece, nephew, lawfully adopted child, or a foster child if placed by an authorized agency or by judgement decree or any court competent jurisdiction

- Residency criteria: must have lived with you in the U.S. for more than 6 months.

**Persons with no qualifying dependents must meet the following:

- You or your spouse (not both if filing married jointly) must be at least age 25 but under age 65 as of Dec. 31 of the tax year

- You cannot be the dependent or a qualifying child of another person

- You must have lived in the U.S. for more than 6 months.

If you qualify for the Earned Income Tax Credit (EITC), you can reduce your taxes and increase your tax refund. The EITC allows taxpayers to keep more of their hard-earned money. The credit is based on your total earned income or your total adjusted gross income (AGI), whichever is higher.

For example, if you have unemployment income, it is not considered earned income, but it will be included in your AGI since unemployment is taxable income. The income limits are adjusted every year, so even if you did not qualify for the EITC in the past, you might qualify now and be able to claim it this year on your return.

Do You Qualify for the Earned Income Tax Credit?

We have easy ways for you to find out if you qualify for the EITC and what your credit amount might actually be. Launch the EITCucator below, answer a few important question about yourself and voila; you will get your answer. No need to read lots of Tax Mumbo Jumbo!

Use the EITCucator

Let's make IT happen! IT is Income Taxes. Start your current year return now and the eFile Tax App will figure this all out for you. No questioning, wondering, nor guessing about IT. Start and PrepareIT, but not alone; we are there with you all the way.

EITC Requirements And Qualifications

What would taxes be without more requirements? It is estimated that 1 out of 5 people who qualify for the EITC think they don't qualify for it, don't know about it, or used to not claim it on their tax returns. You do not have to worry about this if you file your tax return on eFile.com. The eFile Tax App will detect if you qualify for the Earned Income Credit based on the information entered. See more details from the IRS here: EITC Overview.

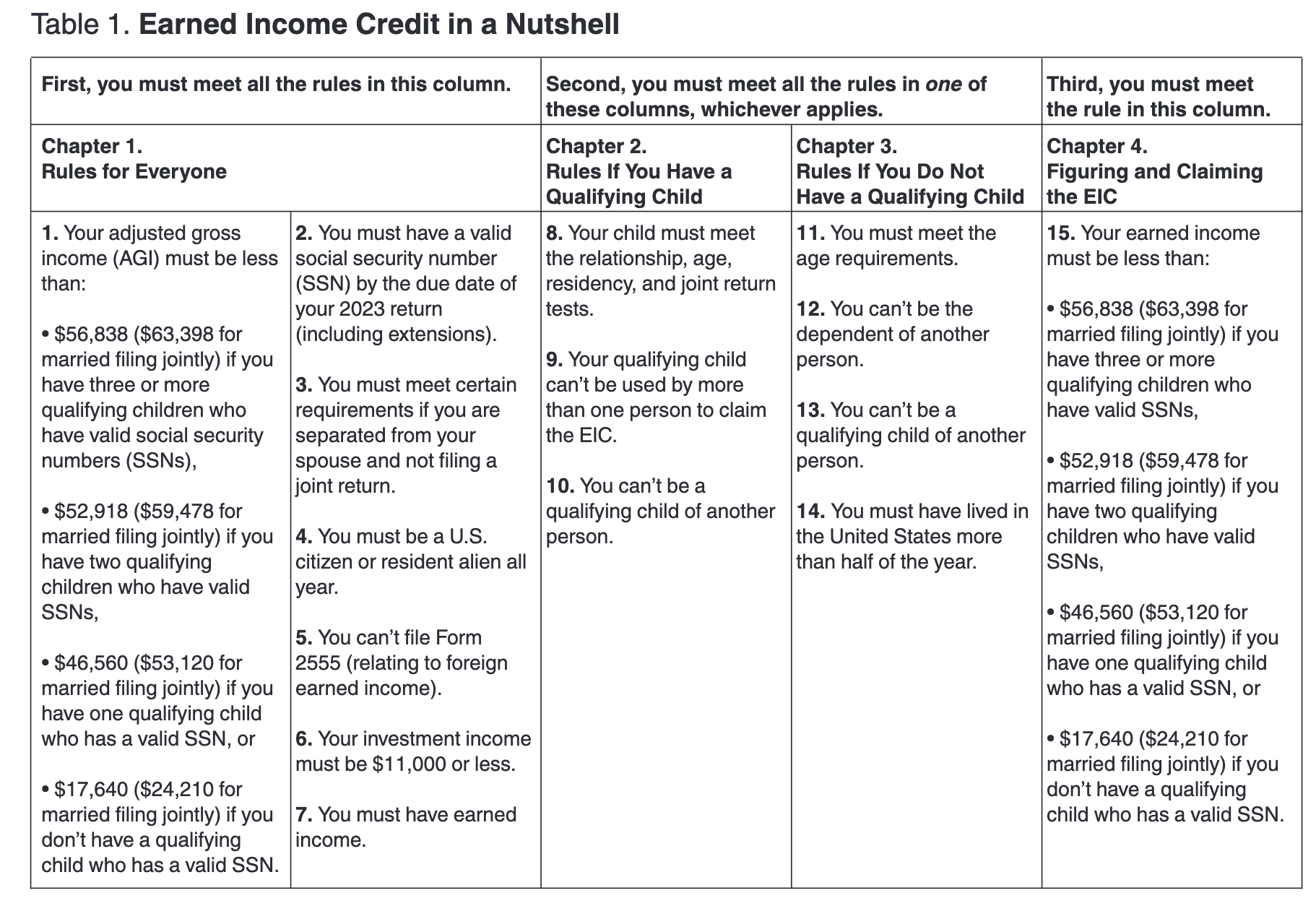

Below is an IRS chart on how one qualifies for the EITC - the figures change year-to-year, see the 2024 year table above.

Single taxpayers with no children or dependents are the largest group of qualifying taxpayers who think they do not qualify for the Earned Income Tax Credit on their taxes or they did not claim the EITC on their tax returns in the past. These taxpayers are most likely to not claim the EITC if they don't use a tax program like eFile.com that claims it automatically.

Attention: Even if you are not married and/or have no children, you may still be able to claim the credit. You qualify for the EITC as long as you were at least 25 but younger than 65 on December 31 of the tax year, you earned income through work, and you meet the income limits specified above. eFileIT and you know you will not miss IT!

KEY TAKEAWAYS

- The Earned Income Tax Credit, or EITC, is a credit you can claim on your taxes if your income falls below a certain level. It is for people who work and earn income from a job or running their own business. Income from investments doesn't count toward qualifying for the credit.

- Not everyone qualifies for the EITC. Whether you qualify for the EITC depends on a few things: your marital status (filing single, married, etc.), how much you earn, and how many kids you have.

- To qualify for the EITC, taxpayers must have an investment income of $11,000 or less for the 2023 tax year. Investment income includes taxable interest, dividends, and capital gain distributions.

- For the 2023 tax year, the maximum EITC ranges from $600 for taxpayers with no children to $7,840 for those with three or more children. Income limits differ based on filing status and number of dependents.

- The EITC can give you a much bigger tax refund than you might expect. This extra money can be a big help with everyday expenses like rent, groceries, or even unexpected bills.

Other taxpayers that frequently think they do not qualify for the Earned Income Tax Credit are: the self-employed, taxpayers in rural areas, grandparents raising their grandchildren, recently divorced couples, recently unemployed taxpayers, taxpayers with no children, and recipients of disability benefits and other income.

Don't let this happen to you! When you prepare your tax return on eFile.com, we will automatically check to see if you qualify for the EITC, calculate the amount of your credit, and fill out the right forms for you to claim it.

Important: Even if you don't owe income taxes or you think you don't have to file a return, you could still get the Earned Income Tax Credit as a form of a tax refund when you e-file or file a return. First, start and use the free EICucator tax tool - Earned Income Credit Educator - to see if you qualify for the EITC.

Additional Requirements to Qualify for the Earned Income Tax Credit

Below are some specific requirements that relate to your eligibility to claim the EITC.

- You, your spouse if married filing jointly, and any qualifying children you claim must each have a valid Social Security Number.

- You must have earned income (from wage employment or self-employment).

- If you file as married filing separate and claim the EITC if you had a qualifying child/person who lived with you for more than half of the year, and EITHER of these 2 qualifications:

- You lived apart from your spouse for the last 6 months of the year.

- You are legally separated according to your state law under a written agreement. or a decree of separate maintenance. and you didn't live in the same household as your spouse at the end of the year.

- You must be a U.S. citizen or resident alien for the whole year, or a nonresident alien married to a U.S. citizen or resident alien and filing a joint return.

- You cannot be the qualifying child (for the Earned Income Credit) of another person.

- Your qualifying child for the EITC cannot be used by more than one person to claim the EITC.

- If you do not have a qualifying child, you must:

- be at least 25 but younger than 65 at the end of the tax year,

- live in the United States for more than half the year, and

- not be the qualifying child of another person.

- You cannot claim the Foreign Income Exclusion for your foreign earned income.

- Your dependents must have a Social Security number to qualify for a higher EITC.

See more detailed information on the Earned Income Tax Credit.

The EITC can be confusing. If you need more help determining if you are eligible for the Earned Income Tax Credit and figuring the exact amount of your credit, you should just begin preparing a tax return using eFile.com and we will calculate your EITC credit amount for you.

Below are some special situations regarding the EITC:

- Members of the Military - Members of the armed forces do not normally include nontaxable pay, such as combat pay, in their earned income when calculating the Earned Income Credit. However, they may choose to include nontaxable pay in their earned income for the purposes of calculating the EITC. This may have the effect of increasing their credit amount.

- Members of the Clergy - The housing allowance provided for a member of the clergy as a part of their pay is not normally included in taxable income, but it is reported as a part of their net earnings from self-employment. Therefore, the housing allowance (or rental value of the home) may be included in earned income for the purposes of calculating the Earned Income Tax Credit.

- Those Receiving Disability Benefits - Disability retirement benefit payments are included in earned income if you are younger than your minimum retirement age (the earliest age you could have received a pension had you not been disabled). After your minimum retirement age, any disability benefit payments will be considered taxable pension payments and may not be counted as earned income. Social Security Disability Insurance and private disability insurance payments for which you paid the premiums are not considered earned income for the purposes of calculating the EITC.

- Adopted Children - If your adopted child has not yet been issued a Social Security Number, he/she may be assigned an Adoption Taxpayer Identification Number for tax purposes. Unfortunately, this number may not be used to claim a qualifying child for the Earned Income Credit. To claim the EITC, you may file an amended tax return once your child has been assigned their SSN. If you have adopted a child, find out about the Adoption Tax Credit.

- The IRS - not eFile.com - has not been processing federal tax refunds to taxpayers who are claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) before mid-February. The IRS is required to hold the entire tax refund, including the portion not associated with the credits mainly for security and fraud prevention reasons. The additional time will ensure taxpayers to receive the refund they’re due, not someone else.

- Noncustodial Parents Claiming the EITC for Dependent: According to the IRS, as a noncustodial parent, you can not claim the EITC for a dependent if the custodial parent relinquished their dependency exemption and assigned it to the non-custodial parent via filing Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. You can only claim it for yourself, not the dependent - you can claim the Child Tax Credit if given permission, however. The IRS will likely you an audit letter requesting more information from you, you need to complete, sign, and mail Form 886-H-EIC to the IRS. Attach any documents listed on the form to prove that you can claim the EITC.

State and Local Earned Income Tax Credits

Twenty-four states, including the District of Columbia and New York City, have their own Earned Income Tax Credits. All of them, except Delaware, Hawaii, Maine, Ohio, Oklahoma, South Carolina, and Virginia have refundable credits. If you are filing a tax return for one of these states, we will help determine if you qualify for a state or local EITC, as well as the Federal EITC, when you prepare your tax return on eFile.com.

States with Local Earned Income Tax Credits:

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- New York City, NY

- Ohio

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Vermont

- Virginia

- Wisconsin

Summary to Claim the EITC

When you prepare your tax return on eFile.com, we will automatically check to see if you qualify for the Earned Income Tax Credit. If you qualify for the EITC, eFile.com will calculate the exact amount of your credit for you. It will also generate the form(s) you need to claim your full credit and prepare them for you. See other tax credits and tax deductions you may qualify for on your tax return.

For specifics, see the income limits and other criteria for current, future, and previous year returns. The tables below (future and previous) indicate the minimum amount of earned income to claim the credit, the amount at which the credit begins to phaseout, the maximum AGI for a taxpayer based on their filing status to claim any of the credit, the maximum credit amount, and the investment income limit.

EITC by Tax Year, Future and Back Taxes

The tables below show the Earned Income Credit by filing status, minimum earned income required, the phaseout range, and the maximum credit by filing status.

Earned Income Credit Limits, Criteria etc. for Tax Year 2023

AGI Minimum for Filing Status: Single, Head of Household, or Widowed

$7,840

$11,750

$16,510

$15,510

AGI Threshold Phaseout for Filing Status: Single, Head of Household, or Widowed

$9,800

$21,560

$21,560

$21,560

AGI Limit for Filing Status: Single, Head of Household, or Widowed

$17,640

$46,560

$52,918

$56,838

AGI Threshold Phaseout for Filing Status: Married Filing Jointly

$16,370

$28,120

$28,120

$28,120

AGI Limit for Filing Status: Married Filing Jointly

$24,210

$53,120

$59,478

$63,398

Maximum EITC Amounts

$600

$3,885

$6,604

$7,840

Investment income limit: $11,000 or less.

Below, find previous year or back tax criteria for the EITC in the respective year.

2022 Earned Income Credit Limits, Amounts, Criteria

Number of Qualifying Children/Persons

Zero

One

Two

Three Plus

AGI Must be Less Than for Filing Status: Single, Head of Household, or Widowed

$16,480

$43,492

$49,399

$53,057

AGI Must be Less Than for Filing Status: Married Filing Jointly

$22,610

$49,622

$55,529

$59,187

Maximum EITC Amounts

$560

$3,733

$6,164

$6,935

Investment Income Limit

Investment Income Limit $10,300 or less

2021 Earned Income Credit Limits, Amounts, Criteria

Number of Qualified Children

Zero

One

Two

Three Plus

2021 AGI Limit for Filing Status: Single, Head of Household, or Widowed

$21,430

$42,158

$47,915

$51,464

2021 AGI Limit for Filing Status: Married Filing Jointly

$27,380

$48,108

$53,865

$57,414

Maximum EITC Amounts

$6,728 with three or more qualifying children

$5,980 with two qualifying children

$3,618 with one qualifying child

$1,502 with no qualifying children

Investment Income Limit

Investment Income Limit $10,000 or less

Note for 2021 Returns and the EIC: As part of the third stimulus bill or American Rescue Plan Act (ARPA), the EITC became more beneficial for low to moderate income taxpayers on 2021 returns. Specifically, the credit was significantly more helpful for single taxpayers with no dependents. Also for your 2021 EIC, you can use your 2019 earned income to determine the amount of your credit if it is higher than your 2021 earned income. Additionally, for 2021 only, specified students under age 24 without a qualified dependent may qualify if they work. They qualify if they are a former foster youth or homeless youth who would otherwise be able to claim it or are married filing jointly with someone who is eligible. Again, these changes were for 2021 Tax returns only. Scroll further down the page to see the amounts in the 2021 table. Get an idea of your tax situation before you file your 2021 return.

2020 Earned Income Credit Limits, Amounts, Criteria

Number of Qualified Children

Zero

One

Two

Three Plus

2020 AGI Limit for Filing Status: Single, Head of Household, or Widowed

$15,820

$41,756

$46,703

$50,162

2020 AGI Limit for Filing Status: Married Filing Jointly

$21,370

$46,884

$52,493

$55,952

Maximum EITC Amounts

$6,660 with three or more qualifying children

$5,920 with two qualifying children

$3,584 with one qualifying child

$538 with no qualifying children

Investment Income Limit

Investment Income Limit $3,650 or less for Tax Year 2020

2019 Earned Income Credit Limits, Amounts, Criteria

Number of Qualified Children

Zero

One

Two

Three Plus

2019 AGI Limit for Filing Status: Single, Head of Household, or Widowed

$15,570

$41,094

$46,703

$50,162

2019 AGI Limit for Filing Status: Married Filing Jointly

$21,370

$46,884

$52,493

$55,952

Maximum EITC Amounts

$529 with no qualifying children

$3,526 with one qualifying child

$5,828 with two qualifying children

$6,557 with three or more qualifying children

Investment Income Limit

Investment Income Limit $3,600 or less

2018 Earned Income Credit Limits, Amounts, Criteria

Number of Qualified Children

Zero

One

Two

Three Plus

2018 AGI Limit for Filing Status: Single, Head of Household, or Widowed

$15,270

$40,320

$45,802

$49,194

2018 AGI Limit for Filing Status: Married Filing Jointly

$20,950

$46,010

$51,492

$54,884

Maximum EITC Amounts

$519 with no qualifying children.

$3,461 with one qualifying child

$5,716 with two qualifying children

$6,431 with three or more qualifying children

Investment Income Limit

Investment Income Limit $3,500 or less

2017 Earned Income Credit Limits, Amounts, Criteria

Number of Qualified Children

Zero

One

Two

Three Plus

2017 AGI Limit for Filing Status: Single, Head of Household, or Widowed

$15,051

$39,617

$45,007

$48,340

2017 AGI Limit for Filing Status: Married Filing Jointly

$20,600

$45,207

$50,597

$53,930

Maximum EITC Amounts

$510 with no qualifying children

$3,400 with one qualifying child

$5,616 with two qualifying children

$6,318 with three or more qualifying children

Investment Income Limit

Investment Income Limit $3,450 or less

2016 Earned Income Credit Limits, Amounts, Criteria

Number of Qualified Children

Zero

One

Two

Three Plus

2016 AGI Limit for Filing Status: Single, Head of Household, or Widowed

$14,880

$39,296

$44,648

$47,955

2016 AGI Limit for Filing Status: Married Filing Jointly

$20,430

$44,846

$50,198

$53,505

Maximum EITC Amounts

$506 with no qualifying children

$3,373 with one qualifying child

$3,373 with two qualifying children

$6,269 with three or more qualifying children

Investment Income Limit

Investment Income Limit $3,400 or less

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.