Tax Payment Options When Filing

During the e-filing or checkout process on eFile.com, you can pay via electronic fund withdrawal (direct debit) or check/money order. You can only submit payments for the 2024 tax year. See alternative IRS and state tax payment options if you choose not to use the options below.

Pay Taxes Online: IRS or Federal | State(s)

If you owe taxes and cannot pay, find out what to do. Even if you can't pay, prepare and e-file your next tax return as soon as possible. If you miss the April 15 deadline, file as soon as possible to avoid or reduce IRS penalties. Filing a tax extension does not give you more time to pay.

How to Pay Taxes with My Return?

When paying the IRS or state taxes, there are three scenarios:

1. Ready to pay now: A taxpayer has the necessary funds or is okay with paying taxes by credit/debit card now.

2. Not ready to pay now but over time: A taxpayer lacks funds to pay on time but wants to pay over time via tax payment plans.

3. Doesn't want to pay taxes now or later: A taxpayer either lacks funds or chooses not to pay taxes.

This page focuses on paying taxes; see how to set up a payment plan if you lack funds.

How to Pay from My Bank Account?

Note: images below are for informational purposes and not interactive.

1. Sign into your eFile.com account.

2. Select "File" in the green menu and follow the prompts until you see:

3. Ensure "Yes, I want to pay my federal taxes owed by direct debit" is selected, then select "Continue Filing".

Note: If you owe state taxes, you’ll see state payment options on the same screen.

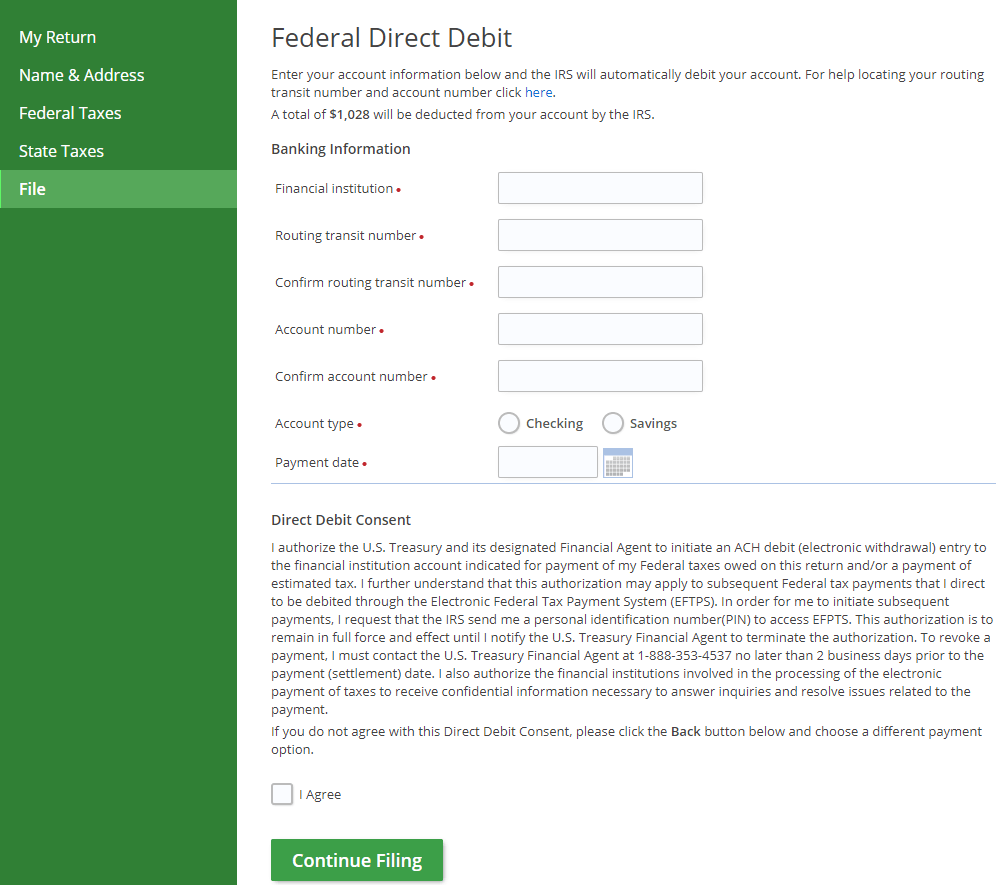

4. Enter your federal direct debit information:

If you are filing after Tax Day, your payment will be authorized on the day you file. Double-check your bank information before submitting your payment.

5. If you owe state taxes, follow the prompts for state payments if applicable.

How to Pay the IRS or State Directly?

Note: images below are for informational purposes and not interactive.

1. Login to your eFile.com account.

2. Select "File" and follow the prompts until you reach:

Select "No thanks, I'll pay later" for the check/money order option, then select "Continue Filing".

3. Under "My Account", download your tax return PDF to access your payment voucher.

Recommended: Keep a copy for your records and go to the IRS payment page to submit your payment online. Pay as little or as much as you can to reduce IRS penalties.

If you prefer not to pay online, print payment voucher Form 1040-V and follow the instructions. Include your Social Security number and other details on your payment.

6. Mail your check/money order and voucher to the correct IRS mailing address.

Any questions about paying your taxes? Contact us for assistance.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.