Where to Mail Federal Tax Return?

Mailing taxes can be a hassle, with paperwork, stamps, and potential delays in delivery. Instead of navigating the stress of traditional filing, consider e-filing your taxes. It’s faster, more secure, and often allows for quicker refunds. Plus, e-filing minimizes the risk of errors and lets you track your submission in real-time.

The mailing address for the IRS depends on the state or territory you currently live in, whether you expect a tax refund, or if you are submitting a payment. These addresses apply to both taxpayers and tax professionals filing Form 1040 or 1040-SR for the current or prior filing years. Note that e-filed returns DO NOT need to be mailed.

Should I Mail or e-File My Taxes?

- You can pay taxes online, even if you are mailing in your return. You can also include your direct deposit information on your return if you’re expecting a refund.

- Always file something, even if you can’t pay right away. Why? Late filing penalties are often higher than late payment penalties!

- The Form 1040-X for tax amendments has a different IRS mailing address compared to your original return. Check the instructions for other tax forms, as they often have their specific mailing address for IRS returns listed on the informational pages.

- If you move and need to update your mailing address with the IRS—especially if you are expecting a tax refund check—complete Form 8822 and mail it to the address provided on the form (this form cannot be e-filed). Alternatively, you can update your address when you file your next tax return, but it’s generally a good idea to update it soon after you move.

Say Goodbye to Paper Returns—E-File Now!

Skip the paper hassle and e-file your IRS 1040 Forms and state returns at eFile.com. Missed the deadline? No problem! Access prior year forms, complete them online, and mail them to the correct address. Get started today!

Where to Mail My Return?

Check out the table below for the IRS mailing addresses organized by residency. It’s important to send your returns to the right address based on the specific Form 1040 you are filing. If you used eFile.com to prepare your return, don’t forget to include copies of your income forms! Lastly, to ensure your tax return is processed smoothly and on-time, double-check that you are using the correct mailing address for IRS.

U.S. Postal addresses are below | see private services

Frequently Asked Questions

What is the official mailing address for the IRS?

The IRS does not have a single official mailing address. The address depends on the specific type of document you are sending. Check out the table above to find the correct IRS mailing address for your needs.

What is the IRS mailing address for 1040?

The IRS mailing address for a 1040 tax return varies depending on your location. You can find the correct address mentioned in the table above or the instructions for the 1040 form.

How to update my mailing address with the IRS?

To update your mailing address with the IRS, you can use the IRS website or submit Form 8822, Change of Address.

What is the IRS mailing address for payments?

The IRS mailing address for payments also varies depending on your location and the type of payment you are making. You can find the correct address mentioned above or in the instructions for the specific payment you are making.

What Are the IRS Mailing Addresses by State?

For U.S. Residents, the IRS has six main addresses for mailing in Ogden, Utah, Kansas City, Missouri, Louisville, Kentucky, Cincinnati, Ohio, Austin, Texas, and Charlotte, North Carolina. These vary based on whether you are attaching payment or expect a refund. Find the IRS Ogden Utah address, the IRS Kansas City address, and more by state below.

Click on the state you live or reside in - most likely the same address as on your tax return - below and find the mailing address for your IRS tax forms. The IRS mailing addresses listed below can also be stored and/or printed by clicking the link.

Alabama Resident

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Alaska Resident

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Arizona Resident

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Arkansas Resident

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

California Resident

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Colorado Resident

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Connecticut

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Delaware

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

District of Columbia

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Florida

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Georgia

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Hawaii

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Idaho

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Illinois

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Indiana

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Iowa

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Kansas

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Kentucky

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Louisiana

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Maine

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Maryland

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Massachusetts

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Michigan

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Minnesota

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Mississippi

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Missouri

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Montana

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Nebraska

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Nevada

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

New Hampshire

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

New Jersey

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

New Mexico

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

New York

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

North Carolina

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

North Dakota

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Ohio

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Oklahoma

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Oregon

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Pennsylvania

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Rhode Island

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

South Carolina

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

South Dakota

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Tennessee

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Texas

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

Utah

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Vermont

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Virginia

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Washington

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

West Virginia

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Wisconsin

1040

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

Wyoming

1040

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

American Samoa

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

Guam

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

Northern Mariana Islands

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

Puerto Rico

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

U.S. Virgin Islands

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

Note: for some of the western states, the following addresses were previously used:

- No payment attached: Department of the Treasury | Internal Revenue Service | Fresno, CA 93888-0002

- With payment attached: Internal Revenue Service | P.O. Box 7704 | San Francisco, CA 94120-7704.

Can I Use UPS, FedEx, etc. to Mail to the IRS?

If you elect to use a private delivery service (PDS), you will want to use the addresses in the table below instead of the by-state addresses.

Attention: The addresses in this section are ONLY if you send via a private sender service, such as FedEx or UPS, that require a street mailing address. If you are sending via United States Postal Service, select from the addresses listed below by state.

Step 1: Identify the IRS processing center location based on your current resident state or IRS tax return mailing address, the address based on the form, and whether your owe taxes or expect a tax refund.

Step 2: If you plan to send via private service, identify the IRS center and lookup the associated private sender address.

Learn your options to

contact the IRS.

UPS, FedEx, etc. ONLY

Kansas Processing Center Address

Kansas City - Internal Revenue Submission Processing Center

333 W. Pershing

Kansas City, MO 64108

UPS, FedEx, etc. ONLY

Austin Processing Center Address

Austin, Texas - Internal Revenue Submission Processing Center

3651 S IH35

Austin TX 78741

UPS, FedEx, etc. ONLY

Fresno Processing Center Address

Fresno - Internal Revenue Submission Processing Center

5045 East Butler Avenue

Fresno, CA 93727

UPS, FedEx, etc. ONLY

Ogden Processing Center Address

Ogden - Internal Revenue Submission Processing Center

1973 Rulon White Blvd.

Ogden, UT 84201

Where to File if I Do Not Reside in the U.S.?

As a U.S. citizen living outside of the states, use the 1040 address below; as a non-U.S. citizen filing a nonresident return, use the 1040-NR. You can e-file both these returns on eFile.com.

1040

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

1040NR

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

If you live in Puerto Rico, Guam, U.S. Virgin Islands, American Samoa, or Northern Mariana Islands, review IRS Publication 570, Tax Guide for Individuals with Income from U.S. Possessions.

Where to Mail Form 941?

The deadlines to file quarterly returns for employers are generally the end of the month following a quarter. For example, for wages paid during Q1 (January - March), the first 941 would be due April 30. If the end of the month falls on a weekend of holiday, the deadline is moved to the next business day.

Note: we at eFile.com currently only support the preparation and e-filing of individual income tax returns via Form 1040 and individual income state returns.

The IRS does accept e-filed 941 Forms for Employer's Quarterly Federal Tax Returns and they encourage employers to e-file rather than mail. Otherwise, use the addresses below to mail your 941 Return based on the state the business operates and whether or not you owe taxes.

Connecticut, Delaware, District of Columbia, Illinois, Indiana, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, Vermont, West Virginia, Wisconsin

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0005

Internal Revenue Service

PO Box 806532

Cincinnati, OH 45280-6532

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0005

Internal Revenue Service

P.O. Box 932100

Louisville, KY 40293-2100

Georgia, Kentucky, North Carolina, South Carolina, Tennessee, Virginia

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

Internal Revenue Service

P.O. Box 806531

Cincinnati, OH 45280-6531

No principal place of business nor legal residence in any state

Department of the Treasury

Internal Revenue Service

PO Box 409101

Ogden, UT 84409

Internal Revenue Service

P.O. Box 932100

Louisville, KY 40293-2100

Special filing addresses for exempt organizations; Indian tribal governmental entities; and other governmental entities, regardless of location

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0005

Internal Revenue Service

P.O. Box 932100

Louisville, KY 40293-2100

How to Prepare a Ta Return for Mailing?

Most returns can be e-filed, but some may need to be mailed; back taxes always need to be mailed and certain forms cannot be e-filed.

Sign in to your eFile.com account and confirm that all of your information entered is correct. Be sure to check your forms under Federal Taxes > Review and review the bank account provided. Then, select My Account from the top menu.

Recommended: Use a desktop or laptop computer, not a phone or tablet.

Select the PDF icon for the tax return you want to mail in which will open the PDF in a new window. Print this full document as you will need various parts of it.

Separate the printed document into sections:

- Federal return

- Each state return.

1. Mailing Your Federal IRS Tax Return

Confirm the bank information is correct on the return if you are having your refund deposited to a bank account. When you mail your return, you can provide a bank account for direct deposit.

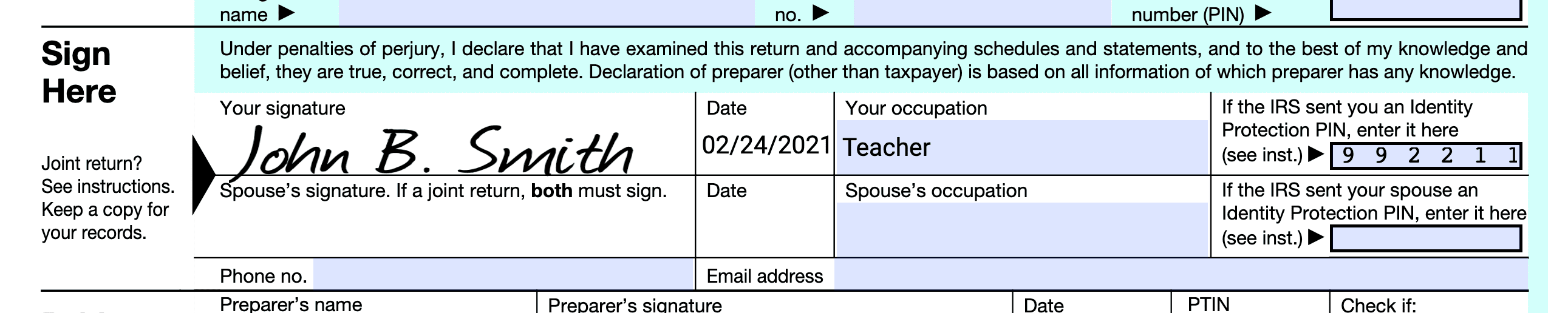

Sign page 2 of the Form 1040 and date it as well. Make sure the Occupation field is filled in and complete the IP PIN boxes if you were assigned one by the IRS (you do not need this, but if you know it, you can enter it). If you are married and filing a joint return, your spouse will also have to complete their portion of the signature section. Your federal tax return is not considered a valid return unless it is signed. You may also consider providing a phone number in the line item.

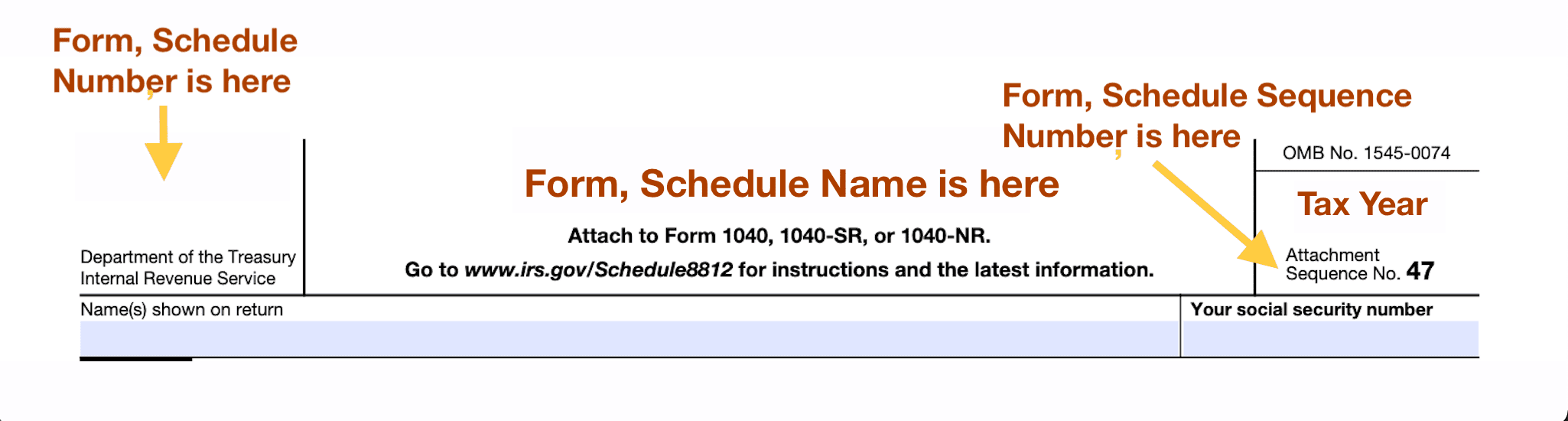

Attach any schedules and forms behind your Form 1040 in the order of the "Attachment Sequence No." shown in the upper right-hand corner of the schedule or form - see image below. For supporting statements, letters, etc., arrange them in the same order as the schedules or forms they support and attach them last. Attach copies of income forms W-2, 1099, and other income documents to the front of your Form 1040.

The IRS address you use depends on where you live and whether you are enclosing a check or expecting a refund - check the addresses above on this page. You should send your return through the U.S. Postal Service with a method for delivery tracking so you will know when the IRS receives your tax return. Note that it could take up to 6-8 weeks for the IRS to process your mailed tax return.

2. Mailing Your State Tax Return

To file your state return(s) by mail, you will follow a similar process to the federal return. You do not mail your state return to the IRS.

Confirm the bank information is correct on the return if you are having your refund deposited to a bank account. Make sure to sign and date the main form, then attach all of the supporting documents and income forms, similar to the federal tax return instructions above.

Where to Mail My State Return?

The proper state mailing address to send your return is typically on the main state tax form page of your PDF. You may also find the proper mailing address on the eFile.com state page for your state. Click on your state in the interactive map below and you will be taken to your state page where the proper mailing address will be at the bottom of the individual state page.

You should send your state return through the U.S. Postal Service with a method for delivery tracking. This way, you will know when the state receives your return.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.