Statistics on Income Tax Returns, Forms, Collections

Taxes are important, but they are often the last thing on people's minds. Just take a look at today's Taxpayer Roadmap - it's a tax jungle! Learn more about tax history and the tax code in the United States or see tax returns by U.S. presidents over time. The history of eFile or electronic tax filing started around 1987; see tax return e-file statistics and direct deposit information.

Tax Returns &

e-file Statistics

According to a recent WalletHub survey, if given a choice, people would rather do any of the following than their taxes:

- Jury duty: 49%

- Talk to their kids about sex: 36%

- Miss a connecting flight: 26%

- Spend the night in jail: 16%

- Swim with sharks: 15%

- Drink expired milk: 13%

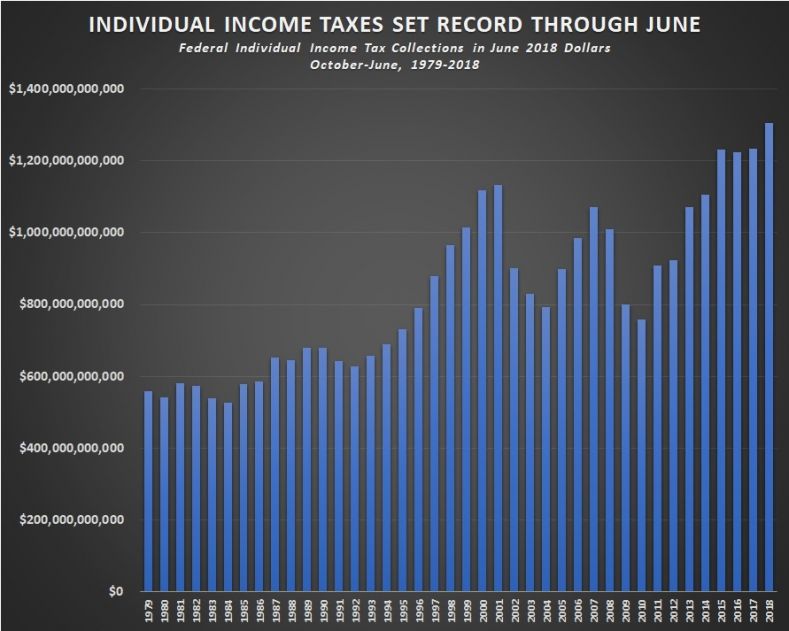

Click image to enlarge

The WalletHub survey also asked people about their biggest Tax Day fears, and here are the results:

- Not having enough money: 34%

- Making a math mistake: 23%

- Getting audited: 22%.

- Identity theft: 21%.

If you would rather do your taxes or do not have a Tax Day fear, let's get your taxes done together. eFile handles all the math and forms for you and we are here to provide support before, during, and after filing your return.

Related Articles:

Over 65 million self-prepared returns were e-filed in 2023. Do it yourself tax preparation allows individual taxpayers to file taxes without the help of a tax professional.

Why eFile? Find out!Review the IRS tax return statistics below. This page is continuously being updated as data and statics become available.

IRS Income Tax Return and Form Data by Tax Year

The table below is organized by the tax year, total tax returns (1040), e-filed tax returns designated by 1040 (e), and tax returns by expired versions of the Form 1040. Many of the Form 1040 forms have been made obsolete as the IRS simplified the Form 1040 for 2018 Returns. Note that 2023 Returns being filed during 2024 are currently being updated as the IRS provides data.

2023

101,849,000

98,4218,000

n/a

n/a

2022

162,037,000

150,448,000

n/a

n/a

2021

164,246,000

151,448,000

n/a

n/a

2020

169,098,000

152,300,000

n/a

n/a

2019

169,684,000

152,802,000

n/a

n/a

2018

155,798,000

138,217,000

n/a

n/a

2017

154,444,000

135,459,000

39,621,000

24,844,000

2016

152,235,000

132,319,000

40,007,000

23,775,000

2015

152,544,000

131,851,000

40,466,000

23,854,000

2014

150,927,000

128,784,000

40,701,000

23,218,000

2013

149,684,000

125,821,000

39,406,000

23,290,000

2012

148,203,000

119,560,000

38,234,000

23,053,000

2011

137,200,000

113,074,000

38,598,000

22,583,000

2010

145,320,000

112,203,000

40,810,000

18,010,000

As e-filing has become more trusted amongst taxpayers, the amount of e-filed tax returns has gone up while paper filed tax returns has decreased. Online tax preparation and e-filing is the simplest way you get your taxes done. Prepare and e-file your taxes on eFile.com with 100% accuracy.

IRS Income Tax Return Forms, Schedules by Tax Year

The PDF documents below show IRS statistics by tax year for each form. See how many taxpayers filed Schedule C, how many taxpayers claimed the Earned Income Tax Credit, and more.

IRS Total Gross & Net Tax Collection by Tax Year

Find IRS statistics below on the amount of taxes they collected during a tax year (gross taxes), the total dollar amount of tax refunds issued, and the average refund amount. The net tax amount the IRS collects in a year would be the total gross taxes minus the amount in refunds issued. For example the IRS collected around $4.7 trillion in taxes, but issued around $271.5 billion in tax refunds for 2023 Returns. This would result in a net tax amount of $4.43 trillion the IRS collected for the year.

2023

$4.7 trillion

$271.5 billion

$3,167

2022

$4.9 trillion

$333.861 billion

$3,145

2021

$4.1 trillion

$327.263 billion

$2,816

2020

$3.5 trillion

$320.114 billion

$2,851

2019

$3.56 trillion

$269.261 billion

$2,622

2018

$3.5 trillion

$274.253 billion

$2,979

2017

$3.3 trillion

$272.980 billion

$3,031

2016

$3.4 trillion

$270.824 billion

$3,026

2015

$3.3 trillion

$317.615 billion

$2,860

2014

$3.3 trillion

$306.016 billion

$2,797

2013

$3.1 trillion

$305.734 billion

$2,792

2012

$2.9 trillion

309.648 billion

$2,984

2011

$2.5 trillion

282.813 billion

$2,707

2010

$2.4 trillion

318.529 billion

$3,109

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.