Tax Return Transcript

Understanding your tax return transcript is crucial for managing your finances. This document summarizes your filed tax return, showing all pertinent details. Whether you need it for loan applications, income verification, or simply keeping your records straight, this page will help you understand the tax return transcript.

What is a Tax Transcript?

A Tax Transcript is a filed IRS Tax Return that shows most of the data of a tax return copy. Below is an overview of the different transcript types. Depending on your tax situation, you may need different transcripts, so we've laid out what you need to confirm your AGI and easily conquer other issues.

When to get a Tax Return Transcript versus a Tax Return Copy?

It's pretty simple. If you need the data for yourself to prepare a return, get a transcript. If you need your tax return for other financial-related applications, you might be required to provide a tax return copy.

- Are you missing your previous year's tax return Adjusted Gross Income (AGI) or other forms (e.g., income forms (e.g., W-2, 1099, etc.) needed to prepare your Tax Return?

- Are you missing wage and income forms or tax return data from years past? Obtain these records online for free via the transcript link below. If you must file previous year(s) or back taxes, find the forms and calculators by tax year. Once you have completed the back tax forms, they can only be mailed to the IRS to the address for the respective tax year. e-File your returns each year so you do not have to handle complicated paper forms.

- Attention: If you prepared and e-filed your latest tax return via eFile.com, obtain a copy of your Tax Return from your eFile.com My Account. We encourage you to use eFile.com when preparing your return this year and in the future. If you do, you'll have access to your tax returns for the past ten years, ensuring you always have your latest adjusted gross income.

Important: If you did not use eFile.com but other tax preparation platforms like TurboTax® or H&R Block® to prepare and file last year's Tax Return, you do not need a Tax Return copy if you do not already have it on hand. Instead, you will only need a free IRS Tax Transcript to get your AGI from that year in order to prepare and e-File your Tax Return this year via eFile.com. More details on how to obtain a Tax Transcript and the AGI.

Free Online Tax Transcript

Contact or Create a Free IRS Account

Or 1-800-908-9946 and order a Transcript copy

More Transcript Order Details

How to Use a Tax Transcript, Tax Return Copy?

When applying for financial agreements (including but not limited to a mortgage or loan, student loans, and social security), you might be asked to provide a tax return copy if the organization does not accept a tax transcript of your IRS tax return.

While a transcript is a document that summarizes your tax return, a copy shows your fully completed, submitted, and accepted tax return, including all forms and schedules. If you are unsure whether to obtain a tax return copy or return transcript, you will need to ask the requesting financial institution for what they need.

If you submitted estimated tax payments and/or applied an overpayment from a prior year's tax return to your current year's return, you could request your transcript a few weeks after the beginning of the year before filing your current year's return to confirm the payments.

In other words: If you made estimated payments for a given tax return during the calendar year, you could also request the transcript with these estimated tax payments.

Create a free eFile.com account and keep all your tax information in one place. eFile.com stores your previous ten years of returns and gives you immediate access to your previous two years of returns. You can view, download, and save these returns for your records. You will keep all your tax information in one place, so you do not have to venture to different sites to retrieve copies or transcripts.

How To Get A Transcript OR A Tax Return Copy

IRS Transcript Types

The IRS provides various types of transcripts which different information. Each can help you plan your taxes, review important data, and view transaction history with the IRS. This information may be useful in applying for a loan or estimating your next income tax return.

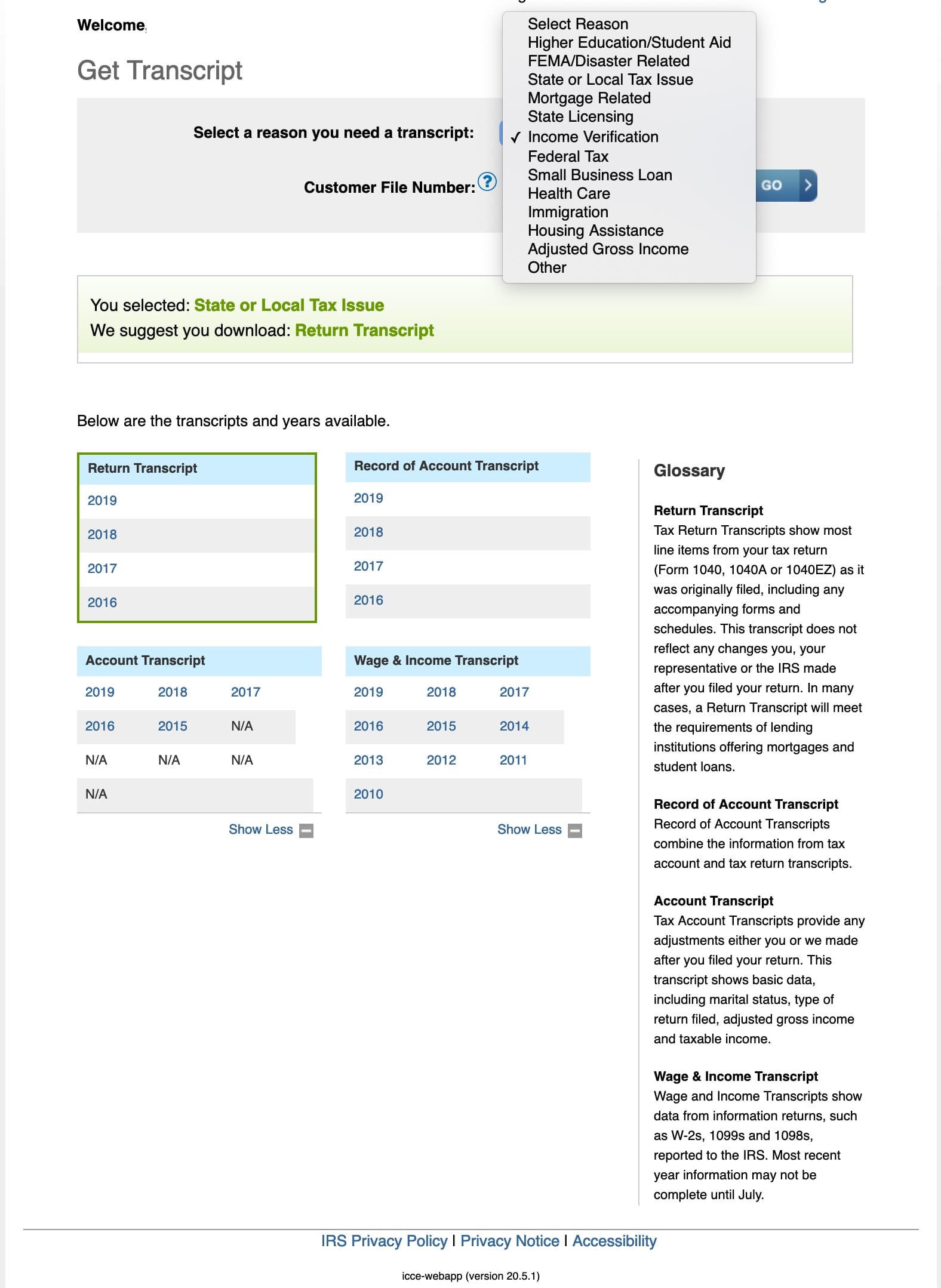

IRS Transcript View

Transcript Types

View of the IRS Transcript Options and the various Transcript Types

1. Tax Account Transcript

-Adjusted Gross Income

-AGI

-After Tax Amendment

Get the Tax Account Transcript for the AGI shows basic tax return data such as filing status, taxable income, and payment types. It also

shows changes made after filing the original return, e.g., via a tax amendment.The Tax Account Transcript is available for the current and nine prior tax years through

Get Transcript Online and the current and three prior tax years through Get Transcript by Mail or by calling 800-908-9946. These years and older tax years can be obtained by

submitting Form 4506-T. Note: If you made estimated tax payments and/or applied an overpayment from a prior year's return, you could request this transcript type a few weeks after the beginning of the calendar year to confirm your payments prior to filing your tax return.

2. Record of Account Transcript

-AGI

The Record of Account Transcript combines the tax return and tax account tax transcripts as listed above into one complete transcript. This transcript is available for the current and three prior tax years using Get Transcript Online or

Form 4506-T.

3. Tax Return Transcript

-Original Tax Return

-AGI

The Tax Return Transcript shows most tax return line items from the original Form 1040, 1040-SR, or 1040-NR, including all the forms and schedules.

Attention: This transcript

DOES NOT show changes made after you filed your original return via a

tax amendment, for example: Use the Account Transcript below for that.

This tax return transcript is available for the current and three prior tax years. A tax return transcript usually meets the needs of financial lending institutions offering mortgages. Note: The secondary taxpayer or spouse on a joint tax return can use

Get Transcript Online or Form 4506-T to request this transcript type. When using Get Transcript by Mail or calling 800-908-9946, the primary taxpayer on the return must make the request.

4. Wage and Income Transcript

-W-2, 1099, 1098, etc.

The Wage and Income Transcript lists tax data from the IRS received from employers, such as Forms W-2, 1098, 1099, and 5498. The tax transcript is limited to approximately 85 income documents. If you have more documents or forms, complete and

submit Form 4506-T. If you see a “No Record of return filed” message for the current tax year, it means income information has not populated the tax transcript yet. Check back in late May to get the updates. This transcript is available for the current and nine prior tax years using

Get Transcript Online or

Form 4506-T.

5. Verification of Non-filing Letter, Notice

The Verification of Non-filing Letter will state that the IRS does not have a record of a processed tax return Form 1040, 1040-SR, or 1040-NR as of the date of the request. It does not indicate if you need to file for the given tax year. This letter is available after June 15 for the current tax year or anytime for the prior three tax years using

Get Transcript Online or

Form 4506-T. Use Form 4506-T if you need a letter for older tax years.

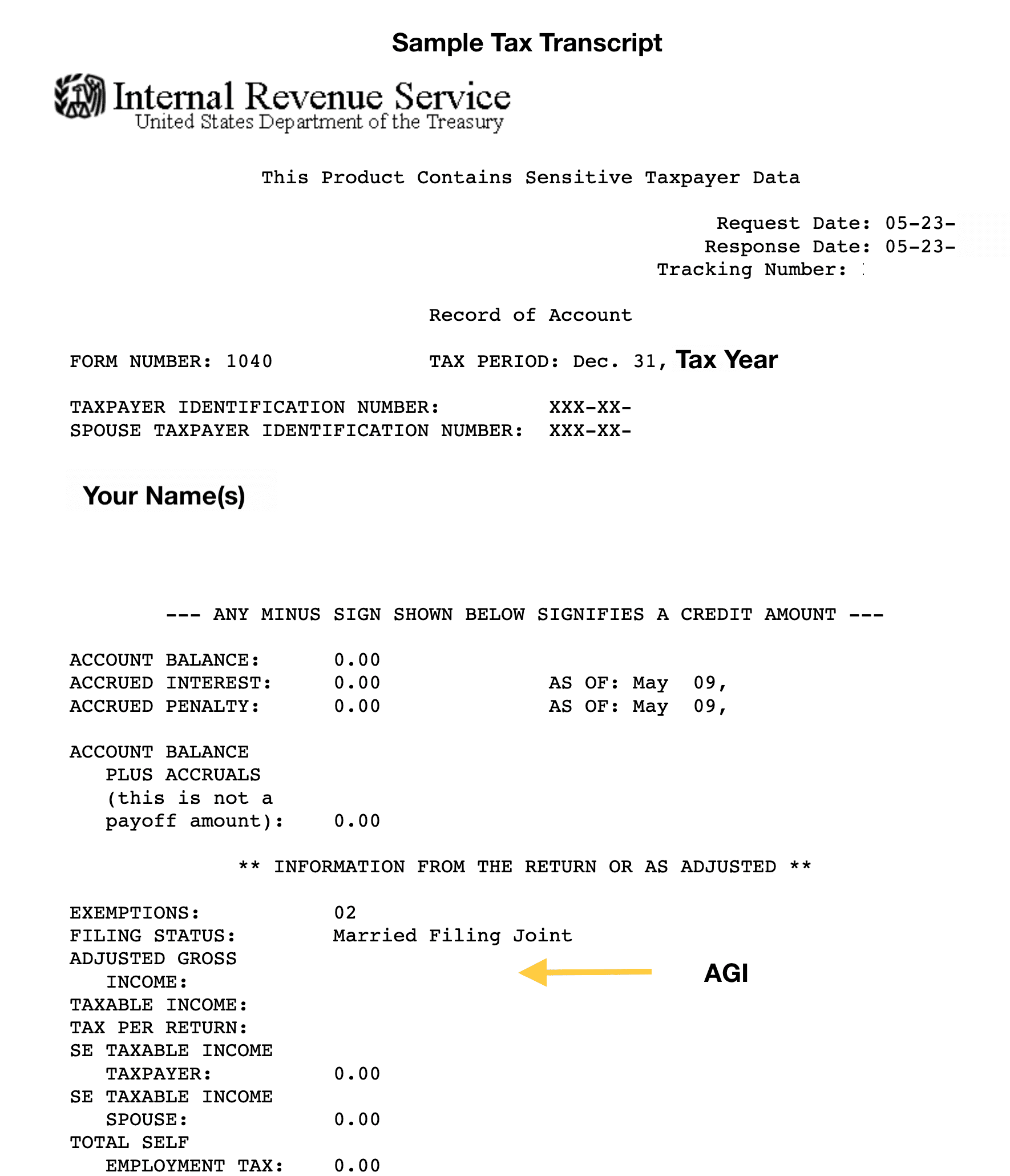

IRS Transcript View

A sample view of an IRS Tax Transcript

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.