IP PIN on Your Upcoming Tax Return

Learn how to obtain an IRS IP PIN or Identity Protection Personal Identification Number for you, your spouse, and/or your dependent(s).

Getting an IP PIN provides an extra layer of security for your identity when filing a tax return. A dependent IP-PIN would prevent unauthorized individuals, such as an ex-spouse, from claiming your qualified dependents on their taxes. See more details on wrongly claimed dependents.

Note: Get an IP-PIN for you or someone else by creating an IRS account. You will have to verify their identity during the process which can all be done online or you can call them.

Lincoln, USA

@noahbuscher

If you have an IP-PIN for the current tax year, see instructions:

A: How to enter your and/or spouse's IP-PIN.

B: How to enter an IP-PIN for your dependent(s).

What Is an IP-PIN?

An IP PIN - Identity Protection Personal Identification Number - is a 6-digit code known only to you and the IRS which assures no one can file your tax return under your SSN without it. During e-filing, you will enter the IP-PIN and only if this IP-PIN matches IRS records will the IRS accept your return.

Any United States Citizen can apply for an IP PIN for themselves, their spouses, and their dependents. Your IP PIN will help keep your tax information safe if you are worried of identity theft or have been a victim of it.

Do I Need an IP-PIN?

Whether or not you need an IP PIN (Identity Protection PIN) depends on your situation. An IP PIN is a six-digit number issued by the IRS to help prevent identity theft and tax fraud. Here are some scenarios where you might need one:

- Identity Theft Concerns: If you’ve been a victim of identity theft or tax fraud, the IRS may provide you with an IP PIN to protect your tax filings.

- IRS Request: The IRS might require you to use an IP PIN to file your tax return if you are part of the IP PIN program or for other reasons.

- Voluntary Enrollment: You can also apply for an IP PIN voluntarily if you want an extra layer of security for your tax filings.

If you don’t fit into any of these categories and haven’t been instructed by the IRS to use an IP PIN, you likely don’t need one. However, if you're unsure or have specific concerns, it’s always a good idea to add this extra layer of security.

An IRS IP PIN is not required to e-file or file your taxes online.

When, Where to Get an IP-PIN?

Apply for an IP PIN from the IRS to secure your information.

- Get IRS IP-PIN(s) for free for you, your spouse, and/or dependent(s) from your IRS account; you will need to create an IRS account for each SSN.

- Starting mid-January, you can obtain a new IP-PIN to file the current year tax return.

- An IP-PIN is only good for one tax return year and you need to get a new IP-PIN each tax year - the IRS is supposed to send these automatically via letter in the mail, but you may need to retrieve it if you do not receive it.

- During the year, you will have the option to opt-out from the IP PIN program; confirmed identity theft victims can't opt out of the IP PIN program unlike other taxpayers.

Taxpayers should store the IP PIN in a safe location and not share their personal PIN with anyone but their tax provider. The IRS will never ask for your IP-PIN; any phone call, email, or text asking for your IP-PIN is a scam.

How to Get an Identity Protection PIN?

Before you apply for your personal Identity Protection PIN, review these points:

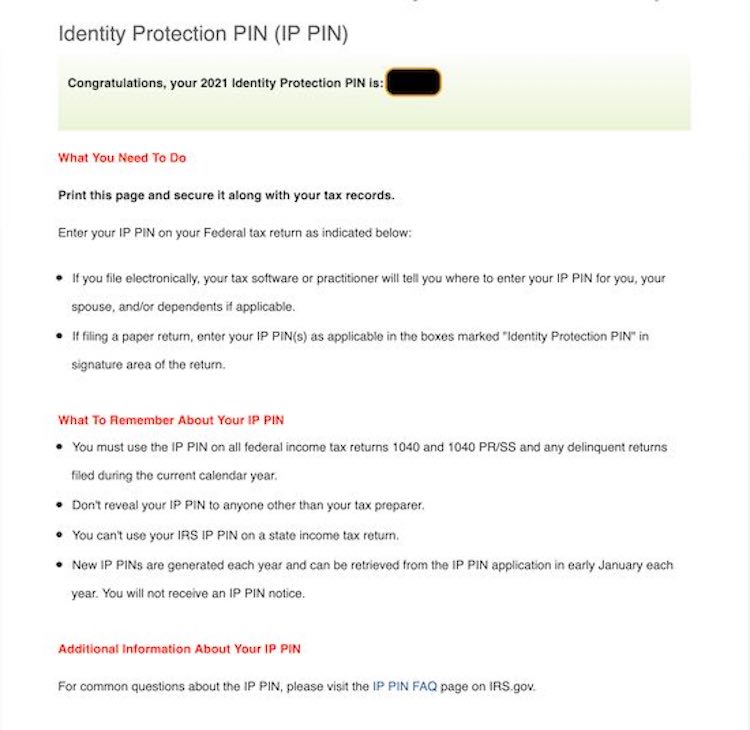

Below is a link and a screenshot of the IRS page.

Get IRS IP-PIN(s)

It's free for you, your spouse, and/or dependent(s) from your IRS account.

You will need to create an IRS account for each SSN holder.

Frequently Asked Questions

What if I enter my IP PIN incorrectly?

The IRS will reject the return temporarily. Login to your eFile account and attempt to refile using the correct IP-PIN. If you are certain the number entered is correct, review it on your IRS online account, contact one of our Taxperts®, or call the IRS to reissue an IP-PIN at 1-800-908-4490 for specialized assistance.

How do I use my IP PIN on a joint return?

Where do I enter my IP PIN when filing my tax return?

Do I have to use my IP PIN to file previous year returns?

No, previous year returns or back taxes cannot be e-filed. Because of this, an IP PIN is not needed.

How long is my IP PIN good for?

Each IP-PIN is valid for one year; the IRS will issue a new one each year. You may apply for one via the instructions above or the IRS may send you Letter CP01A with your new IP-PIN sometime in late December or early January..

Should I get rid of my IP PIN after I have filed?

Keep your IP-PIN in a safe location for the entire year, even if you have already used it. After you have received a new one for the new year, it is safe to dispose or delete the old one, but we recommend keeping it for your records.

How do I use my dependent's IP PIN on my tax return?

If you claim a dependent on your tax return and they have their own IP-PIN, you will enter this when you e-file your return. The eFile Tax App will help you with this when applicable.

What forms do I use my IP PIN on?

Will I get my tax refund faster by using an IP PIN?

Using your IP-PIN does not determine how or when you will receive your refund, if owed. See our free DATEucator to estimate your tax refund date.

What does the IRS IP PIN page look like?

You should only enter your personal information on trusted sites - you can be sure you are in the right place if it looks like the screenshot below. Use this link: IRS IP-PIN Application .

How to Get Your IP PIN Offline?

- For obtaining a new IP-PIN: Taxpayers with income of $72,000 or less can complete Form 15227, IP PIN Application and mail it to the IRS address listed on the form. Once the IRS has received the form, the taxpayer will receive a call from the IRS to verify the personal identity. They will then receive an IP PIN for the next filing season after passing.

- Taxpayers who can't apply online or are not eligible file Form 15227 can make an appointment with a Taxpayer Assistance Center. The taxpayer has to provide two forms of picture identification. Once the taxpayer passes the authentication, an IP PIN will be mailed to the taxpayer.

- For retrieving your assigned IP-PIN: If there is any trouble creating an IRS Account (no credit card or loan to verify identity, etc.), there are alternatives. Taxpayers can call the IRS at 1-800-908-4490 for assistance with this. The IRS will help verify your identity and mail your most recently generated IP-PIN to the address they have on record within 21 days. International users can call them at 1-267-941-1000.

If a taxpayer is unable to electronically file their return without this and cannot get their IP-PIN in time, they may have to mail in their tax return as this will not require the IP-PIN.

How to File with an IP PIN?

When you file your taxes with eFile.com, you will enter your IPPIN during the checkout process by answering "Yes" if you have one. This will quickly and easily verify your identity and allow your return to be processed and get your tax refund to you, if owed. Be sure to enter it correctly on the first attempt in order to avoid any errors or rejections.

- An incorrectly entered IP PIN on an electronically filed tax return or extension will result in a temporary rejection. This can be corrected by entering the correct IP PIN and re-efiling at no charge. What to do if the IRS rejected your return for an invalid IP PIN?

Important: When e-filing your next return, use these key points to e-file successfully and avoid rejection:

- Enter all your IP PINs for you and your family. If you and/or your spouse have an IP PIN, enter this when you e-file your return on eFile.com. If your dependent or dependents have IP PINs, enter these on the dependent screen within your eFile account.

- The IRS issues an IP PIN each year, so your IP PIN last year is no longer valid. The IRS should issue you Notice CP01A with your IP PIN; otherwise, you will need to retrieve your most recently issued IP PIN.

- You can retrieve this online using the resources below.

- The IRS-issued IP PIN and your five-digit signature PIN are two separate numbers. Your PIN is one you create which acts as an electronic signature on your return; the IRS IP PIN is used for identity verification.

If you are rejected, you can re-file your return at no extra cost once you retrieve your IP PIN.

Additional questions? Our Taxperts® are here to help.

Lost IP-PINs can also be retrieved via the online account; review IRS identity theft information for taxpayers.

Register Account, Get IP PIN

Prepare your tax return with eFile.com and use your IP-PIN to verify your identity. See the ways eFile practices security for user data.

Learn about fake IRS emails and how to handle identity verification through an IRS letter you received.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.