Saving Money and The Relationship

Did you know that over 50% of relationships or marriages face serious challenges due to two main issues? They are:

- Sex (especially infidelity)

- Money (particularly financial disagreements)

If money problems are straining your relationship, we can help you sort them out and hopefully save your love. Unfortunately, we can’t help with issues related to sex. But with our help on the financial side, you might improve your relationship!

Before we dive into how we can assist, let’s first explore whether money issues can strain your relationship.

Fact: Money Can Negatively Affect Relationships

Does money outweigh love? According to various statistics, it could:

- The #1 argument among couples is money, according to a University of Denver poll.

- A survey by ForbesWomen and YourTango indicated that 75% of women would turn down proposals from their unemployed boyfriends.

- 88% of women find money important in a relationship, stated by a MSNBC survey and eZine.

- Financial problems amongst married folks is the leading cause of divorce.

There are many considerations when you are part of a family, whether it be you and your boyfriend/girlfriend, husband/wife, or if you add dependent children to your family. With more people in your life to consider, you may face personal and financial problems.

These factors usually cause an unbalanced relationship in money and other aspects, resulting in a breakup:

- One partner saves more money than the other partner.

- A spouse spends more money than the other spouse.

- One significant other often (or always) uses another partner's money.

- One partner becomes single and pregnant and lacks much-needed support.

It may result in troubles in the relationship that could otherwise be avoided by communicating financial concerns and struggles. Saving money can certainly help with some of these problems. See these tips on how to save money during the year:

Work, transportation, and travel | Entertainment, technology, and health

Home, shopping, and food | Everyday expenses, finances, and more

You can also save money on taxes by keeping track of your finances, understanding your deductions, maximizing tax-free income, and using tax software to claim all credits and deductions you are entitled to.

Here’s how we can assist:

A great way to start is to prepare and e-file your next tax return on eFile.com and take the stress out of filing taxes online. The eFile app will guide you through completing and filing the correct form(s) based on your answers to a series of questions. Additionally, find ease when selecting the proper filing status by using the STATucator to determine whether to claim married filing jointly or married filing separately, if applicable. As a married couple, you and your spouse may qualify for different marriage-related tax breaks.

Additional Resources:

The Marriage Penalty

What is a marriage tax penalty? A marriage tax penalty occurs with certain state tax returns and generally not with the IRS or federal income tax return. For example, in a state that has the marriage tax penalty, when a couple files their state income tax return as married filing jointly they will pay more in state income taxes or have a higher effective tax rate compared to if they had filed their returns as two single taxpayers with the same amount of combined income. In most states, your filing status must match your IRS filing status and if you are married, you must file as married jointly or separately.

In some married couples, there may be a marriage tax penalty for high income earners. This is for those in the 37% income tax bracket as the limit for income taxed at 37% does not double as it does for the lower rates. Thus, filling as jointly may be less beneficial than filing as separate in this case.

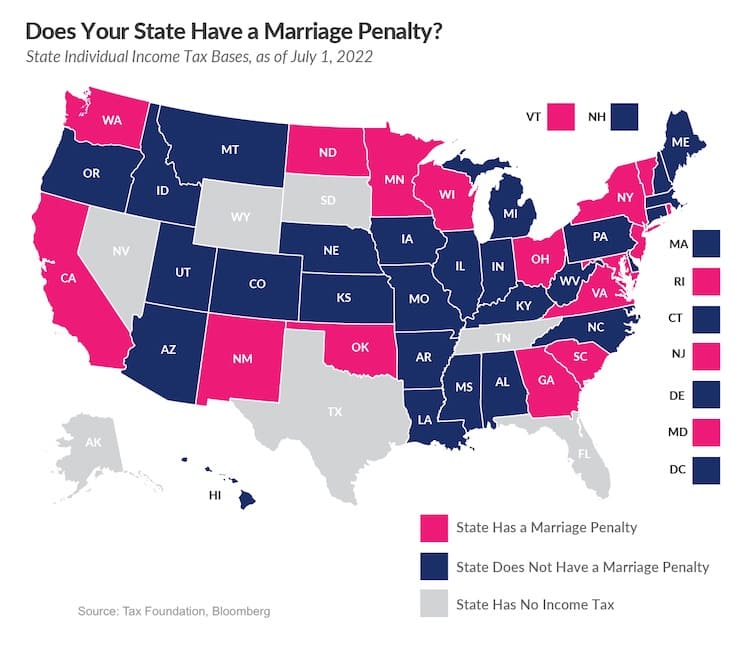

The following sixteen states have an income tax related marriage tax penalty. Of these sixteen, Washington state does not have wage income tax, but a capital gains tax with a $250,000 filing threshold. The marriage tax penalty in Washington state exists because the $250,000 limit is not doubled for married filers.

The table below summarizes the 16 states with a marriage tax penalties plus those without a penalty or without income taxes.

Yes

California, Georgia, Maryland, Minnesota, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, Vermont, Virginia, Washington, and Wisconsin

No

Alabama, Arkansas, Arizona, Colorado, Connecticut, Delaware, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Carolina, Oregon, Pennsylvania, Utah, Washington D.C., and West Virginia,

No Income Tax

Florida, Nevada, South Dakota, Tennessee, Texas, Washington State (no individual income tax but capital gains tax), and Wyoming

In most cases, there is a marriage tax bonus or benefit when you get married and file taxes together. In general, married couples with similar, moderate incomes will pay less taxes when filing together than what they would pay if they filed single. When you and your spouse combine your income on your return, your standard deduction increases, you qualify for more easily for different tax credits, and your tax rate brackets increase.

If you are insure about how getting married affects your taxes, estimate your taxes using this calculator. In the tool, enter your information as if you are filing single or married separately and save the results, then restart the tool as if you are filing jointly and compare to your first return.

Once you have an understanding of your taxes and finances, start your return and file your taxes online today!

Want to put your finances back on track? Read on to find out how you can balance your money and save your love!

eFile Tax Tips to Help Save Your Love!

Follow these eFile Tax Tips for managing your finances and relationship which will be less taxing and have more value!

Take control of your personal life relationships, finances, and taxes: follow the tips on this page and keep up with tax planning for next year. You can use this free tax refund calculator for next year to get a high-level understanding of your taxes.

Related Tax/Love Connections

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.