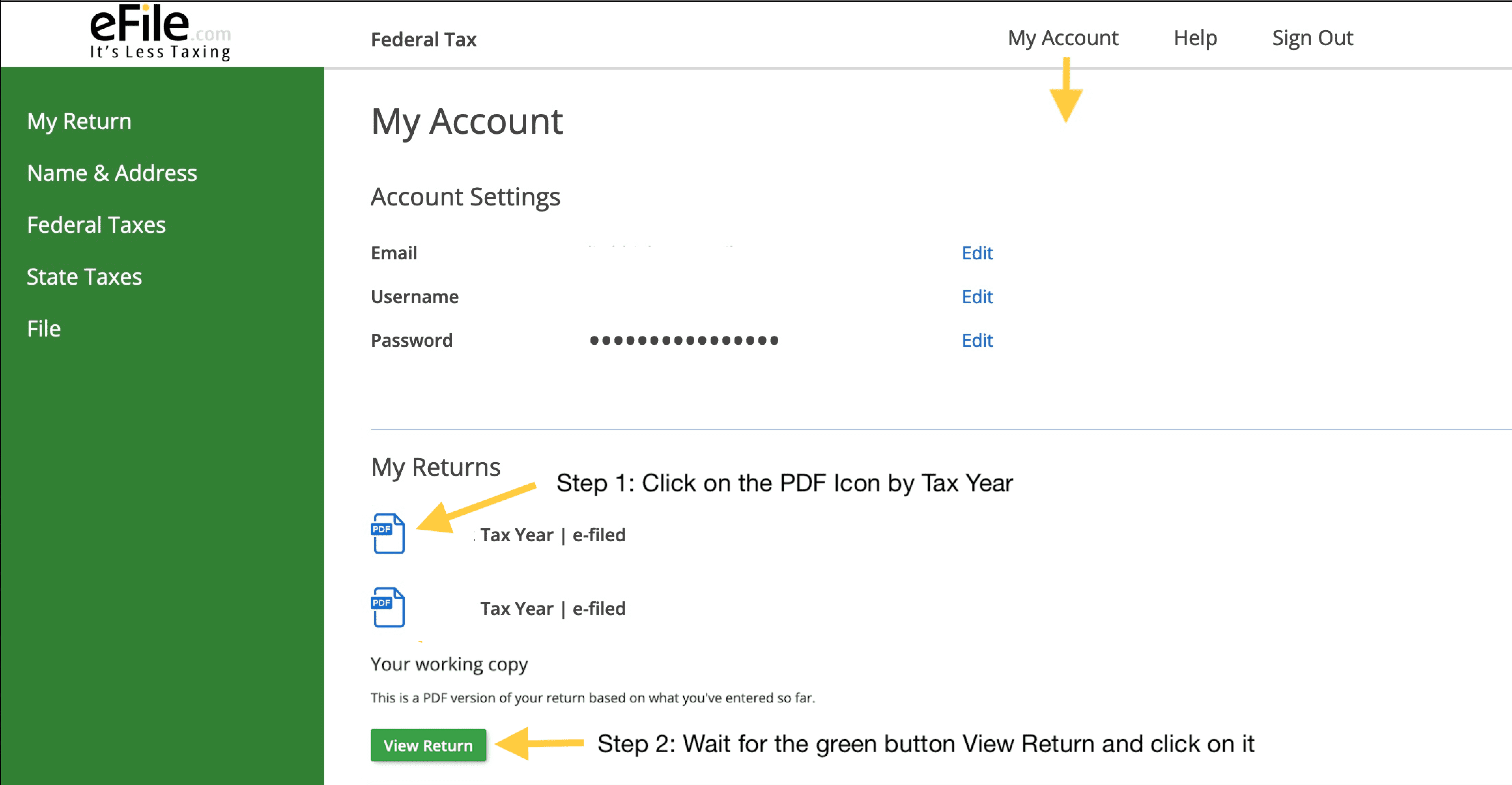

First, navigate to My Account and select the PDF icon next to the tax year. The PDF will be created based on your current entries. Every time you make a change to your return, click on it again to see these changes.

When opening the document, wait for the green button to load; once the button shows, click on the button, and based on your browser settings, your PDF will load in a tab or prompt you to download the file to your device.

Need a Tax Return Copy? Click on the PDF icon for a copy of the e-filed and IRS-accepted return(s).