What Is Form 1099-A and How To File It?

Form 1099-A, Acquisition or Abandonment of Secured Property, is used by lenders when a borrower abandons property or has it foreclosed. This form provides essential details about the property, such as its fair market value and the outstanding mortgage balance. This page will walk you through the basics of Form 1099-A and how to file it.

Filing Deadline for Form 1099-A

The issuer of Form 1099-A must send or transfer the form to you by January 31 following the tax year. You need to include Form 1099-A with your tax return if your debt was fully or partially satisfied. For instance, if a mortgage lender foreclosed on your property and canceled some or all of the mortgage, or if the lender sold the property in a short sale, you would receive a Form 1099-A for each mortgage on the foreclosed property.

Reporting Capital Gains from Foreclosure

In the case of a home foreclosure, you must report the sales price listed on Form 1099-A on your tax return. If you had a capital gain, which is the difference between the sales price and the purchase price of your home, you need to report this on Schedule D. A capital gain occurs when the selling price of your home is higher than what you originally paid for it. If your home was foreclosed, you calculate the capital gain by subtracting the original purchase price from the foreclosure sale price.

Exclusions for Primary Residences

You generally only need to report capital gain on a foreclosed property if:

- You lived in the home and used it as your primary residence for at least two of the previous five years.

- You might be able to exclude up to $250,000 of the capital gain from your income if you are single, or up to $500,000 if you are married and filing jointly.

This means you only need to report capital gains that exceed these amounts.

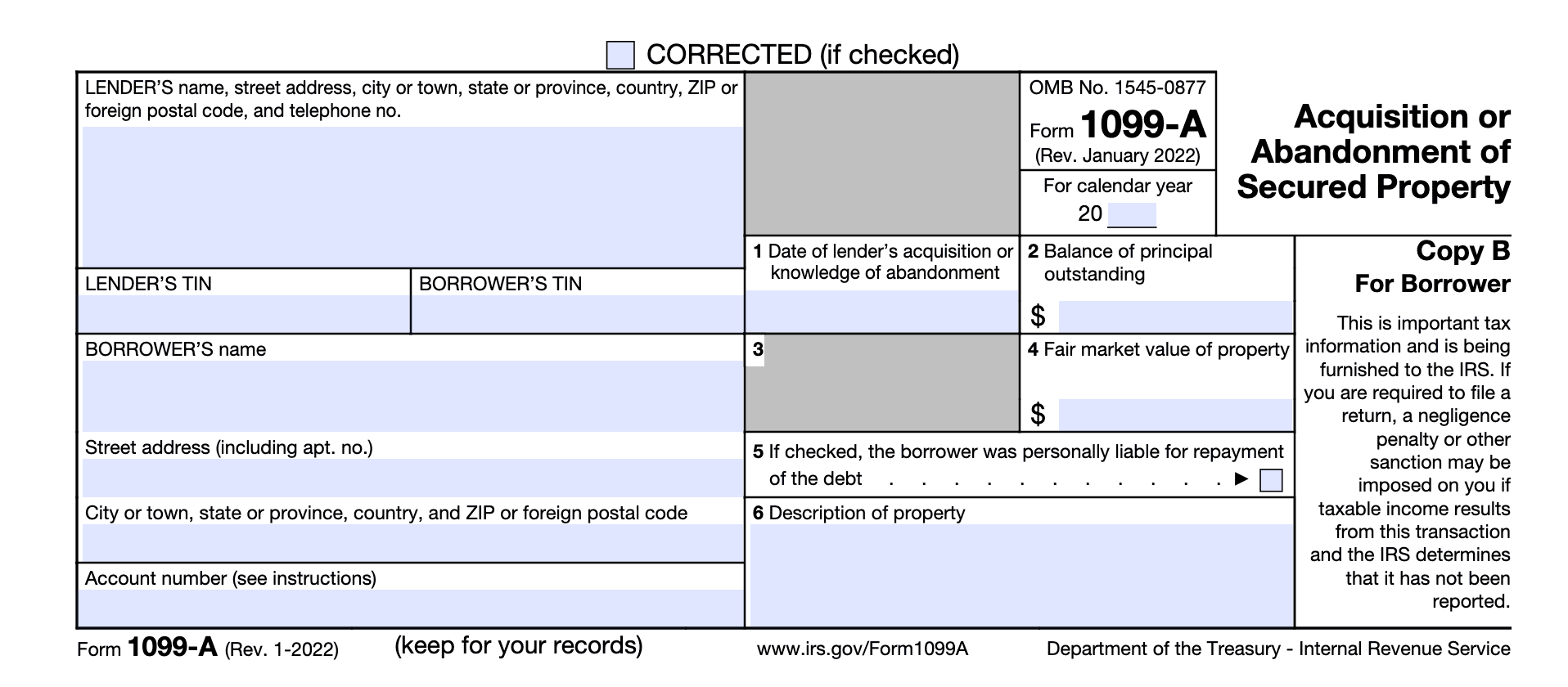

2. Form 1099-A

Sample

Sample Form 1099-A - Acquisition or Abandonment of Secured Property.

3. Where Do I

Enter Data?

You enter Box 2, 4, and Box 5 of 1099-A on Schedule D. Use the value in Box 2 or 4 as the value of the property; if Box 5 is checked, you may be responsible for the repayment of the debt. As a result, Schedule D will be reported on Line 7 for Form 1040.

To enter 1099-A into your eFile account, start in the Income section. Your 1099-A will be entered as a sale of a home or other property under the Investments section. Enter the date the property was acquired, the date it was sold, and the sales price. Review the boxes in section 4 below to determine which amount to use from your 1099-A.

See a detailed description of each Box of form 1099-A below.

4. Box Descriptions

Box 1099-A

Box 2 of Form 1099-A: Outstanding loan balance.

Box 4 of Form 1099-A: Fair Market Value - use this if you are not liable for the remaining debt.

Box 5 of your Form 1099-A: If is checked, then enter the outstanding loan balance as your sales price as the lender could pursue you to collect any outstanding balance not recovered by selling the property.

See detailed instructions for Form 1099-A.

5. Form 1099-C

You might also receive a Form 1099-C in addition to Form 1099-A for a foreclosed property if it is considered canceled debt.

6. How to Add, Delete

a Form or Page

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.