Learn what to do if you sold some investments during the year and need to file Schedule D with your income tax return by following the simple steps below.

B: Start the Tax Interview

Once you set up your account, you can follow a series of questions that goes through every section. Otherwise, you can add your information for Schedule D by following these steps.

C.1: Add Your Investments

Step 1: Select Federal Taxes > Income > Investments

Step 2: Answer the applicable questions to enter your type of investment.

Step 3: Add each asset sold for the tax year before finishing the Investments section and saving. eFile will generate your Schedule D and Form 8949.

C.2: Manually Add Schedule D

If you want to just fill out Schedule D, you can do this by manually adding the form.

Step 1: Select Federal Taxes > Review > I'd like to see the forms I've finished or search for a form.

Step 2: Search "Schedule D" and click on Add Form.

Step 3: Input your investment information for Schedule D.

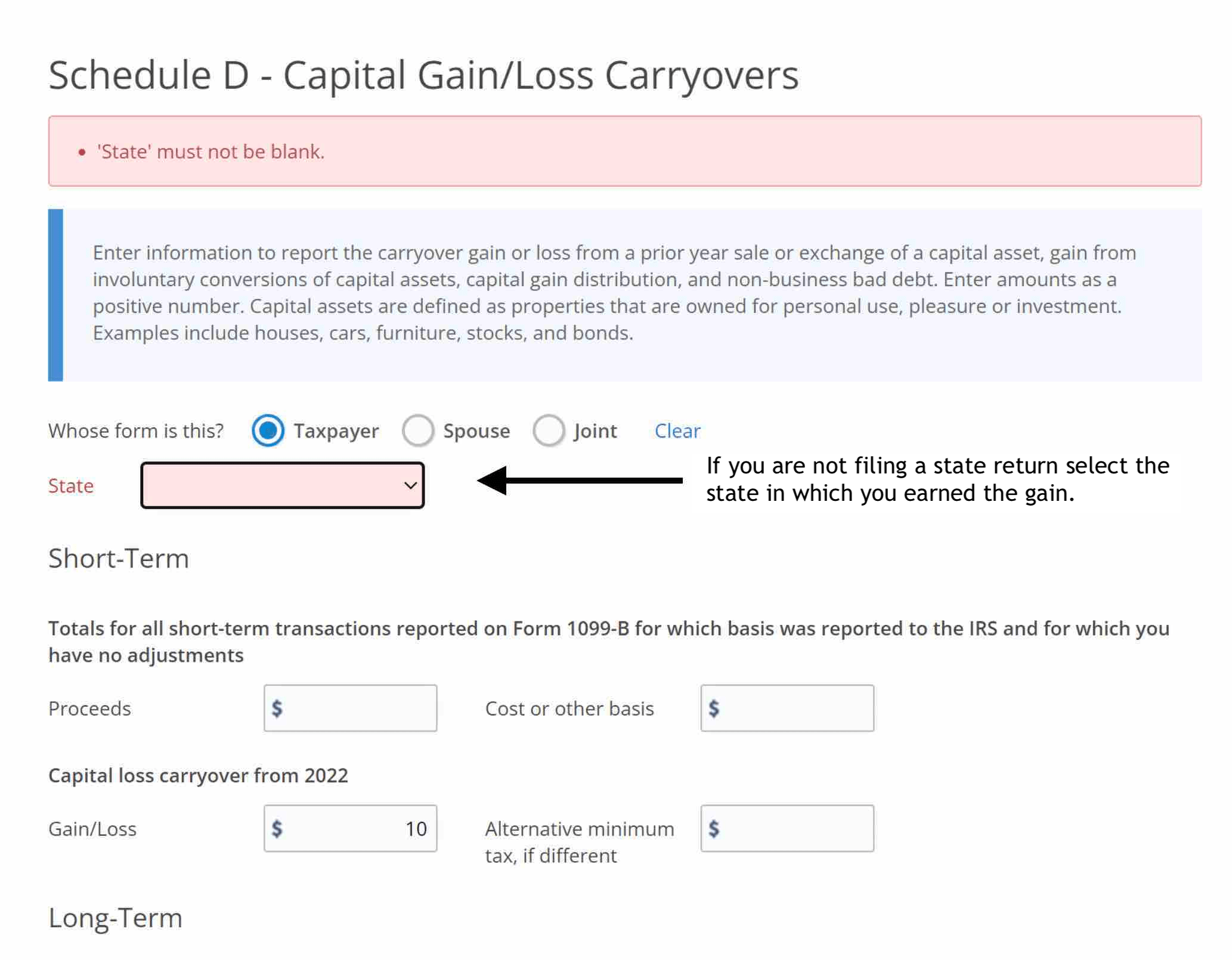

C.3: Select a State on Schedule D

Generally, select your state residency. If you do not file a state return, select the state where you earned the the gain or had a loss.

State selection

D: Finish Your Return

Work through all of the income and deduction sections. You should report all your income from the year on one return and submit your IRS and applicable state returns together.

E. Draft Copy of Your Return

You can verify that your return has Schedule D and Form 8949 by going to My Account and clicking on the PDF link next to Tax Year | In progress to view your draft return.

Capital losses that exceed the current year's gains can be carried forward or reported in subsequent tax returns using Schedule D.