How to Fill Out or Complete a W-4

Almost always, a tax return refund is the result of too much tax withholding. In a perfect world, you would like to receive a $1.00 refund - why is that? There are no late filing or late payment penalties and you have 3 years to file your return before your $1.00 refund expires. We at eFile are trying to provide clarity to whether or not a large refund is a good thing or not.

The W-2 is used specifically to deduct income taxes from your paycheck for federal purposes - there are other deductions you can make, state tax withholding forms to complete, and mandatory Social Security and Medicare taxes that are also withheld from your pay. The following are examples of possible deductions that can be taken from your pay:

The W-4 Form does not make it easy to see how your tax return will look like - can you expect a tax refund or will you owe taxes? We suggest you use the paycheck/w-4 calculator below and create your W-4(s) based on your paycheck.

Create, Complete your Form W-4

Pick one of these 2 options to create your Form W4:

- Form W-4 Creator: The online W-4 Form Creator guides you through to just fill out a Form W-4 without additional calculations. Just follow the step-by-step instructions and a W-4 PDF will be created. For a W-4 based on your paycheck, use the tool below.

- Paycheck/W-4 Calculator: The PAYucator will create your W-4(s) on your current or future paychecks and you will see the actual withholding amount per pay period. Monitor your actual paychecks and make adjustments based on your tax goal. For most accurate results, enter your W-4 withholding amount and total income for the year into the 2024 calendar year tax calculator and see the actual or estimated tax return results.

Below are links that explain the W-4 in more detail.

What is a Form W-4 - Video?

How to complete a W-4?

Types of W4 Forms

W4 Tax Withholding Calculator

W-4 withholding examples

Is a Large Tax Refund a Self Imposed Penalty?

What Is needed to Complete a Form W-4?

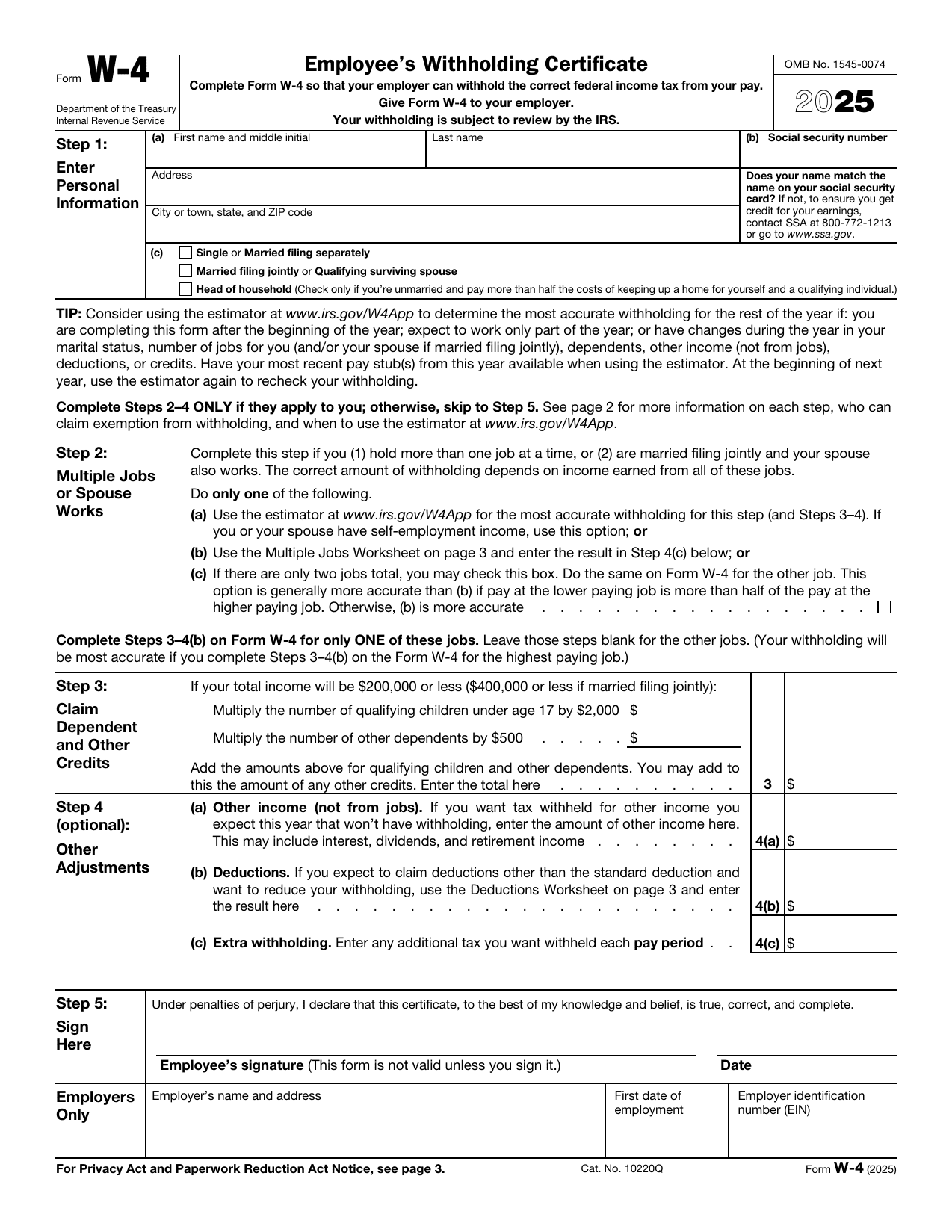

Form W-4: Step 1 Image

Name, Address, SSN

Step 1

Your current address does not have to match your tax return address.

Tax Return Filing Status

Step 1

Select single, married jointly or separately, surviving spouse (previously qualified widow[er]), or head of household.

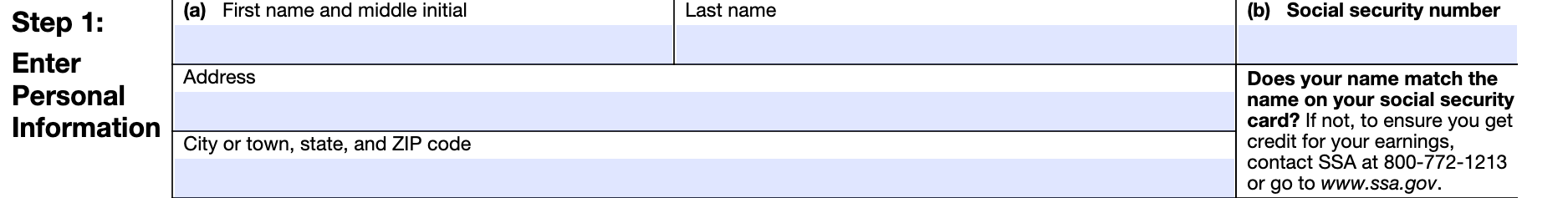

Form W-4: Step 2 Image

Number of Jobs

Step 2

If you only have one job, leave the checkbox under c blank. Mark the checkbox if you either hold more than one job at a time, or you are married and filing jointly with a spouse who also has a job. Logically, this means that together you have 2 jobs and this should be marked as such. The correct amount of withholding depends on the income earned from all of these jobs. If there are 2 jobs in the household, enter your dependent(s) and/or deductions on the W-4 with the highest income. Do not enter the dependents/deductions on each of the two W-4 forms.

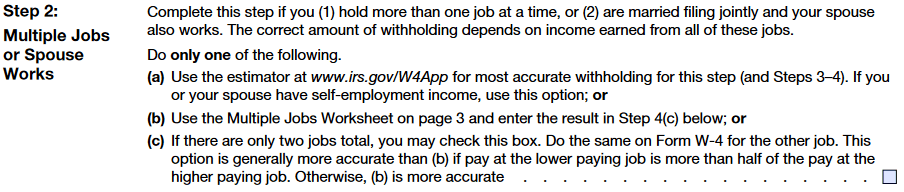

Form W-4: Step 3 Image

Dependents

Step 3

If you do not have dependents, you can leave this blank. Otherwise, enter the number of your

qualifying dependents and other dependents (e.g.

qualifying relatives) you could claim on your tax return. If there are 2 jobs in the household, enter the dependents ONLY on the W-4 with the highest income. Leave the second W-4 blank in Step 3.

Tip: An increased number of dependents would decrease your IRS tax withholding for each pay period. A decreased number of dependents would increase your IRS tax withholding.

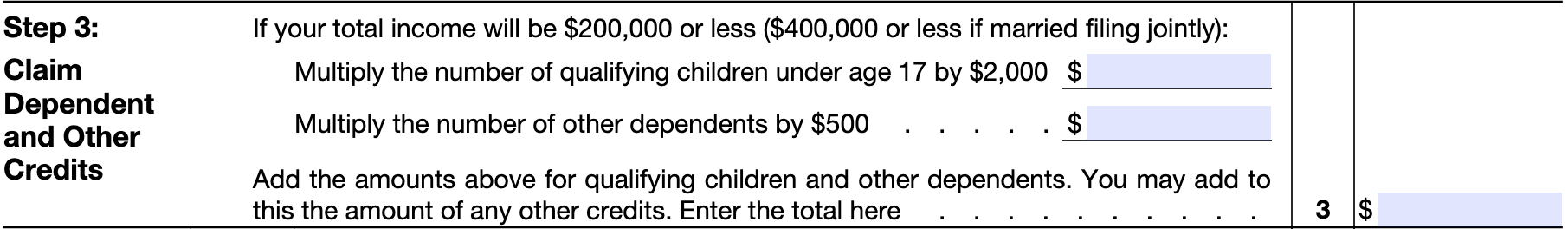

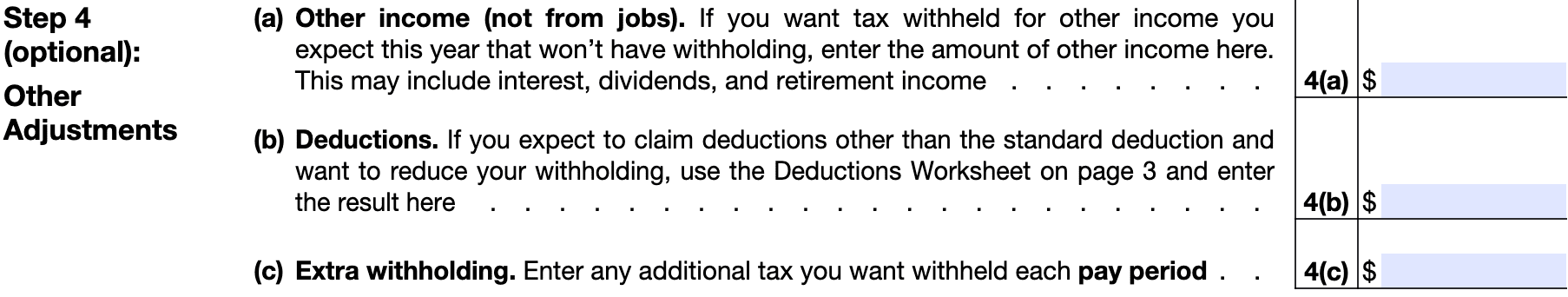

Form W-4: Step 4 Image

(a) Other Income

Step 4

(Optional) Only add this if you have other income and you wish to have taxes withheld for this income. If you are already withholding taxes for this income, leave this blank.

(b) Deductions

Step 4

(Optional) Enter expected tax deductions for the given tax year. Do not list the

standard deduction here. Generally, you would enter an amount here that would exceed your standard deduction or you plan on

itemizing your deductions on your next tax return.

Tip: An increased deduction amount would decrease your IRS tax withholding for each pay period. A decreased deduction amount would increase your IRS tax withholding.

(c) Extra Withholding

Step 4

(Optional) Add a dollar amount of extra income taxes you want to have withheld through your paycheck.

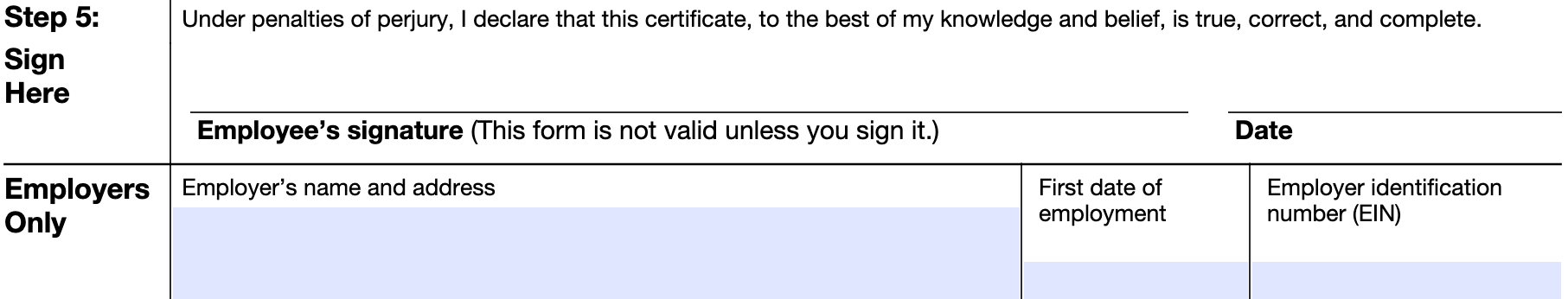

Form W-4: Step 5 Image

Signature, Date

Step 5

Sign the form and enter the date, which would be either the day you're signing the document or the effective date of the Form W-4.

Ways to Calculate and Create a W-4

W-4 Creator

Create, sign, and distribute your Form W-4 without any prior tax estimate calculations. Use this tool if you already know what to enter on the Form W-4.

Start the W-4 Creator.

Paycheck Calculator

Determine your tax withholding amount based on your paycheck-based income, the number of dependents, and the deductions you entered. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the Paycheck Calculator.

Income Tax Rate

This calculator, or RATEucator, will estimate your annual federal income taxes based on your total annual income. From the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the RATEucator.

Tax Calculator

This calculator, or TAXstimator, will estimate your tax return for this year which will be due next year. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the TAXstimator.

State Income Taxes

This calculator, or STATEucator, will estimate your annual state income taxes based on your total annual income. Based on the result, create your W-4 and manage your tax withholding for the remainder of the year.

Start the STATEucator.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.