Standard Deductions for Tax Year 2025

2025

Standard Deductions

Attention: The 2025 standard deduction amounts listed below have been updated based on the 2025 Tax Reform (One Big Beautiful Bill or OBBB).

The standard deduction method is generally advantageous for most taxpayers, unless the total amount of itemized deduction is larger than the total standard deduction amount. In addition to the standard deduction, a taxpayer might qualify for these other deductions and income adjustments. See a detailed comparison of standard versus itemized deductions.

Calculate your Standard Deduction

What Are the Standard Deduction Amounts by Year?

What Is the 2025 Standard Deduction?

Frequently Asked Questions

What is the standard deduction?

The IRS standard deduction is a dollar amount that reduces taxable income on your income tax return based on age, tax filing status, and if you are blind or not. The standard deduction amounts are generally increased each tax year by the IRS and/or state tax agency if the state has one as well. The eFile Tax App applies the standard deduction for your based on your entries.

Read this in-depth PDF publication for more information about standard deductions.

What is the standard deduction for seniors or the blind?

Your age and/or whether you fall under the IRS category of blindness will increase the basic standard deduction. Those over age 65 will see a higher standard deduction as well as those considered blind - if you qualify for both, your standard deduction is greatly increased.

What is the standard deduction for dependents?

What other deductions can I claim?

View a list of income adjustments in form of tax deductions you might qualify in addition to the standard deduction. Above-the-line deductions can be claimed using Schedule 1 which eFile will help you fill out; they are separate from your standard deduction.

Should I itemize or take the standard deduction?

Will I get a refund if I make less than the standard deduction?

How do I claim the standard deduction?

The standard deduction is a line item on your Form 1040 - when you file online with eFile, the tax app will automatically claim the standard deduction for you and calculate its value when preparing your taxes.

The eFile Tax App applies the basic, additional, and dependent standard deduction amounts based on the taxpayer's information. Start and eFileIT!

2025 Tax Year Standard Tax Deduction Amounts

The 2025 standard deduction table below is organized by filing status (single, married, head of household, surviving spouse), whether you were older or younger than age 65 - born on/after or before Jan. 2, 1961, and whether you are legally blind or not.

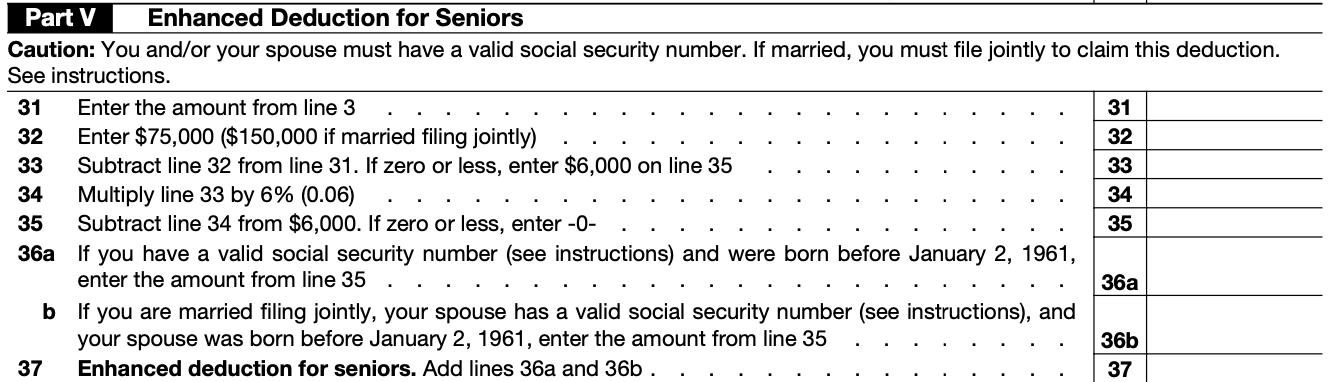

Enhanced Senior Deduction if born before Jan. 2, 1961

The enhanced senior deduction is reported via the IRS Form Schedule-1-A for additional deductions. The eFile.com tax estimator will calculate the enhanced senior deduction when you estimate your next tax return and the social security tax calculator will let you know if you have to pay taxes on your social security income. Below is the outline as seen on Schedule 1-A for Form 1040.

- If born before Jan. 2, 1961, seniors can deduct the enhanced maximum $6,000 (in addition to the age related amount) deduction. This amount phases out at MAGI (modified adjusted gross income) $75,000 (ends at $175,000) for singles, head of household, married separate and at $150,000 (ends at $250,000) for married filing jointly. MAGI for the senior deduction means AGI plus foreign and certain territorial excluded incomes. The married filing separate filing status does not qualify for the enhanced senior deduction.

- The enhanced senior deduction is in addition to the regular standard and existing age-based deductions. Itemized deductions are not required to claim this deduction, however the deduction can be claim via itemized deductions as well.

- The enhanced $6,000 deduction is reduced by 6 cents for every $1 the MAGI exceeds the threshold or phase-out level.

- For example: A senior taxpayer filing as single with a $100,000 MAGI for tax year 2025 would see their deduction reduced by $1,500 or $100,000 minus 75,000 = $25,000 x $0.06 = $1,500. The senior deduction in this case is $4,500 ($6,000 minus $1,500) instead of the $6,000.

The IRS and state standard deduction amounts generally increase each tax year. When you use eFile.com, you can be sure that the correct standard deduction is applied to your tax return. 2025 tax returns are due by April 15, 2026.

Standard Deduction Amounts by Filing Status, Age, Blind, Senior Discount

Single

Birth Date: After Jan. 2, 1961 = Standard Deduction: $15,750, and legally Blind (add $2,000) = Standard Deduction $17,750

Single

Birth Date: Before Jan. 2, 1961 (add $2,000) = Standard Deduction $17,750, and legally Blind (add $2,000) = Standard Deduction $19,750.

=> Add $6,000 senior deduction (phases out $75,000 Modified Adjusted Gross Income - MAGI - and ends at 175,000).

Head of Household

Birth Date: After Jan. 2, 1961 = Standard Deduction $23,625, and legally Blind (add $2,000) = Standard Deduction $25,625

Head of Household

Birth Date: Before Jan. 2, 1961 (add $2,000) = Standard Deduction $25,625, and legally Blind (add $2,000) = Standard Deduction = $27,625.

=> Add $6,000 senior deduction (phases out $75,000 Modified Adjusted Gross Income - MAGI - and ends at 175,000).

Attention: When you prepare and eFile your taxes on eFile.com, all of these various scenarios will be calculated for you. Plus, the eFile Tax App will calculate itemized deductions and make a recommendation for you. However, you decide which deduction method you prefer.

eFileIT and Make IT Less Taxing!

Married Filing Separately

Important: Both spouses have to use the same deduction method either Standard or Itemized. Birth Date: After Jan. 2, 1961 = Standard Deduction $15,750, and legally Blind (add $1,600) = Standard Deduction = $17,350

Married Filing Separately

Important: Both spouses have to use the same deduction method either Standard or Itemized. Birth Date: Before Jan. 2, 1961 (add $1,600) = Standard Deduction $17,350, and legally Blind (add $1,600) = Standard Deduction $18,950.

=> MFS filing status does NOT qualify for the enhanced senior deduction.

Surviving Spouse

Birth Date: After Jan. 2, 1961 = Standard Deduction $31,500, and legally Blind (add $1,600) = Standard Deduction $33,100

Surviving Spouse

Birth Date: Before Jan. 2, 1961 (add $1,600) = Standard Deduction $33,100, and legally Blind (add $1,600) = Standard Deduction = $34,700.

=> Add $6,000 senior deduction (phases out $75,000 Modified Adjusted Gross Income - MAGI - and ends at 175,000).

Married Filing Jointly

Birth Date: After Jan. 2, 1961 = Standard Deduction = both Spouses after = Standard Deduction $31,500 or one Spouse before and one Spouse after add $1,600, and legally Blind (only Spouse legally Blind add $1,600) or (both Spouses blind add $3,200)

Married Filing Jointly

For example: Both Spouses are born before Jan. 2, 1961 (add $1,600/each or total $3,200) = Standard Deduction $31,500 plus $3,200 = $34,700. If both Spouses are also blind (add $3,200) = Standard Deduction = $37,900. In comparison, one Spouse born before (add $1,600) and one Spouse born after (add $0) = Standard Deduction (one Spouse before $33,100) (one Spouse after $33,100), and one or both are blind (one Spouse blind add $1,600) (both Spouses blind add $3,200) = Standard Deduction and one Spouse younger than 65 (after) and one over 65 (before) and one blind (add $3,200 = Standard Deduction= $34,700. Or one Spouse younger than 65 (after) and one Spouse 65 or older (before) and both Spouses are blind (add $4,800) = Standard Deduction = $36,300.

=> Add the $6,000 senior deduction for each spouse. The deduction phases out at MAGI - Modified Adjusted Gross Income - at $150,000 and at 75,000 (if one spouse is younger than 65) and the phase out ends at 250,000 and 175,000 (one spouse is younger than 65). MAGI in this case is: AGI plus foreign and certain territorial excluded incomes. AGI plus foreign and certain territorial excluded incomes.

Dependent

At any age, if you are a dependent on another person's tax return and you are filing your own tax return, your standard deduction cannot exceed the greater of $1,350 or the sum of $450 and your individual earned income. Additionally, this rule does not apply if the dependent makes equal to or greater than the standard deduction for their filing status. Learn more about

how to file a tax return as a dependent.

Sample 1: If your earned income was $700. Your standard deduction would be: $1,150 as the sum of $700 plus $450 is $1,150, thus less than $1350.

Sample 2: If your income was $15,000, your standard deduction would be: $15,750 as the sum of $450 plus $15,000 is $15,450, thus greater than $1,350, but it cannot exceed the single standard deduction amount for 2025 which is $15,750.

Sample 3: As a dependent, if you have taxable income of $16,000, then you claim the standard deduction for single taxpayers of $15,750 and pay tax on the remaining $250.

Learn more about

who qualifies as a dependent.

Nonresident Aliens

As a nonresident alien or dual-status alien, you are not allowed to claim the standard deduction and must

itemize in order to claim tax deductions on

Form 1040NR.

Standard Deduction Exception Summary for Tax Year 2025

- If you are age 65 or older - born on/after Jan. 2, 1961 or before, your standard deduction increases by $2,000 if you file as single or head of household. If you are legally blind, your standard deduction increases by $2,000 as well.

- Plus if you are 65 or older, seniors can deduct an additional maximum $6,000 in deductions (in addition to the above age adjustment). This amount phases out at $75,000 (ends at $175,000) for singles, head of household, married separate and at $150,000 (ends at $250,000) for married filing jointly.

- If you are married filing jointly and only ONE of you was born before Jan. 2, 1961, your standard deduction increases by $1,600. If BOTH you and your spouse were born before Jan. 2, 1961, your standard deduction increases by $3,200 ($1,600 for each qualifying spouse). If one of you is legally blind, it increases by $1,600, and if both are, it increases by $3,200.

- As a surviving spouse , your standard deduction increases by $1,600 if you were born before Jan. 2, 1961. If you are legally blind, it increases by $1,600.

- Disaster Loss: Your standard deduction may only be increased by the net amount of any disaster loss you suffered if your area is a federally declared disaster. This is the same amount you would report as an itemized deduction if you were itemizing.

To qualify as blind by the IRS, you must keep in your tax records a certified letter from an eye doctor (or optometrist) stating that you have non correctable 20/200 vision in your best eye or that your field of vision is restricted to 20 degrees or less. For more information about additional standard deduction for any disabilities, see Exemptions, Standard Deduction, and Filing Information.

Does the Standard Deduction Have Rules, Criteria?

The standard deduction has certain situations and other rules which can affect how it is claimed and the amounts. These are for informational purposes as the eFile app claims your standard deduction for you when you eFileIT.

The standard deduction for is based on the taxpayer's age, blindness, and the filing status - the amount is increased for those age 65 and older and those who are legally blind. The standard deductions increased significantly due to the 2018 tax reform while many other deductions were disqualified. There are still deductions in addition to the standard deduction available that can reduce your taxes.

- Generally, if a taxpayer's income is under the standard deduction amounts, this taxpayer might not have to file a tax return. However, there are other reasons you may need to or want to file an income tax return, such as state tax rebate or refund programs or federal tax credits.

- All United States citizens generally qualify for the standard deduction unless they choose to itemize deductions.

- For example: A single taxpayer makes $20,000 annually from employment reported on Form W-2. On a federal level, the IRS allows the taxpayer to deduct a dollar amount from this income, meaning only a portion of the total income is subject to income taxes, putting the taxpayer in a lower tax bracket than if the entire $20,000 was taxed. For a single filer in 2025, the standard deduction is $15,750. This $4,250 would then be subject to the appropriate tax bracket. For 2025, the 10% tax bracket for single filers is on taxable income up to $11,925. So, this taxpayer would fall into the 10% bracket. There are different rules if you make income from self-employment or as an independent contractor. If you make $400 or more from self-employment, you will need to file taxes.

Who Does Not Qualify for the Standard Deduction?

Certain individuals may not qualify for the standard deduction; review the information below or simply start free on eFile.com and we will determine this for you.

Married Filing Separate

When a couple file as

married filing separately and if one spouse

itemizes deductions, than the other spouse can not claim the standard deduction. As this filing status, both taxpayers need to use the same deduction method.

Trust, estate, etc.

A common trust fund, estate or trust, or partnership can not claim the standard deduction.

Filing Period

A taxpayer who who files a tax return for a period of less than 12 months as the result of a change in the annual accounting period does not qualify for the standard deduction. This does not apply to most taxpayers filing a regular, annul income tax return in a timely manner.

Nonresident Alien

There are

nonresident aliens who can claim the standard deduction, however, in general, a

nonresident alien filing Form 1040-NR can not claim the standard deduction. Here are the exceptions:

A: If a nonresident alien is married to a U.S. citizen or resident alien as of Dec. 31 of the tax year and makes a joint election with the spouse to be treated as a U.S. resident for the entire tax year, then they can claim the standard deduction.

B: If a nonresident who is married to a U.S. citizen or resident converts to a U.S. citizen or resident by Dec. 31 of the tax year and makes a joint election with the spouse to be treated as a U.S. resident for the entire tax year, then they can claim the standard deduction.

C: Nonresident students and/or business apprentices who are residents of India at the end of the tax year, and who are eligible for benefits under

paragraph 2 of Article 21 (Payments Received by Students and Apprentices) of the United States-India Income Tax Treaty, can claim the standard deduction.

Dependent

Dependents are able to claim a deduction on their income, but it is limited due to their status. The table above has specific details.

Instead of wondering whether or not you qualify for the standard deduction, start your next tax return and let the eFile platform figure this out for you by entering simple information. You can also apply or select the itemized deduction method on the eFile tax app.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.