New York Income Tax Return Instructions

New York has one of the most extensive tax codes of all United States - e-file your NY return with your IRS return so you do not have to worry about many of these complicated rules and regulations.

eFile will generate your respective NY tax form(s) for you as you work - this includes your IT-201, IT-203, and other NY tax forms. Just follow the tax interview, proceed to the state section, answer a few state questions, and your return is ready. Additional information may be required - refer to the details below.

Note: you may be eligible for the Empire State Child Credit (ESCC) if you were a resident of NY for a full year, have a qualifying child, and you meet these income thresholds:

- $110,000 or less for married filing jointly

- $75,000 or less for single, heads of household, or surviving spouse

- $55,000 or less for married filing separately.

How to File NY Income Taxes?

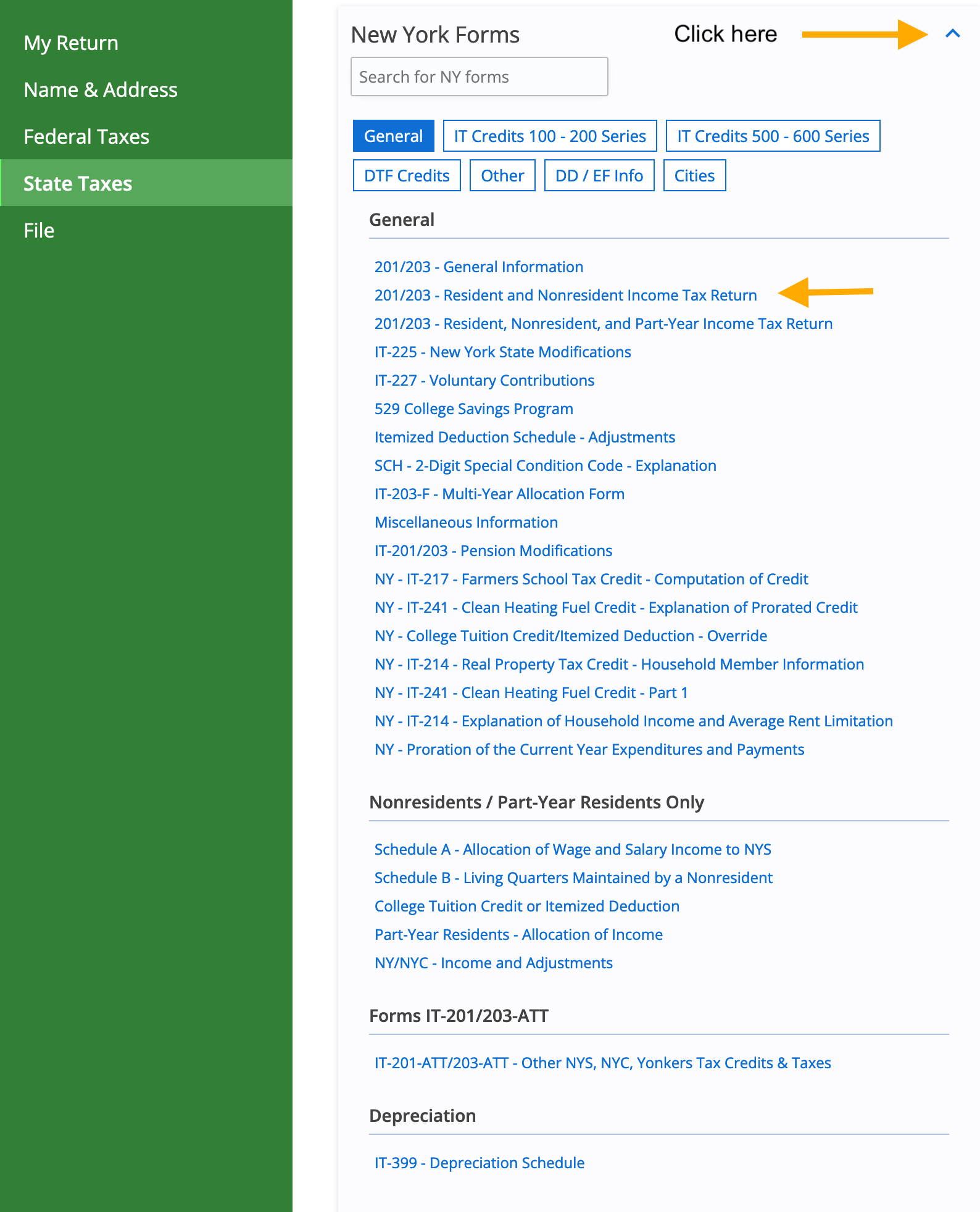

A: Access NY Forms

Step 1:

Sign in to eFile.com Step 2: Click on

State Taxes on the left menu.

On the right page click on the link

I'd like to see the forms I've filled out or search for a form.Step 3: Scroll to the NY State Forms drop-down and select the right arrow.

Step 4: Select the form in question and review, edit the entries and save.

or Step 5: Use the NY search box to find other forms or select the links below the search box.

Step 6: Select

Add Form next to the form name; complete, save, and continue.

Overview of NY pages on eFile.com. Click a link below that applies to you or ask a Taxpert

® if you need assistance.

B: Tax Return Residency Status

You are a resident of NY for tax purposes if you maintain a permanent place abode in New York State for a substantial part of the year or the whole tax year. Additionally, you must spend 184 days or more in New York State during the taxable year, whether or not you are domiciled in New York State for any portion of the year. See more details on your

New York residency status for your NY state tax return.

D: NY Filing Instructions

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.