1. Sign In

After you have prepared and e-filed your IRS tax amendment via eFile.com:

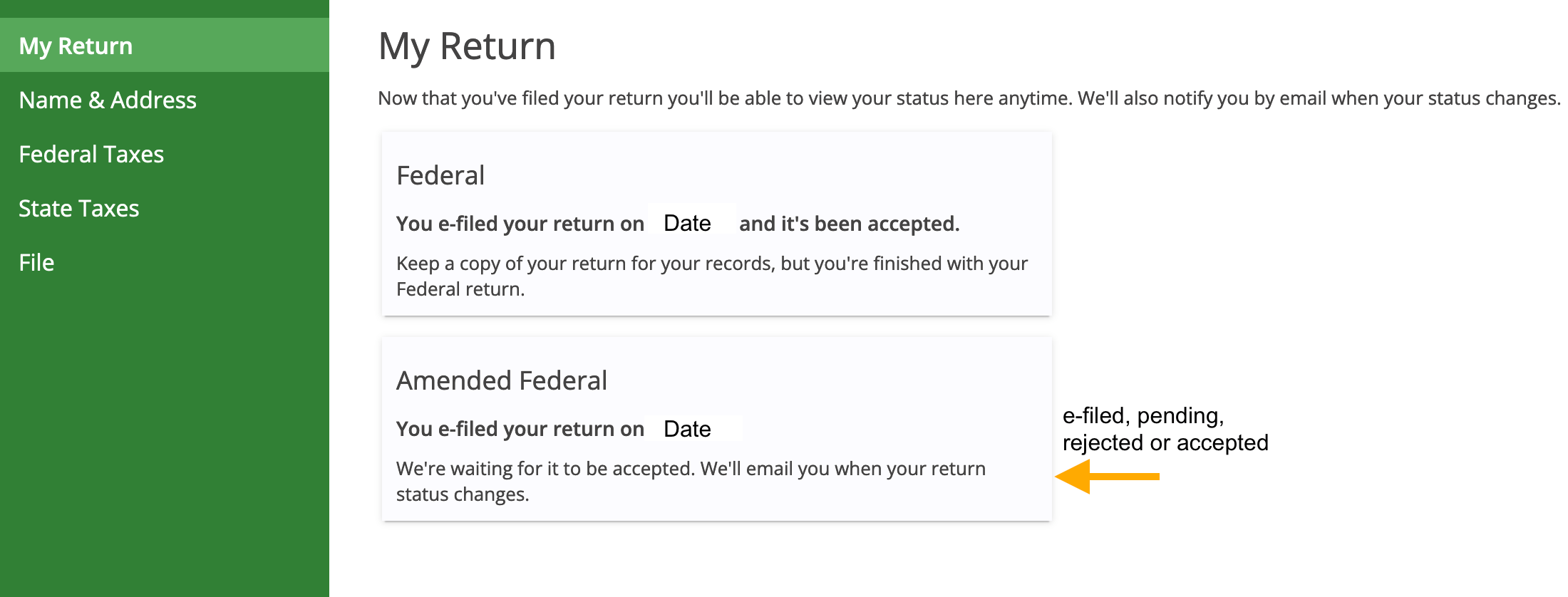

Sign to your eFile.com account, then select

My Return in the upper left and monitor the tax amendment status on the right-side page.

Important: If you did

not use eFile.com to e-file an IRS tax amendment, you will not see the IRS tax amendment status in this account.

You cannot e-file a state tax amendment via eFile.com or anywhere else. Instead, follow these

state tax amendment instructions.

You will see the e-filing status of the e-filed IRS tax amendment as shown below.