Sale of Home, Real Estate on a Tax Return

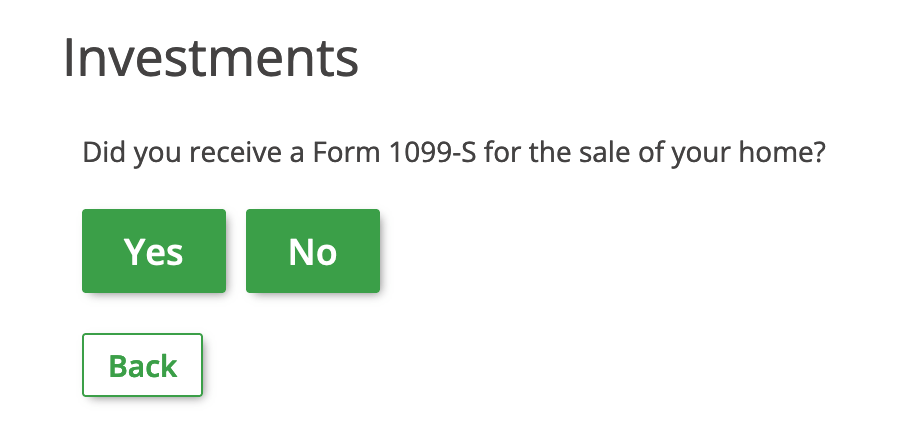

If you received Form 1099-S as the result of the sale of your home, report the transaction on your tax return as outline below. The profit from the sale of your home may be taxable.

What Are the Steps to Report a Home Sale on Your Taxes?

Step 2Add Your Income

Select

Federal Taxes on the left menu and then

Income -

see more details on entering your income.

To add your 1099-S or home sale, scroll through the right side page to the

Investments section and select the link

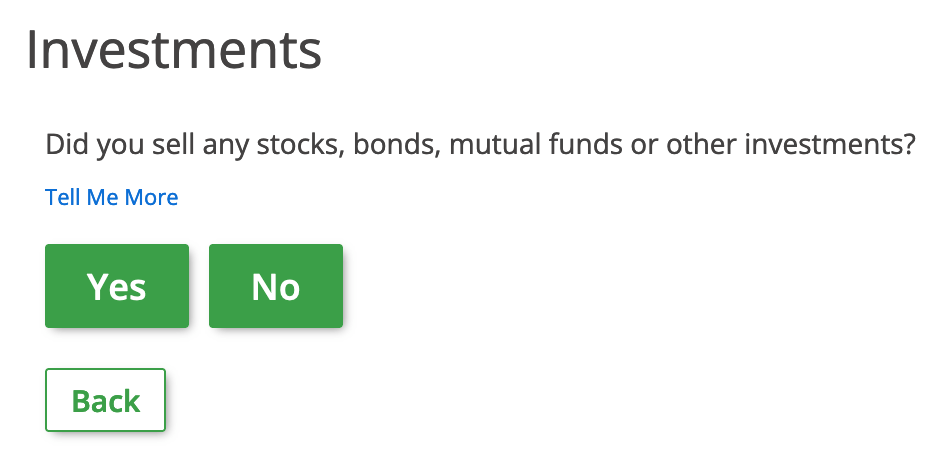

Tell us about your investments.Answer

Yes to any applicable questions - you will be asked if you sold your home towards the end of the questions.

Answer

Yes if applicable or

No to move on.

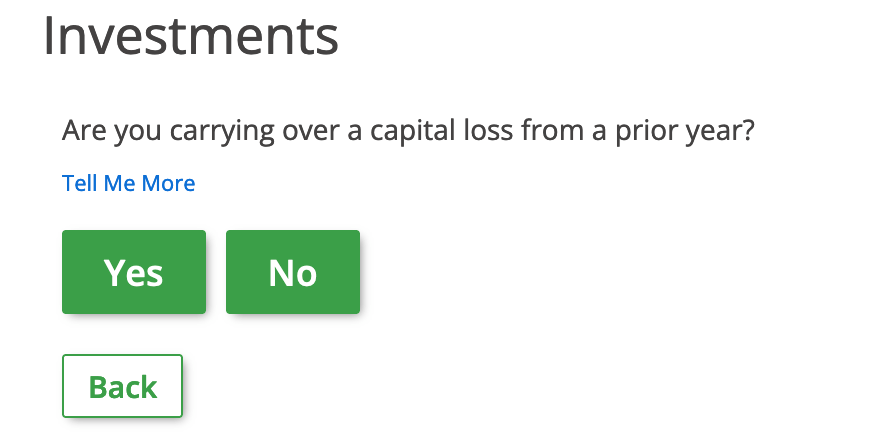

Answer

Yes if applicable or

No to move on.

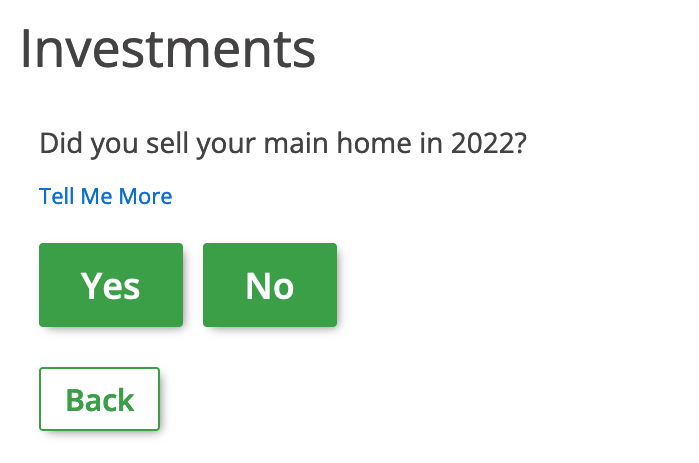

Answer

Yes if applicable or

No to move on.

Select

Add this information.

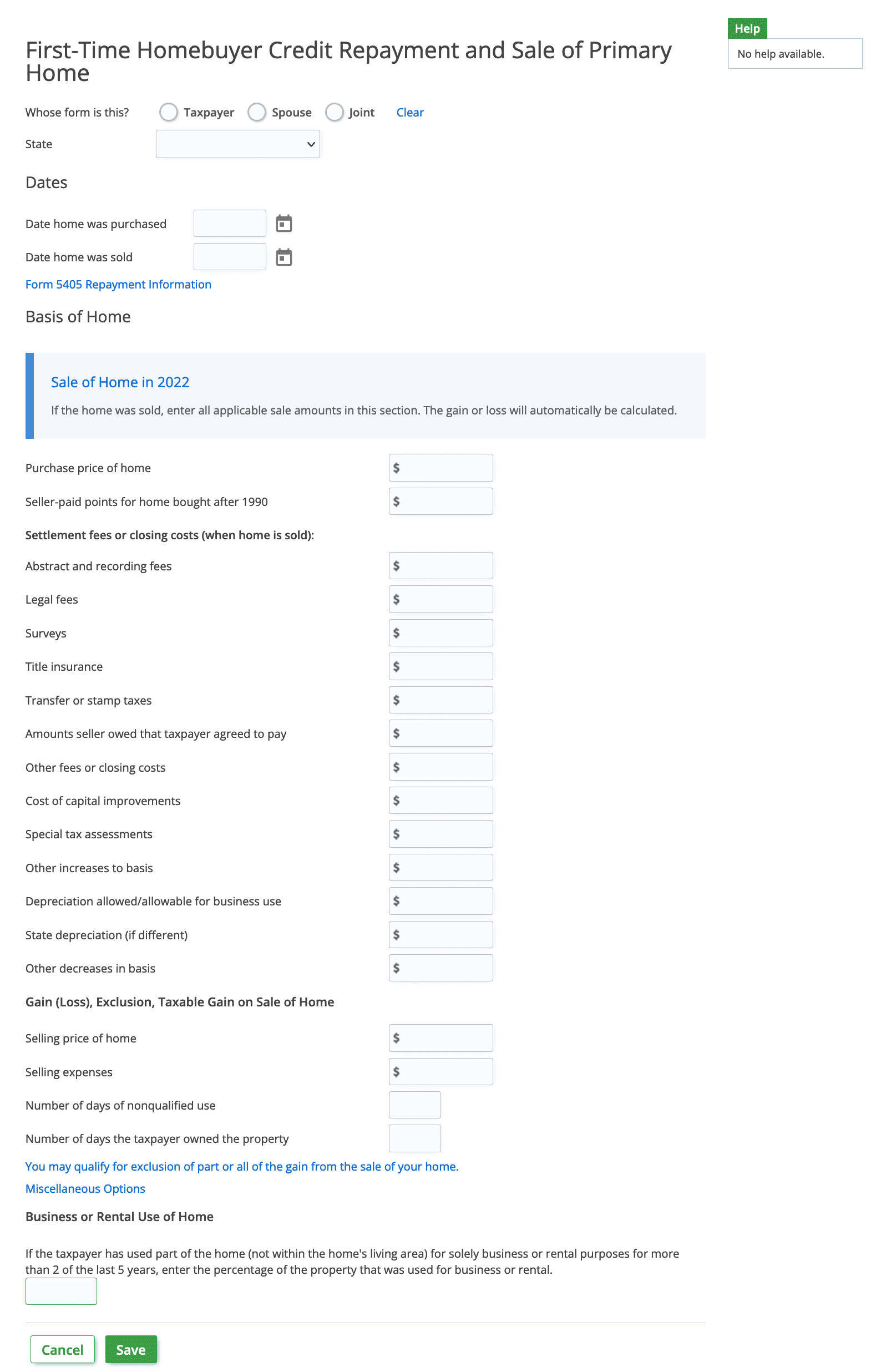

Step 3: Home Sale Entry Screen

Enter your home sale information here. Have your original home purchasing date, home sales price, and other figure handy. Tip: Check the HUD-1 form or HUD-1 Settlement Statement for your home. The selling price of your home for this transaction is in Box 2 on Form 1099-S - see above.

In your account, add all applicable information and leave empty any questions or inputs that do not apply to your situation. Select Save when you are finished; you can always return to this under the Investments section or you can see all the forms you filled out under Federal Taxes > Review.

For further questions, clarification, or help, contact us here with the email address connected to your account so we can assist you. Or, review more helpful resources:

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.