Tax Return Income Types

You may have earned or received multiple types of income during the year. On eFile.com, you will be walked through adding all your income types and forms. Otherwise, you can enter them manually; see how to enter various income types on your tax return by following the steps below.

How to Add a Specific Form or Type of Income?

If you go through the eFile tax interview and did not add a form or income type that you have, you can manually search and add this income. Follow the steps below to find specific income types and forms.

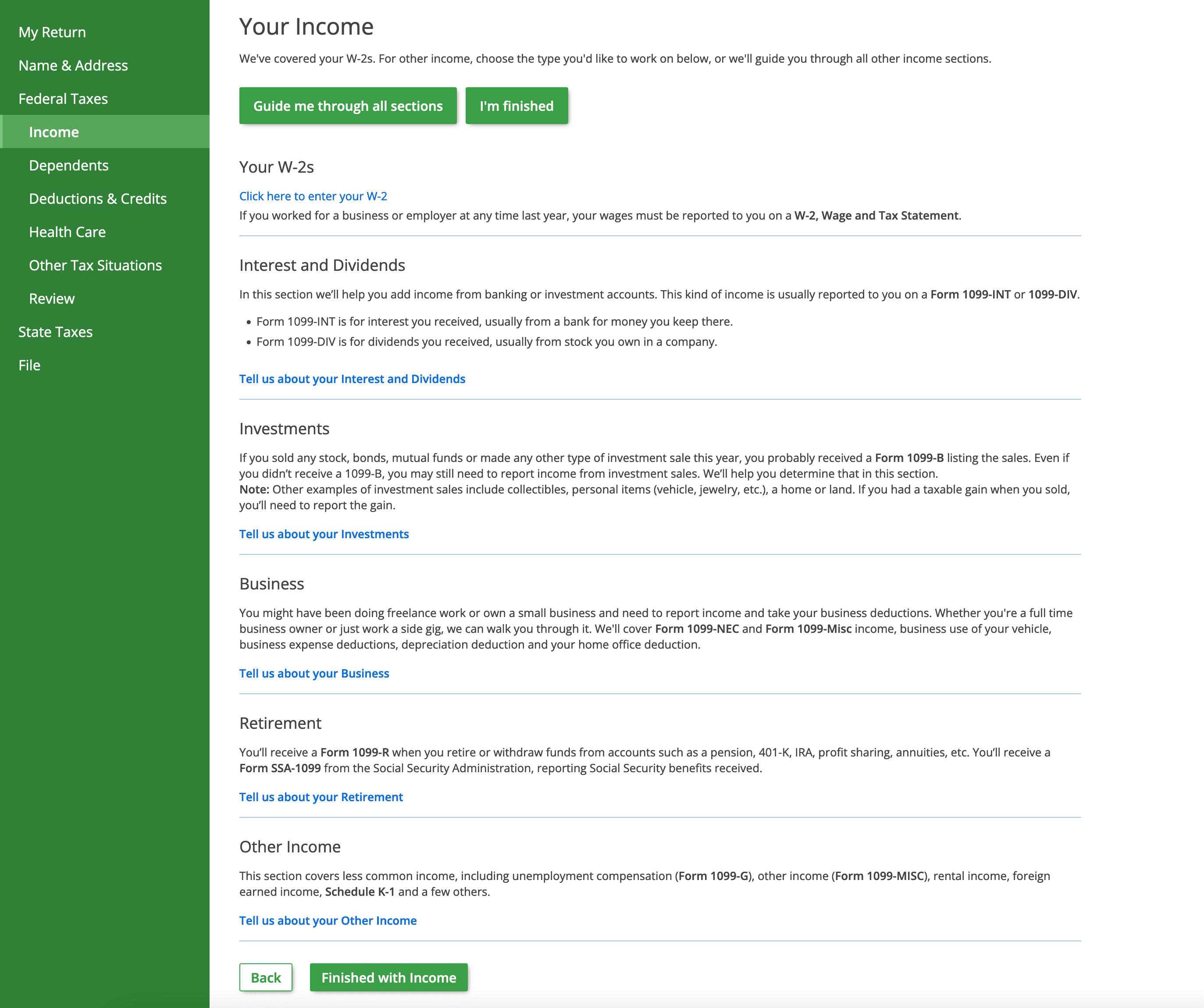

C: Federal Taxes -> Income

Recommended: Select

Guide me through all sections to go through each income entry so you do not miss any forms. For specific entries, see below.

Step 2: Click on

Federal Taxes on the left menu and then

IncomeStep 3: Scroll through the right-side page to the desired section and then follow the prompts to add your income.

D: Search Feature

Select Review to see all the forms you have started or completed; you can also manually search for new forms or sections to add. Enter a keyword to search for related forms or, if you know the form you need, simply enter the form number.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.