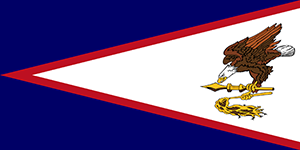

American Samoa Income Taxes and Tax Forms

American Samoa

American Samoa

American Samoa has its own tax system that is independent of the tax system of the United States. It has significant differences but is based on the United States tax code used by the IRS.

Bona Fide Resident of American Samoa

If you are a bona fides resident of American Samoa for the entire tax year, then you must file a tax return with American Samoa reporting gross income from worldwide sources. If you are also a U.S. citizen or resident alien, you must file a U.S. tax return reporting your worldwide income, with the exception of income from American Samoa.

You can prepare your U.S. Tax Return online by clicking the button below:

Start United States Federal Tax Return

If you have self-employment income, you may have to report your information on Form 1040-SS - you can e-file this form on eFile.com.

Nonresident Alien

Suppose you are a nonresident alien of the United States and a bona fide resident of American Samoa for the entire tax year. You must file an American Samoa tax return reporting worldwide source income in that case. You must also file a U.S. tax return reporting worldwide source income but leaving out American Samoa source income.

Non-Bona Fide Resident of American Samoa

If you are not a bona fide resident of American Samoa and a U.S. citizen or resident alien, you must file an American Samoa income tax return reporting income originating only from American Samoa. You must also file a U.S. tax return reporting worldwide income.

Nonresident Alien

If you are not a bona fide resident of American Samoa and a nonresident alien, you must file an American Samoa income tax return reporting income only from American Samoa. You must also file a U.S. tax return using Form 1040NR.

For more information, including special rules, consult IRS Publication 570, Tax Guide for Individuals with Income from U.S. Possessions.

Additional Resources

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.