Qualified Business Income Deduction, QBI

Form 8995

and 8995-A

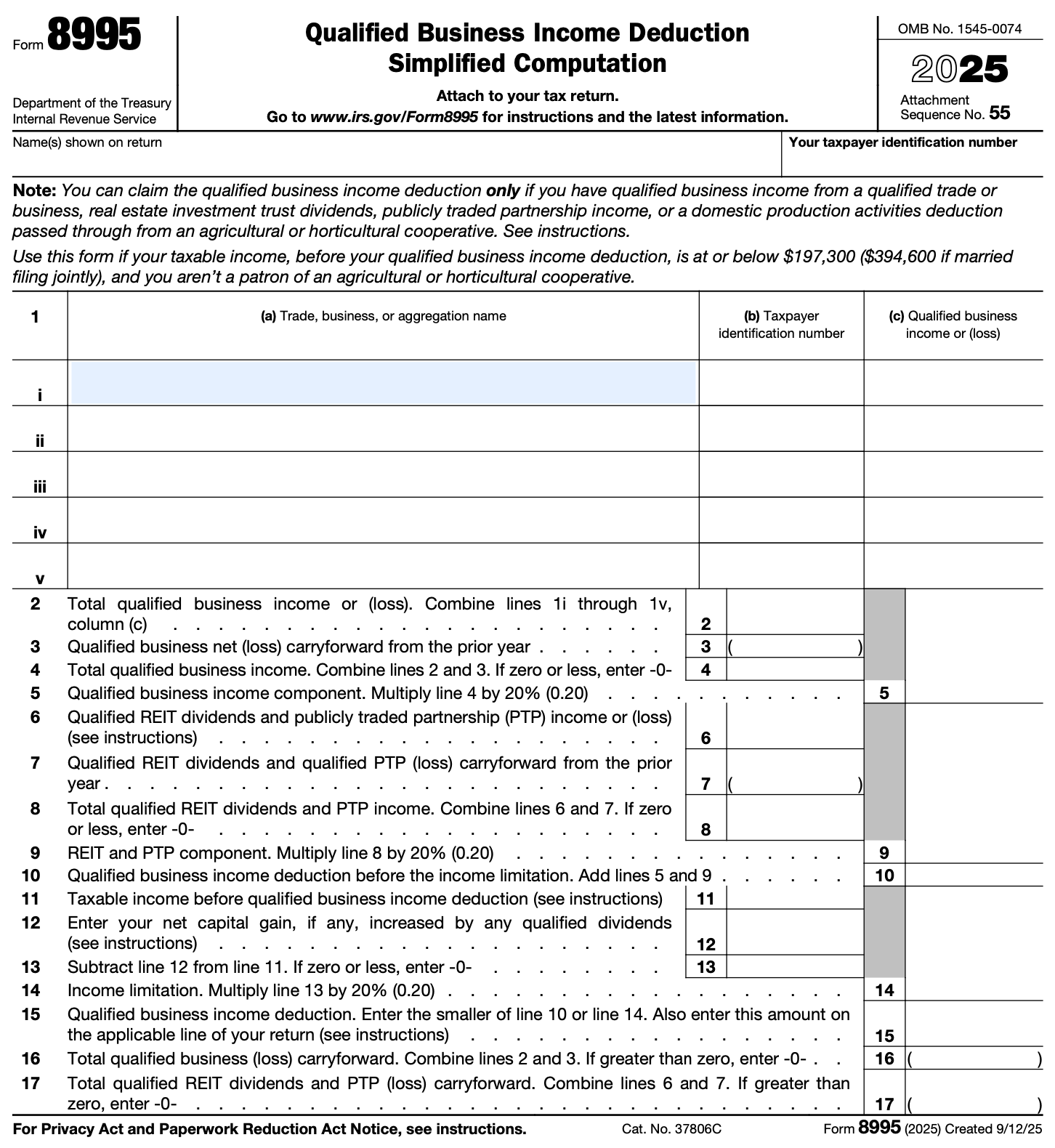

The qualified business income (QBI) deduction is calculated via Form 8995. Individual taxpayers can only claim the qualified business income deduction if they have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative.

Form 8995 and 8995-A - QBI Deduction Calculator

Use the Form 8995 - Qualified Business Income Deduction as also listed below to see if you qualify for this deduction. Enter the amount on line

Steps to calculate the qualified business income deduction - Form 8995

When completed enter line 15 on the eFile.com Tax Calculator below the standard or itemized deduction section.

Enter the amount from line 15 on form 8995 on the eFile.com tax calculator below the standard or itemized deduction section.

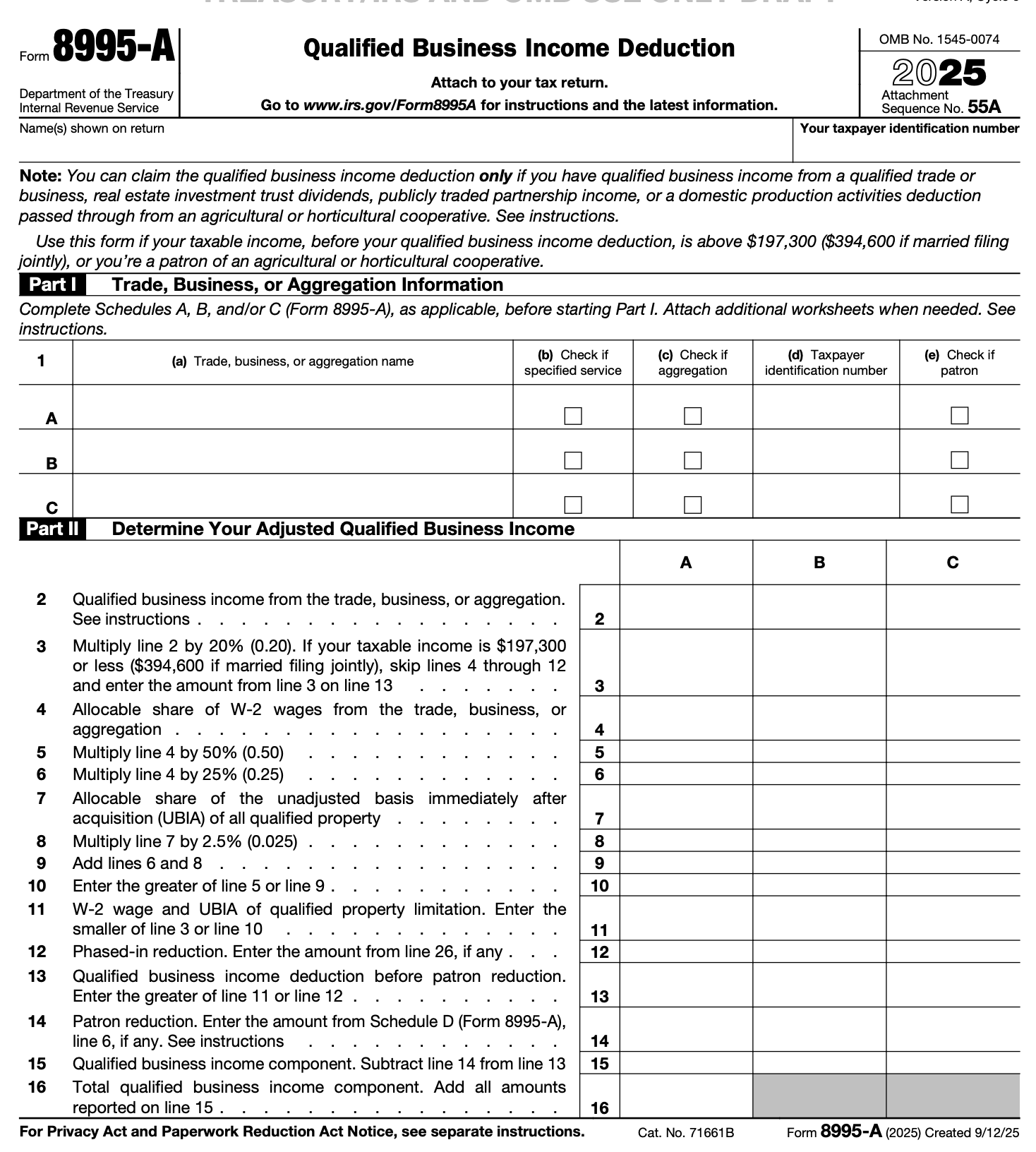

Calculate the qualified business income deduction - Form 8995-A page 1

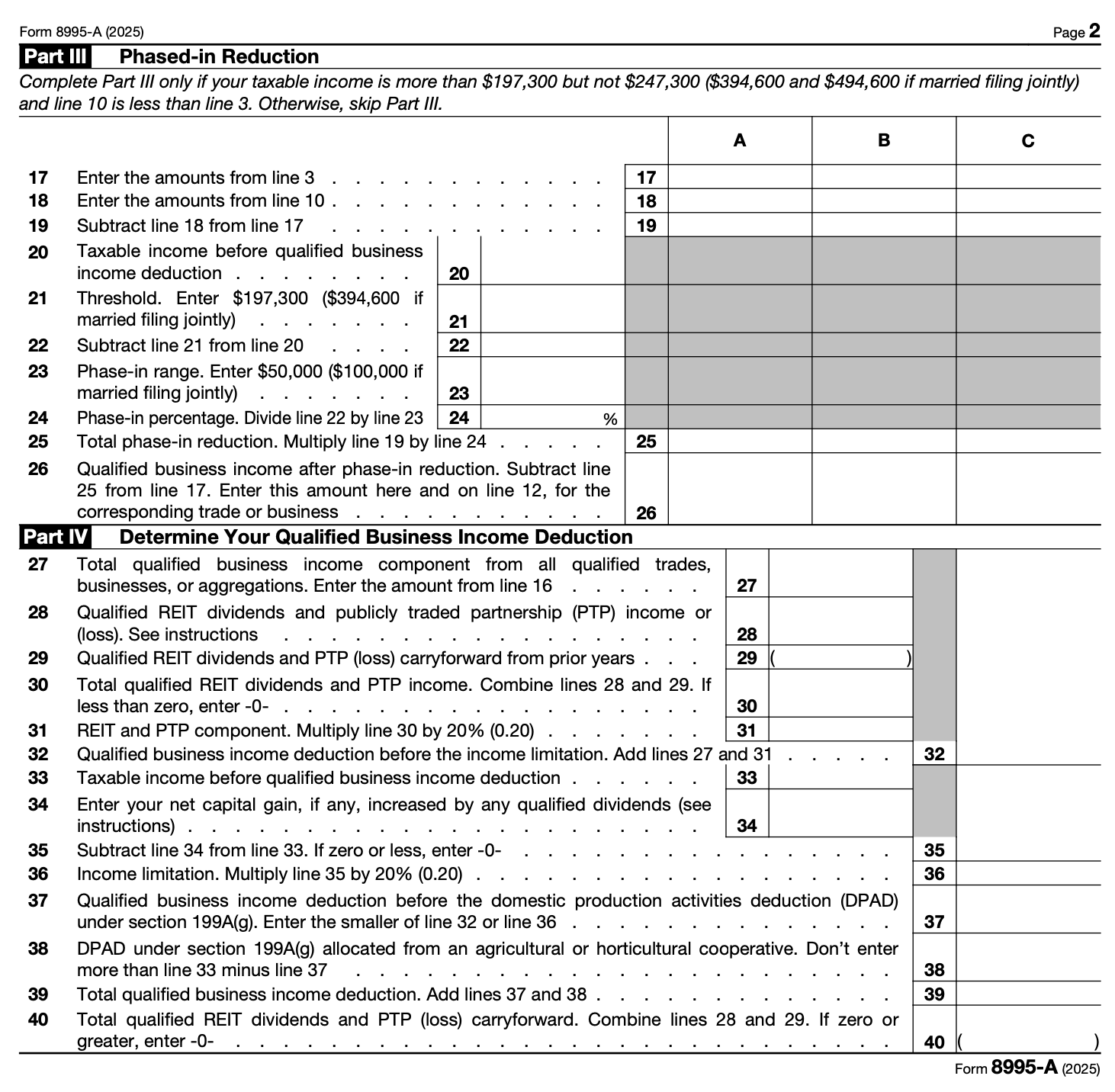

Calculate the qualified business income deduction - Form 8995-A page 2

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.