Can You Deduct Your Home Mortgage Interest?

Deciding whether you can or should deduct home mortgage interest is not the same thing. Generally, if you have a mortgage on your home, you can deduct the interest, but there are certain limits. Whether you should actually claim this deduction depends on other deductions you qualify for. Here’s what you need to know about deducting home mortgage interest on your income tax return:

1. Deduction Limits: You can deduct interest on the first $750,000 of your mortgage debt ($375,000 if you’re married and filing separately). This limit applies to joint returns, singles, surviving spouses, and heads of household. If your mortgage started before December 16, 2017, the limits are higher—$1 million for joint returns and $500,000 for married filing separately.

2. Mortgage Insurance Premiums (PMI): Unfortunately, the deduction for mortgage insurance premiums has expired and can no longer be claimed.

3. Home Equity Loans: Interest on home equity loans can only be deducted if the loan was used to build, buy, or substantially improve your home. You cannot deduct interest if the loan was used for other purposes.

4. Home Acquisition Debt: The deduction applies to the actual cost of the mortgage and debt taken on to buy or build the home. It does not include home improvements or other factors that might affect the home's value.

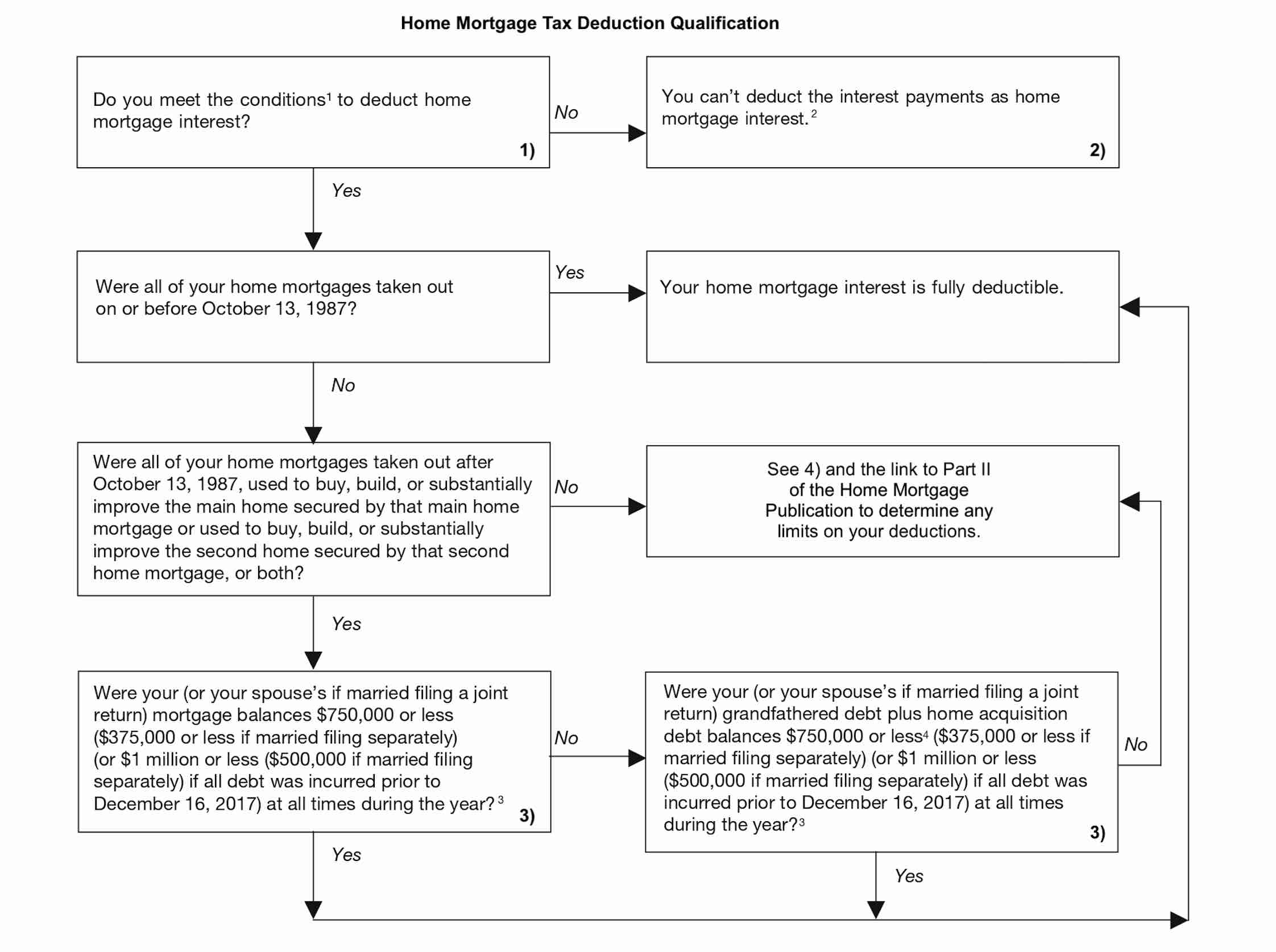

To find out if you can claim this home mortgage interest deduction on your current year’s tax return, refer to a simple chart below.

The table above is taken from the IRS publication on deducting home mortgage interest:

IRS Publication 936: Home Mortgage Interest Deduction

Generally, if you are home mortgage interest amount does not exceed your standard deduction when combined with all your itemized deductions, then it would not benefit you to itemize the mortgage interest deductions. However, if the total of all your total deductions exceeds the standard deduction, then you should itemize your deductions. When you use the eFile Tax App and eFile IT, this determination is done for you so you do not need to figure it out yourself. Itemized deductions are reported on Schedule A for Form 1040.

The home mortgage loan must be a secured debt on a qualified home. See Part I for details in the IRS Home Mortgage Interest Deduction publication. Additionally, details on how to deduct other interest payments are available in Part II.

A taxpayer may use the 2017 threshold amounts of $1,000,000 ($500,000 for married filing separately) if:

- They entered into a binding contract before December 15, 2017 in order to close on the purchase of a principal residence before January 1, 2018, and

- The purchase was finalized before April 1, 2018.

If both criteria are met, then you are considered to have incurred the home acquisition debt prior to December 16, 2017.

If your mortgage was taken out before October 14, 1987 or it was refinanced, then it may qualify as grandfathered debt which is not limited by the interest calculations. More details can be found in the linked publication above.

See additional information on how to report a home purchase or sale and filing instructions for 1099-S.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.