Form 5329, Additional Taxes on Qualified Plans

Form 5329 is used to report additional taxes related to specific retirement accounts and savings plans. You may need to file this form if you owe taxes on:

- IRAs (Individual Retirement Accounts)

- Other qualified retirement plans, including:

- 401(k) plans

- 403(b) plans (tax-sheltered annuity contracts)

- Qualified annuity plans

- Modified endowment contracts

- Coverdell Education Savings Accounts (ESAs)

- Qualified Tuition Programs (QTPs)

- Archer Medical Savings Accounts (MSAs)

- Health Savings Accounts (HSAs)

- ABLE (Achieving a Better Life Experience) accounts.

Filing Form 5329 helps you report and pay any additional taxes on your retirement and savings accounts. Be sure to complete it accurately to avoid any issues with the IRS.

What Are Examples of Who Must File Form 5329?

Here are simple examples to help you understand who needs to file Form 5329 for taxes on retirement plans and accounts.

A. Early Distribution from Retirement Plans

If you received an early distribution from a qualified retirement plan (excluding a Roth IRA) that is subject to taxes, you might need to file Form 5329. However, if your Forms 1099-R show distribution code 1 in box 7 and you owe the additional tax on the entire amount shown, you do not need to file Form 5329. Instead, report the 10% additional tax directly on Schedule 2 (Form 1040), line 8, as per the instructions for Form 1040 or Form 1040-NR.

Contact us with questions.

B. Distribution from a Roth IRA

You must file Form 5329 if you received a distribution from a Roth IRA and:

a. The amount on line 25c of Form 8606 is greater than zero, or

b. The distribution includes a recapture amount subject to the 10% additional tax, or

c. It's a qualified first-time homebuyer distribution.

C. Missed Minimum Required Distribution

If you didn’t receive the minimum required distribution from your qualified retirement plan (this applies to trusts and estates as well), you may need to file Form 5329. You can refer to the section on “Waiver of tax for reasonable cause” for more details on how to waive the tax on excess accumulations in qualified retirement plans.

D. Distribution Exceptions Not Indicated

If you received a distribution subject to the early distribution tax from a qualified retirement plan (excluding a Roth IRA) and you qualify for an exception that is not indicated on your Form 1099-R, or the exception doesn’t apply to the entire distribution, you must file Form 5329.

E. Taxable Distributions from ESAs, QTPs, or ABLE Accounts

You must file Form 5329 if you received taxable distributions from Coverdell ESAs, Qualified Tuition Programs (QTPs), or ABLE accounts. Additionally, if your contributions to traditional IRAs, Roth IRAs, Coverdell ESAs, Archer MSAs, HSAs, or ABLE accounts exceed the maximum contribution limit for the current tax year, or if you had a tax due from an excess contribution on line 17, 25, 33, 41, or 49 of your previous year’s Form 5329, you would need to file this form.

Also Read: 1099 forms and associated distributions.

How to File Form 5329?

Follow the steps below to prepare and e-file a return with Form 5329 included.

2. Where To Enter Data for 5329?

To manually add your form, select

Federal Taxes and then

Review. Here, select

I'd like to see the forms I've filled out.Enter "5329" in the search box or in the

Help search box on top. Select + Add Form next to Form 5329 - Additional Tax on Qualified Plans.

You can then fill out the details based on your form(s).

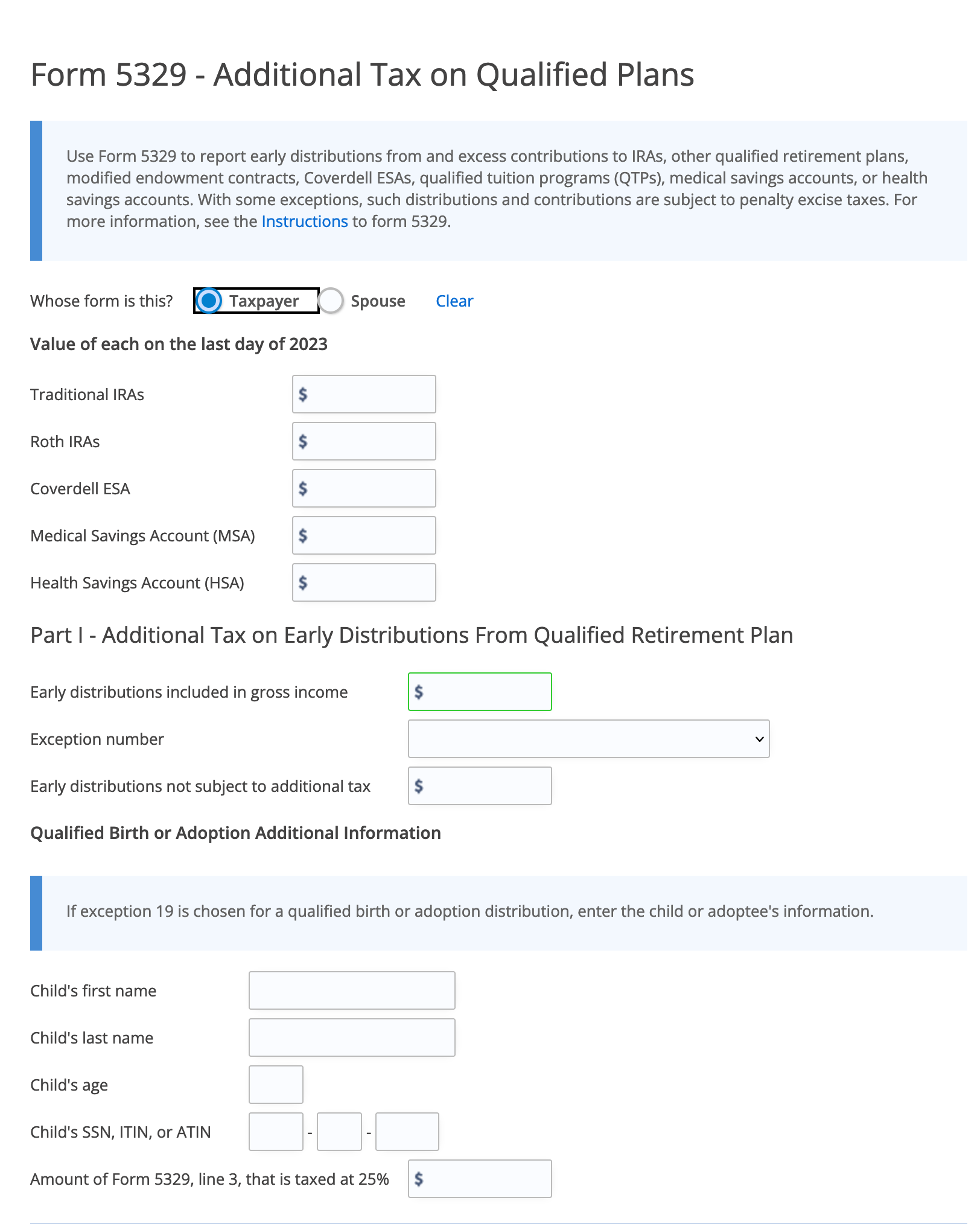

The entry page for form 5329 is shown below.

5. How to Add, Delete a Form or Page

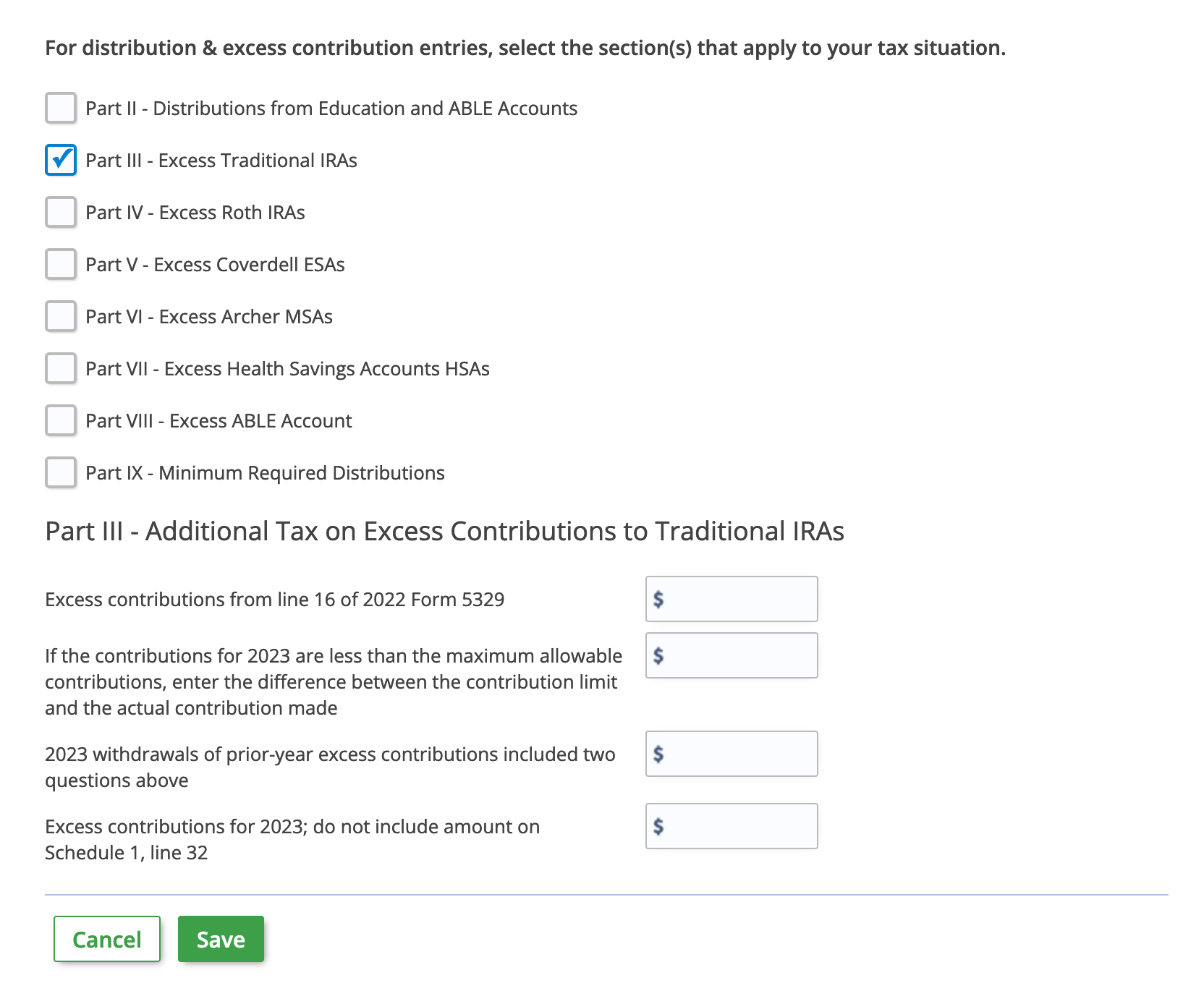

Add in other sections or parts as needed by selecting the checkbox and filling in the data. Contact us for further help.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.