How to Select, Enter Depreciation

If you hold assets for business, rental, or other purpose which lose value over time, then you can depreciate and write of its value each year, Follow the steps below to add your depreciation deduction to your return.

A: Depreciation Page

Sign in hereAs you work through the tax interview, you should come across the business section. Enter your business information, income, expenses, and proceed. One of the last sections of the business section is where you will be prompted to enter depreciable expenses. Otherwise, add the form manually:

- Select Federal Taxes on the left

- Select Review below and on the right side the link: I'd like to see the forms I've filled out or search for a form

- Then scroll either through your My Forms, or

- In the Federal Forms box, enter a search term Depreciation Deduction or Form 4562 and select Add Form to the right. When done, save and continue.

- Or, if you wish to delete delete a from, select the Trash can icon.

The complete tax return as a PDF file is in your My Account (the link is in the upper right) so you can see the entire return there before you file.

B: Depreciation Methods

Overview of Depreciation Methods:

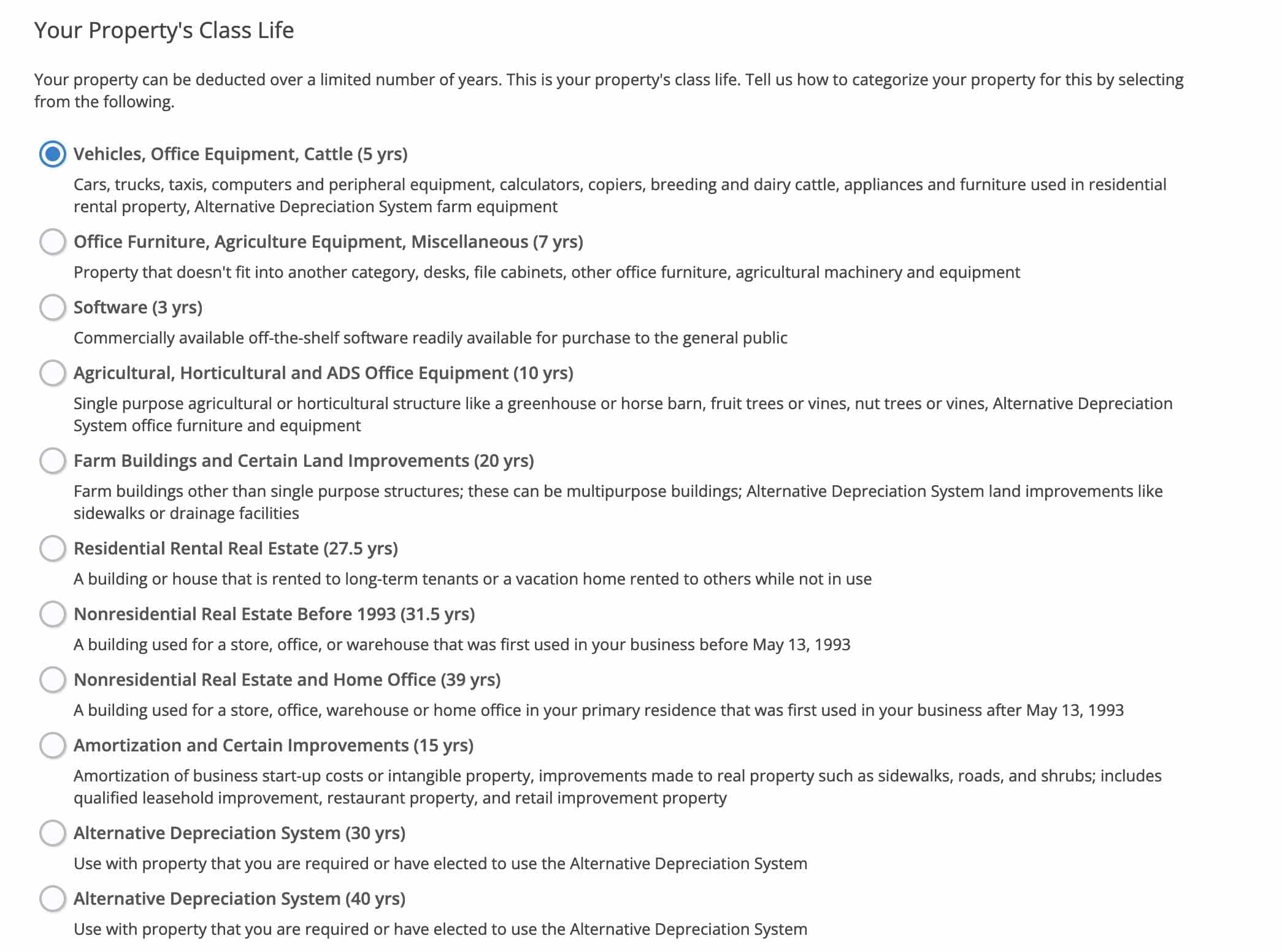

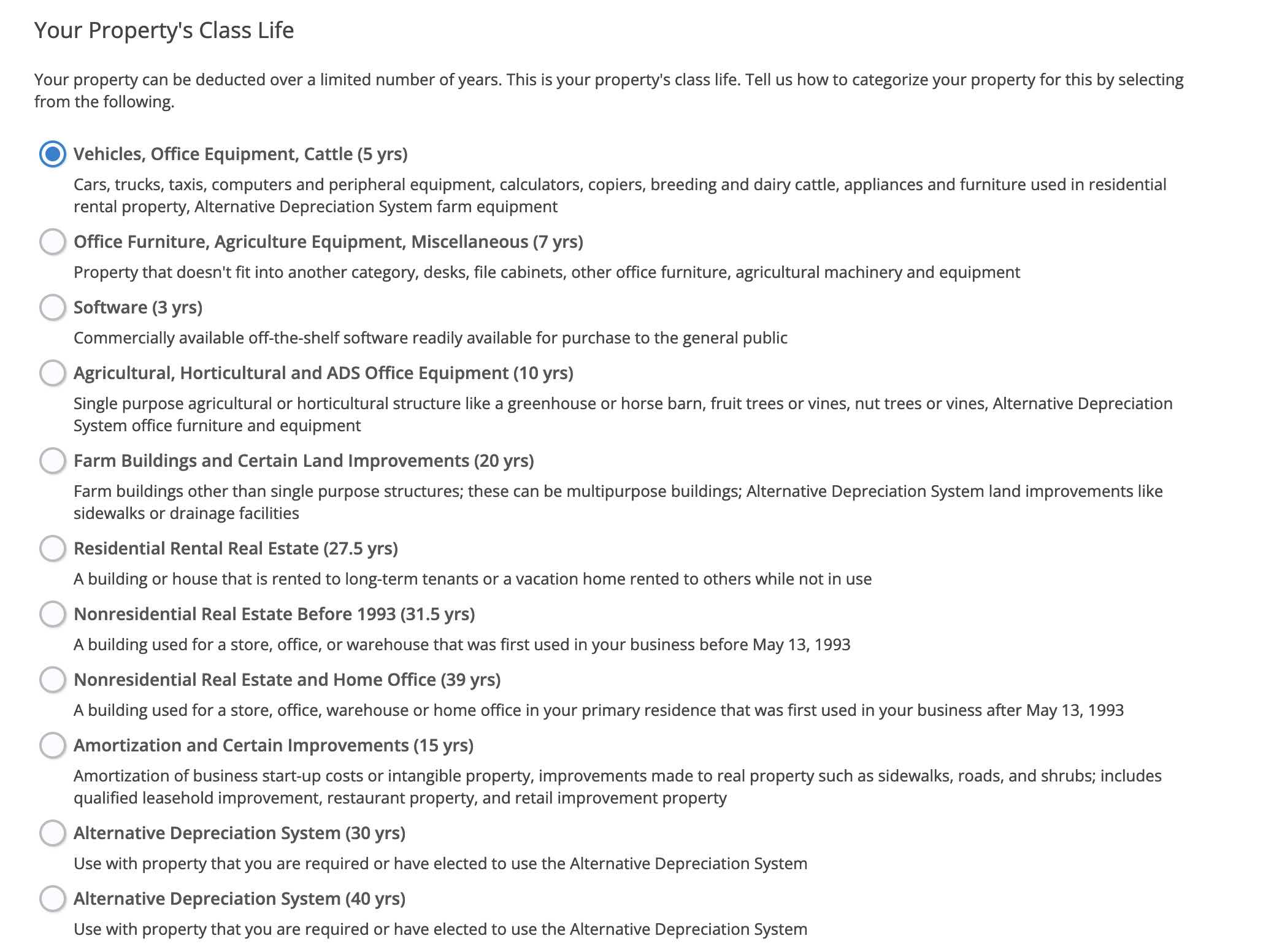

C: Property Class Life Cycle

Overview of Property Life Cycle Periods:

D: Straight Line Method

The same tax deduction amount each year over the useful life of the property.

1. Determine the adjusted basis, salvage value, and estimated useful life of your property.

2. Subtract the salvage value from the adjusted basis = total depreciation amount for the useful life of the property.

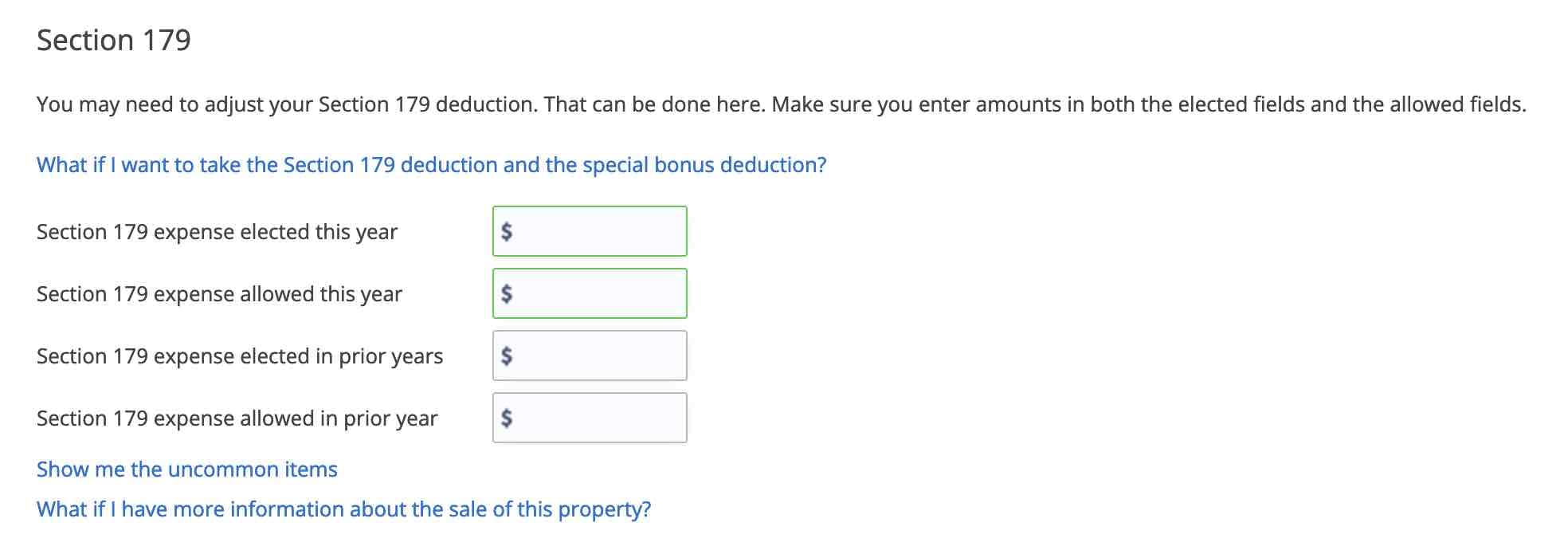

C: Section 179 Method

Overview of Method Section 179. If an asset is eligible for section 179, the following fields must be completed:

- Date to Begin Depreciation (must be in the tax year)

- Your Property's Class Life (Certain class lives are not eligible for 179)

- Listed Property (Most listed property is ineligible for 179)

- Your Depreciation Method; (select "Deduct Full Cost (Section 179)".

D: Form 4562

Calculate deduction amounts for depreciation and amortization. Form 4562 will be part of the tax return if you are claiming any of the following:

- Depreciation on any vehicle or other listed property, regardless of when it was placed in service. A deduction for any vehicle if the deduction is reported on a form other than Schedule C , Form 1040.

- Depreciation for property placed in service during the current year.

- Section 179 deduction for the current year or a section 179 carryover from a prior year.

- Amortization of costs if the current year is the first year of the amortization period.

- Depreciation or amortization on any asset on a corporate income tax return (except Form 1120-S for an S Corporation) regardless of when it was placed in service.

Depreciation is a deduction or tax saving method for the self-employed, including business owners of independent contractors. To depreciate an asset is to report a business expense, such as as vehicle or computer which depreciates (loses value through use or general wear and tear) over time. eFile will help you take the full depreciation deduction this year or to spread it over multiple years.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.