Deleted eFile.com Account

What does and does not get deleted after you deleted your eFile.com account? Review the items below if you are considering deactivating your eFile account or if you already have done so. Important: if you are dissatisfied with the eFile service or your return on eFile.com, contact us first so we can help make things right for you. Give our Taxperts a chance to help you with our platform before deleting all your hard work and tax records.

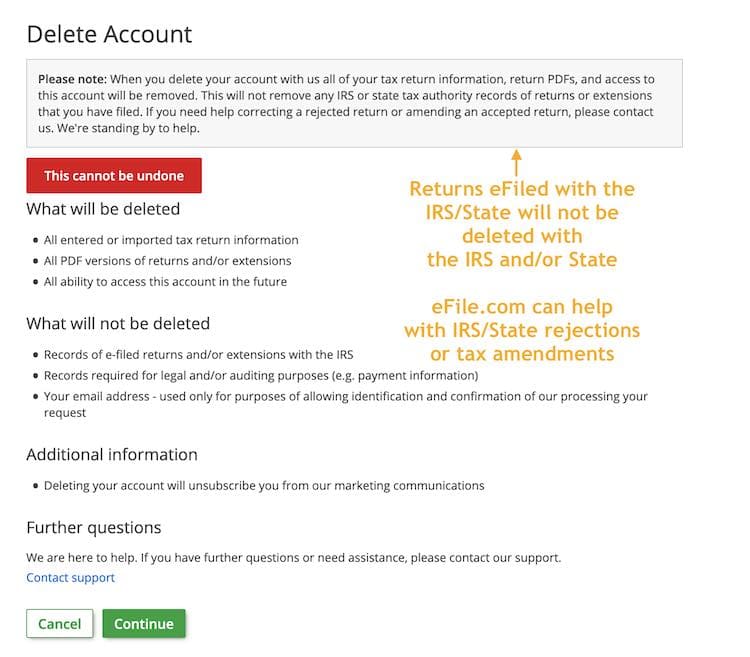

What does and does not get removed or cancelled:

- If you e-filed a tax return with the IRS/state and that return got accepted, that IRS and/or state tax return will not be deleted after you have deleted your eFile.com account (the return will still be efiled), however you will NOT be able to access the return via eFile.com. Your eFile.com account containing your information and the PDF of your efiled return will no longer be in the system. We will not be able to see the information you entered, nor will you be able to obtain a copy of your efiled return, and we will not be able to provide a copy to you.

- If the IRS and/or state rejected your tax return(s), you can no longer correct and re-efile this return at no charge after you have deleted your eFile.com account. You can create a new account on eFile.com and re-efile again in the case of a tax return rejection.

- If you need to change an e-filed IRS/state accepted tax return, you can do this by preparing and filing a tax amendment. However, you will no longer be able to do this if you deleted your account and will need to start from scratch.

- If you paid for an IRS/state tax return on eFile.com, the fees you paid are not deleted or refunded with the deletion of your account. The fees you paid on eFile.com are for the preparation of your return and e-filing is free, thus not part of the fee(s). Review the eFile.com tax preparation fee refund policy here.

Keep in mind:

- You can no longer sign into a deleted eFile.com account and your information in that account can no longer be accessed by anyone.

- After you have deleted an eFile.com prepared IRS/state tax return and you wish to create a new efile.com account and/or tax return, let us know so we can apply previously paid fees of one or more deleted accounts to your new account.

- We can not refund the paid tax preparation fees - refer to our refund policy linked above - but we can credit paid fees associated with a deleted account to future year tax returns prepared on eFile.com.

During the eFile.com account delete process, you agreed to the following:

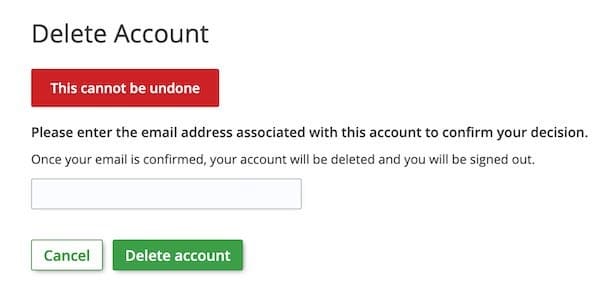

In order to successfully delete an eFile.com account, you must enter the email address associated with your account as show below.

Check the tax refund status of an e-filed and IRS/state accepted tax return after you have deleted your eFile.com account.

Contact us if you have questions about a deleted account.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.