Overtime Pay and Tax Exemption, Deduction 2025-2028

Due to the 2025 Trump tax reform, also known as the One Big Beautiful Bill Act, you may be wondering if you have to pay taxes on your overtime pay or if you can deduct it on your tax return to increase your refund or reduce the taxes you owe. Find out if you qualify for allowable deductions for overtime pay when no taxes are withheld.

Overtime Payment Deduction Qualification

Generally, taxpayers must meet the following requirements to claim the overtime pay deduction. The deduction is NOT automatic and must be claimed by the taxpayer on the tax return. The deduction is available for both the standard and itemized deduction method.

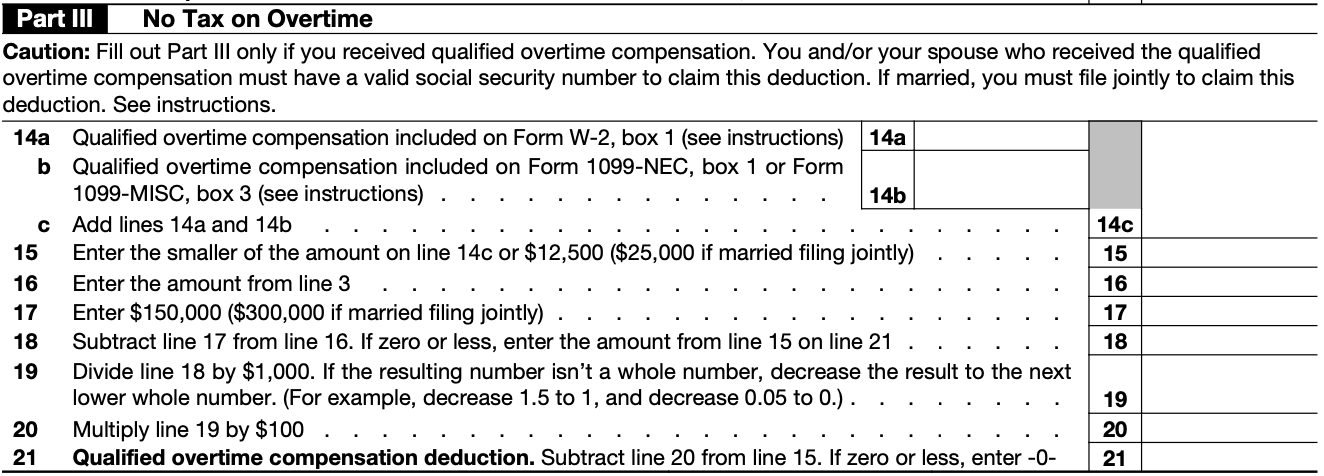

The overtime income pay deduction is reported via the IRS Form Schedule-1-A for additional deductions. The eFile.com tax estimator will calculate the tip income deduction when you estimate your next tax return. Below is the outline as seen on Schedule 1-A for Form 1040.

- W-2 employees earning FLSA-mandated overtime pay: Overtime must be paid to nonexempt employees according to the Section 7 of the (FLSA) Fair Labor Standards Act of 1938 and it must exceed the regular rate of pay at which the individual is employed. Section 7 prohibits employers from requiring employees to work more than a specified number of hour/week unless they are compensated at least 1.5 times of their regular pay rate for hours worked beyond that threshold: 44 hours/week in the first year, 42 hours/week in the second year, and 40 hours/week per week thereafter.

- Social security number: In order to qualify for the overtime income payment deduction, the taxpayer must include a social security number on the tax return.

- Married couples: The overtime payment deduction ONLY applies if a married couply files under the filing status married filing jointly. In other words the filing status married filing separately does not qualify.

- As of now, the overtime payment deduction expires by Dec. 31, 2028.

Taxpayers who do NOT qualify for the overtime payment deduction:

- Independent contractors.

- Salaried and exempt employees who are not receiving FLSA overtime payments.

- Overtime payments under state laws or union contracts that exceed FLSA rules.

Qualified Overtime Payment Deduction Limits by Filing Status

- Single, Head of Household (married filing separately do not qualify): $12,500 overtime pay deduction limit.

- Income based deduction: The deduction phases out if the modified adjusted gross income (MAGI) exceeds $150,000 for single, head of household filers the deduction is reduced by $100 for every $1,000 of MAGI.

- Married filing jointly: $25,000 overtime pay deduction limit. Deduction phase out: If the MAGI exceeds $300,000 for married filing joint filers.

Single, Head of Household

$12,500

$150,000 MAGI

$400,000 MAGI

Married filing jointly

$25,000

$300,000 MAGI

$550,000 MAGI

Married filing separately

Not qualified

Not qualified

Not qualified

Other Overtime Payment Deduction Factors

- Overtime compensation is reported by employers on the taxpayer's Form W-2 - see Box 14 or a dedicated section. Expect new overtime payment reporting standards by the IRS. Form 1099 can report overtime payment.

- Social Security and Medicare taxes still apply to all overtime wages and are not deductible, and only federal income tax will be reduced for the eligible portion.

How is the Overtime Pay Deduction Calculated?

- For example, if a nonexempt employee works more than 40 hours per week, as defined by the FLSA (Fair Labor Standards Act), and is paid $20 per hour for regular work hours, then the overtime pay is $30 per hour. In this case, the difference between the overtime pay of $30 per hour and the regular pay of $20 per hour is $10 per hour. This extra $10 per hour is the overtime payment deduction amount. If a taxpayer, with the filing status single, had 800 hours in annual overtime, the taxpayer could claim $8,000 (800 hours x $10) in overtime pay deductions if the MAGI (modified adjusted gross income) is below $150,000.

- As stated earlier Social Security and Medicare taxes still apply to all overtime wages and are not deductible, and only federal income tax will be reduced for the eligible portion.

Frequently Asked Questions

How much overtime pay can you deduct?

The overtime pay is reported on the W-2 form or form 1099. However, taxpayers can not deduct the full overtime payment amount listed on the W-2 at this point, but rather the overtime hours multiplied by difference between the regular hourly rate and the overtime hourly rate. If you are unsure of the correct amount, contact your employer. Tthe IRS might change the overtime reporting requirements on the W-2 next year. See the above section for details.

How is overtime pay taxed?

It is taxed at the same rate as your other income in accordance with your individual tax bracket and rate. Tax bracket overview and estimates. Taxes on overtime is still paid each pay period and taxes should be withheld during the year. The tax deduction is taken on the tax return.

Which deduction method should I use?

Should I adjust my W-4 tax withholding form?

The IRS might adjust tax withholding tables form W-4 in the future and factor in the overtime payment deduction. Check with an eFile Taxpert® on your tax withholdings.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.