Auto Loan Interest Deduction from 2025 to 2028

As part of the proposed One Big Beautiful Bill (OBBB) tax reform in 2025, taxpayers may be eligible for a new tax deduction for interest paid on certain personal auto loans for tax years 2025, 2026, 2027 and 2028.

Auto Loan Interest Deduction Overview

From tax years 2025 through 2028, taxpayers may deduct up to $10,000 of interest paid on a loan used to purchase a qualified vehicle for personal use. This deduction is available for the standard and itemized deduction methods. Auto lease payments do not qualify.

Auto Loan Requirements

- The Auto Loan must have originated after December 31, 2024

- Loan was used to purchase a vehicle for which the original use starts with the taxpayer (no used vehicles)

- Vehicle must be for personal use, not business or commercial purposes

- Loan must be secured by a lien on the vehicle

- Refinanced loans qualify up to the amount of the original debt amount or indebtedness.

Calculate Your Car Loan Interest Deduction

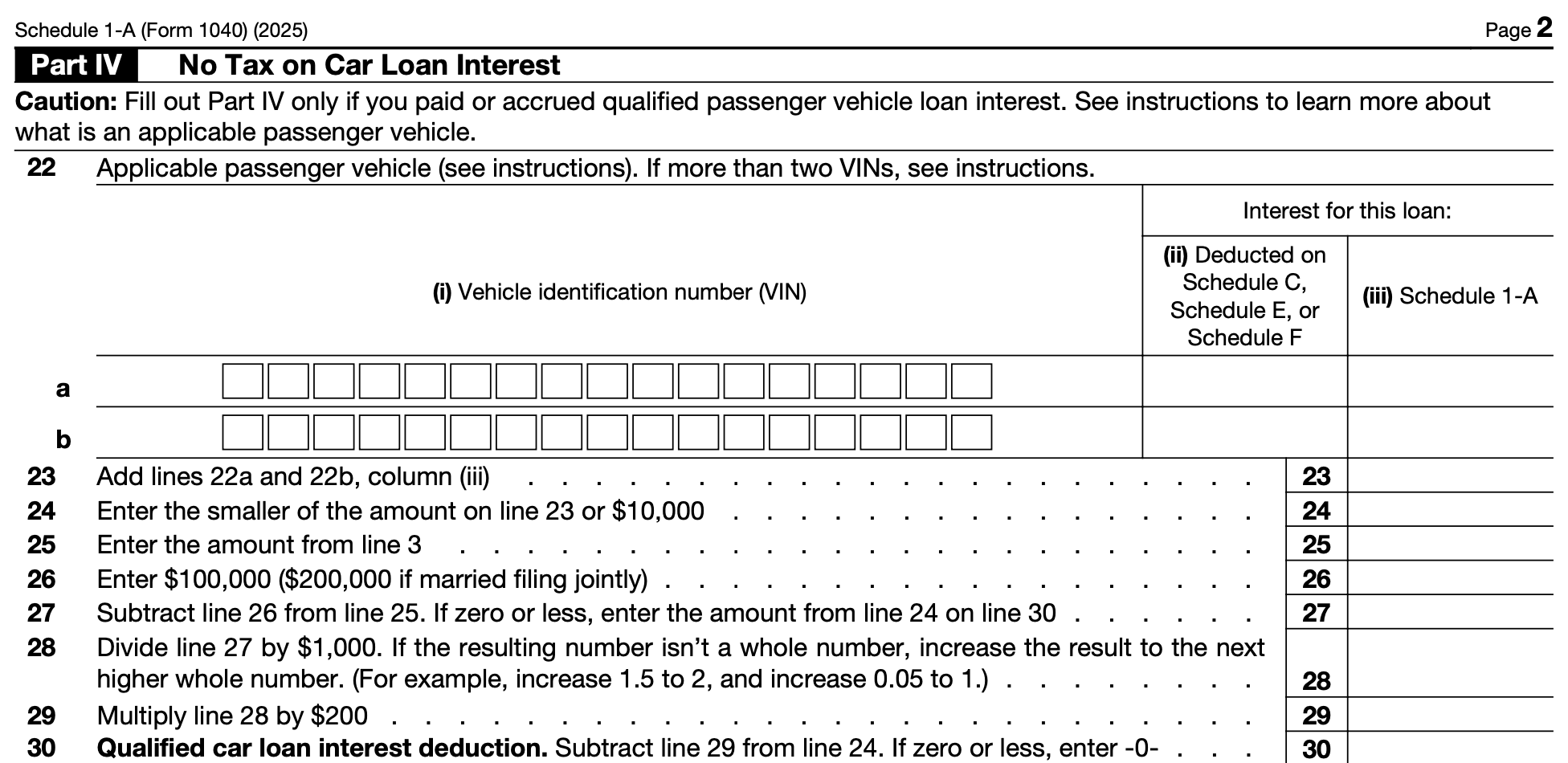

The car loan interest deduction is reported via the IRS Form Schedule-1-A for additional deductions.

When you use the eFile.com free tax calculator and estimator enter line 30 from the calculation below.

Qualified Vehicle Definition

- A car, minivan, van, SUV, pickup truck, or motorcycle with a gross vehicle weight rating (GVWR) under 14,000 lbs, undergoing final assembly in the U.S.

Auto, Car Eligibility

- Vehicle Identification Number (VIN) must be reported on the tax return for each year the deduction is claimed.

Lender, Loan Reporting

- Lenders receiving $600 or more in interest payments must file information returns with the IRS and provide taxpayers a statement:

- Amount of auto loan interest payments received.

- Outstanding auto loan principal amount

- Auto or Vehicle details (e.g., make, model, year, VIN)

Taxpayer Income Limits (Phase-out)

The modified adjusted gross income or MAGI must be below $100,000 or $200,000 and will phase out at the following MAGI limits or thresholds:

- Between $100,000-$149,000 for taxpayers filing as single, head of household or married filing separately

- Between $200,000-$249,000 for married filing jointly

- The tax deduction is reduced by $200 for every $1,000 (or fraction thereof) exceeding the MAGI threshold.

Details on the Clean Vehicle Tax Credit.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.