Step 3: If your eFile.com

My Return shows your return was accepted, check your

IRS Refund Money status. Before or after you click the link, ensure you have a copy of your accepted tax return handy. You can find a return copy in your eFile.com

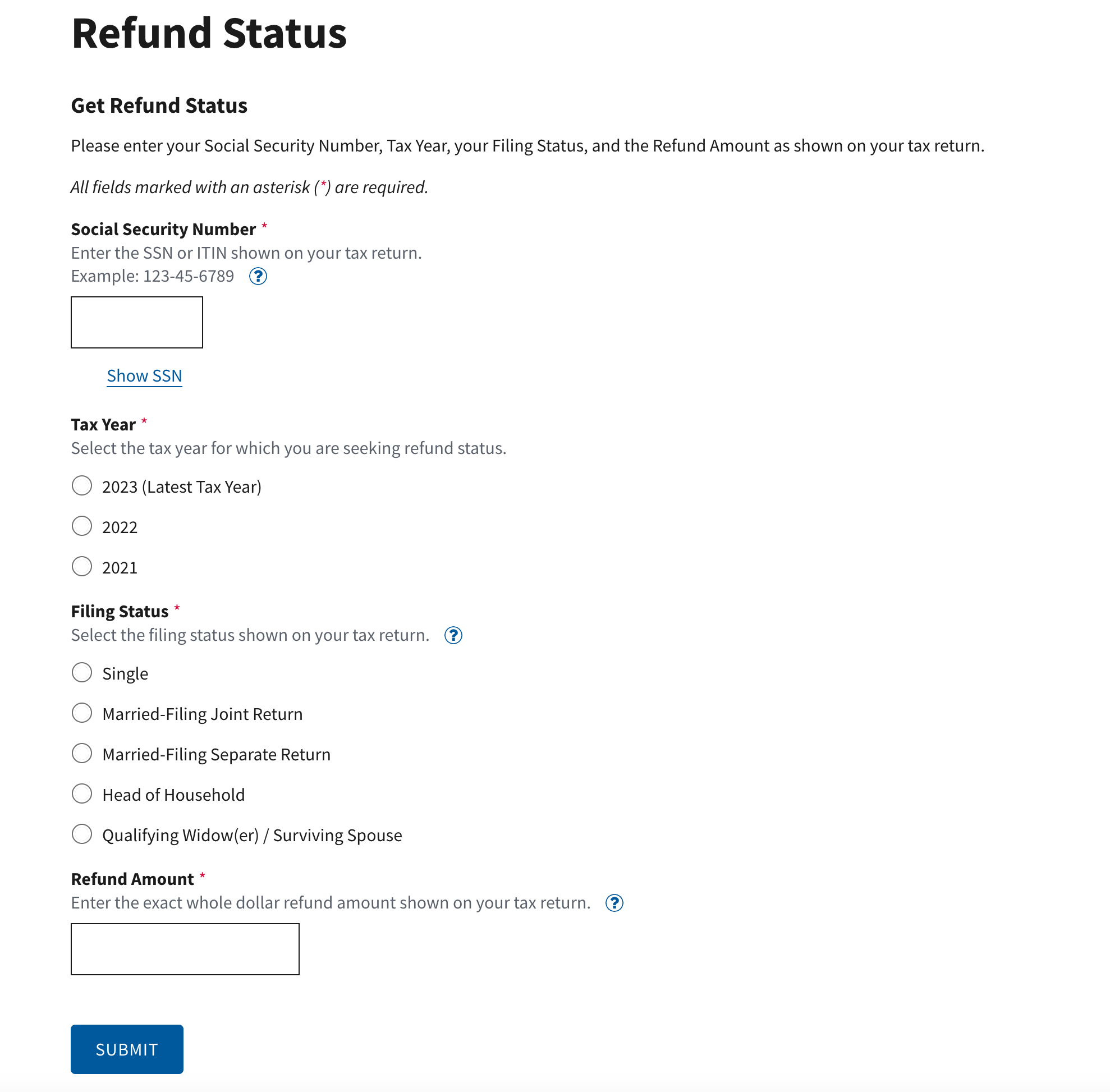

My Account, as you will need to provide the following information from your tax return:

- Social Security Number SSN or Individual Taxpayer Identification Number - ITIN of the primary taxpayer

- Tax Return Filing Status: Single, Married filing joint, Married filing separate, Head of household, or Surviving Spouse - see Form 1040 page 1 on top.

- Tax Refund Dollar Amount: The exact whole dollar amount of your refund - see form 1040, page 2.

The Where's My Tax Refund Money? Page. will look like the image below

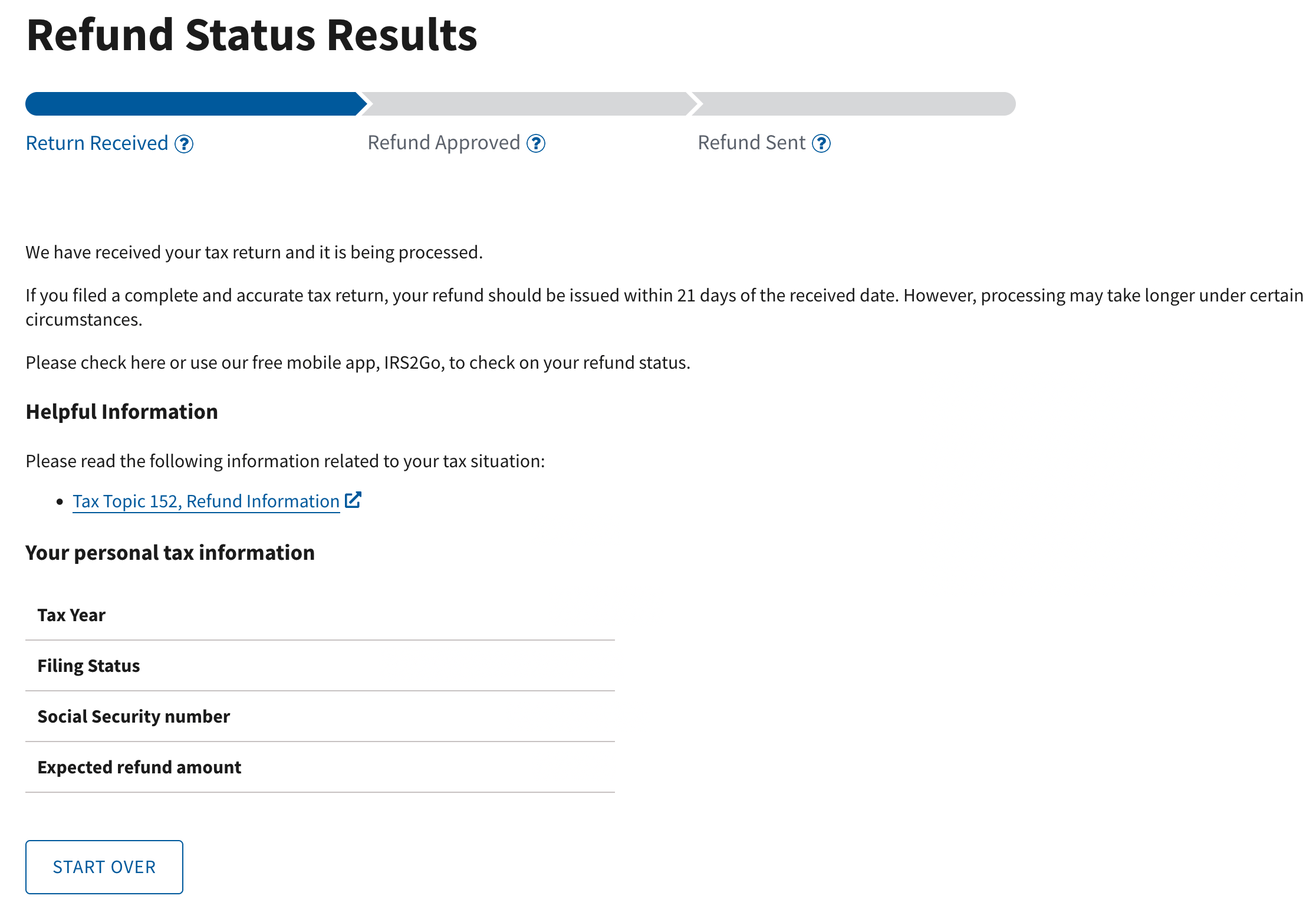

The Where's My Refund lookup tool result page:

If you have further IRS questions about the status of your return, you can also call the IRS Tax Assistance Hotline: 1-800-829-1040 (Monday through Friday from 7:00 a.m. to 10:00 p.m. local time).