Step 1:

Sign in to eFile.com Step 2: Click on

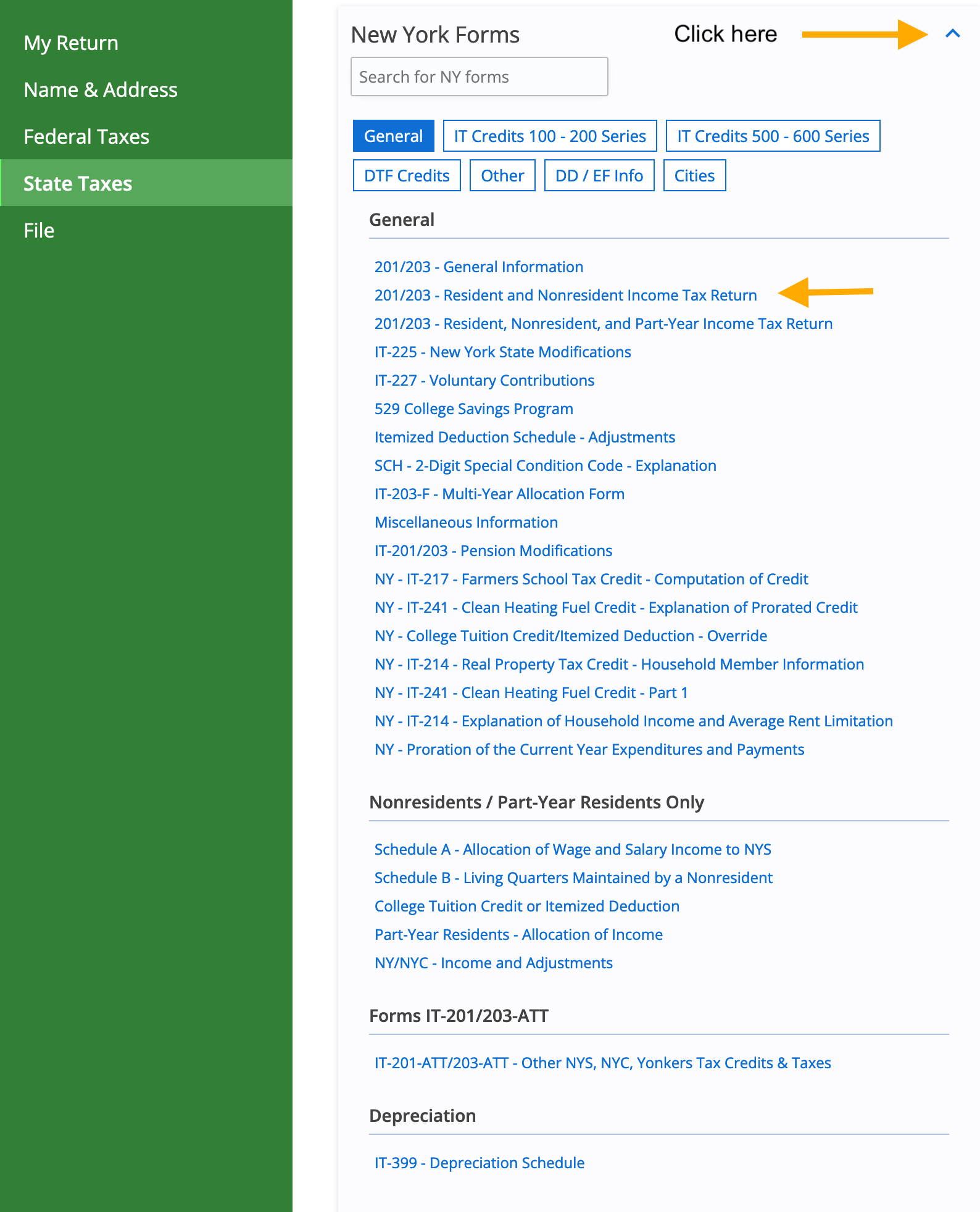

State Taxes on the left menu.

On the right page click on the link

I'd like to see the forms I've filled out or search for a form.Step 3: Scroll to the NY State Forms drop-down and select the right arrow.

Step 4: Select the form in question and review, edit the entries and save.

or Step 5: Use the NY search box to find other forms or select the links below the search box.

Step 6: Select

Add Form next to the form name; complete, save, and continue.

Overview of NY pages on eFile.com. Click a link below that applies to you or ask a Taxpert

® if you need assistance.