Hawaii Income Taxes

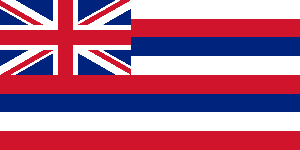

Hawaii

Hawaii

"The Aloha State"

Prepare and e-file your current year Hawaii state tax return - resident, nonresident, or part-year resident returns - together with your IRS return now via eFile.com.

- State return only regulations: Per IRS and Hawaii state tax agency regulation - not eFile.com - you can NOT just prepare and e-file a state return (with the exception of California) without also e-filing the IRS return on the same platform. If you have filed your federal return already, you can prepare an Hawaii state return on eFile.com and then download, print, sign, and mail in the return. See instructions on how to ONLY prepare and print a Hawaii or other state tax return.

- File your HI and IRS taxes online with eFile.com each year so you never have to worry about mailing anything.

HI Tax Resources and Help

Hawaii State Income Tax Rate: 11%

Prepare only a HI state return without an IRS return.

Where Is Your IRS Refund?

Hawaii Income Tax Extension

Hawaii Income Tax Amendment

Hawaii, IRS Late Filing, Tax Payment Penalties

1. Failure to File Penalty: The penalty is 5% of the total tax due per month. The maximum penalty 25% of the taxes owed amount.

2. Failure to Pay Penalty: The penalty is 20% of the tax that hasn't been paid after 60 days past the deadline. In case of the failure to pay penalty being imposed, interest will also be calculated on a monthly basis at a rate of 0.66%. When a taxpayer makes a partial payment to cover the tax debt due, the payment will first cover the interest accumulated and then the actual tax due.

3. IRS Penalties: Calculate and estimate your

potential IRS income tax return penalties.

HI Tax Return Mailing Addresses

Find various

Hawaii mailing addresses for tax returns, tax amendments, and tax payments.

Hawaii Income Tax Brackets

Hawaii Unemployment Benefits

Start Federal and Hawaii Tax Returns

e-File These Current Hawaii State Tax Forms

Prepare and e-file these state forms for current tax year in conjunction with your federal and state income tax return. As you go through the eFile.com tax interview, the eFile app will select the correct state forms for you based on your answers to several questions. You can also select tax forms individually. All these forms will then be e-filed by you to the state tax agency and IRS or see instructions on how to only prepare a state income tax return.

HW-4 - Hawaii Employee's Withholding Allowance and Status Certificate

N-101A - Hawaii Individual Income Tax Extension Payment Voucher

N-2 - Individual Housing Account

N-200V - Individual Income Tax Payment Voucher

N-586 - Tax Credit For Low-Income Housing

Schedule AMD - Hawaii Explanation of Changes on Amended Return

N-103 - Sale Of Your Home

N-11 - Hawaii Individual Income Tax Return Resident

N-15 - Hawaii Individual Income Tax Return Nonresident and Part Year Resident

N-210 - Underpayment of Estimated Tax by 2020 Individuals, Estates, and Trusts

Schedule CR - Schedule Of Tax Credits

Due to IRS and State Tax Agency tax data sharing and validation requirements, you can only e-file a State Income Tax Return while also e-filing a Federal Income Tax Return. This is not an eFile.com created policy, but all online tax web sites have to adhere to this IRS/state issued tax data sharing policy. You can however prepare all 44 State Income Tax Returns on eFile.com if you have already e-Filed or filed your IRS return. Instructions on how you can ONLY prepare and file State Income Tax Return(s). Only on eFile.com can you prepare, file or e-file unlimited State Tax Returns for one low price and not pay for each State return like you would do on H&R Block® vs. TurboTax®. Dare to Compare Now.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.