How to eFile an IRS Tax Extension

You can only prepare and e-file a federal income tax extension while state income tax extensions can only be mailed in. Let's get your IRS extension e-filed for free!

An income tax return extension only postpones the filing deadline for 6 months. The deadline to prepare and e-file an IRS extension is generally Tax Day, April 18 which extends your deadline to the following October 15, meaning you have 6 months to e-file your tax return after the April deadline.

If you owe taxes and do not pay by the April deadline, but filed an extension, then the late tax return filing penalty will not apply but a late payment penalty might apply. Generally, the late tax return filing penalty is higher than the late tax payment penalty - see details about tax penalties. Learn more about why and why not to prepare and e-file a tax extension - File something (return or extension) by the April deadline even if you can't pay anything! Options to pay taxes.

File a Tax Extension Online Step-by-Step

Sign up to eFile.com sign in to your existing eFile account.

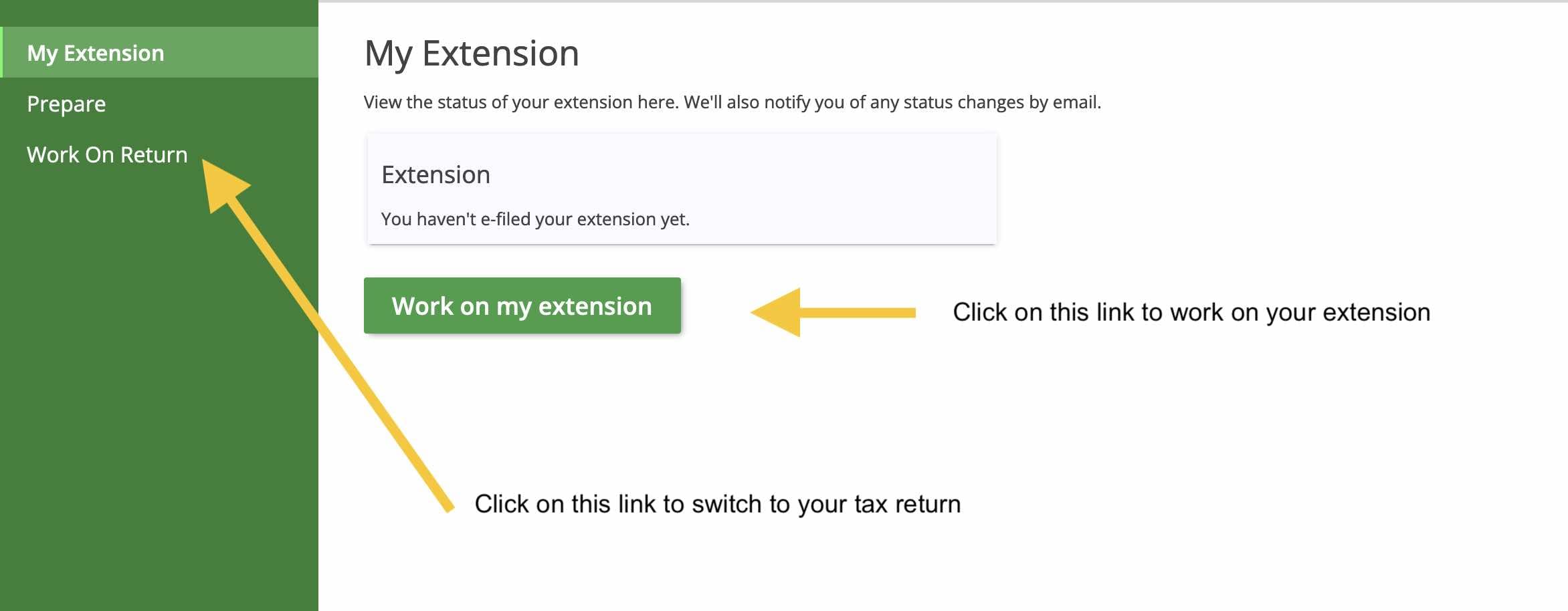

You will see the button on the right side: Work on my extension - select that to create your extension.

Step 1: Start Your Extension

Otherwise, select the Work on Return link above to work on your tax return - see below.

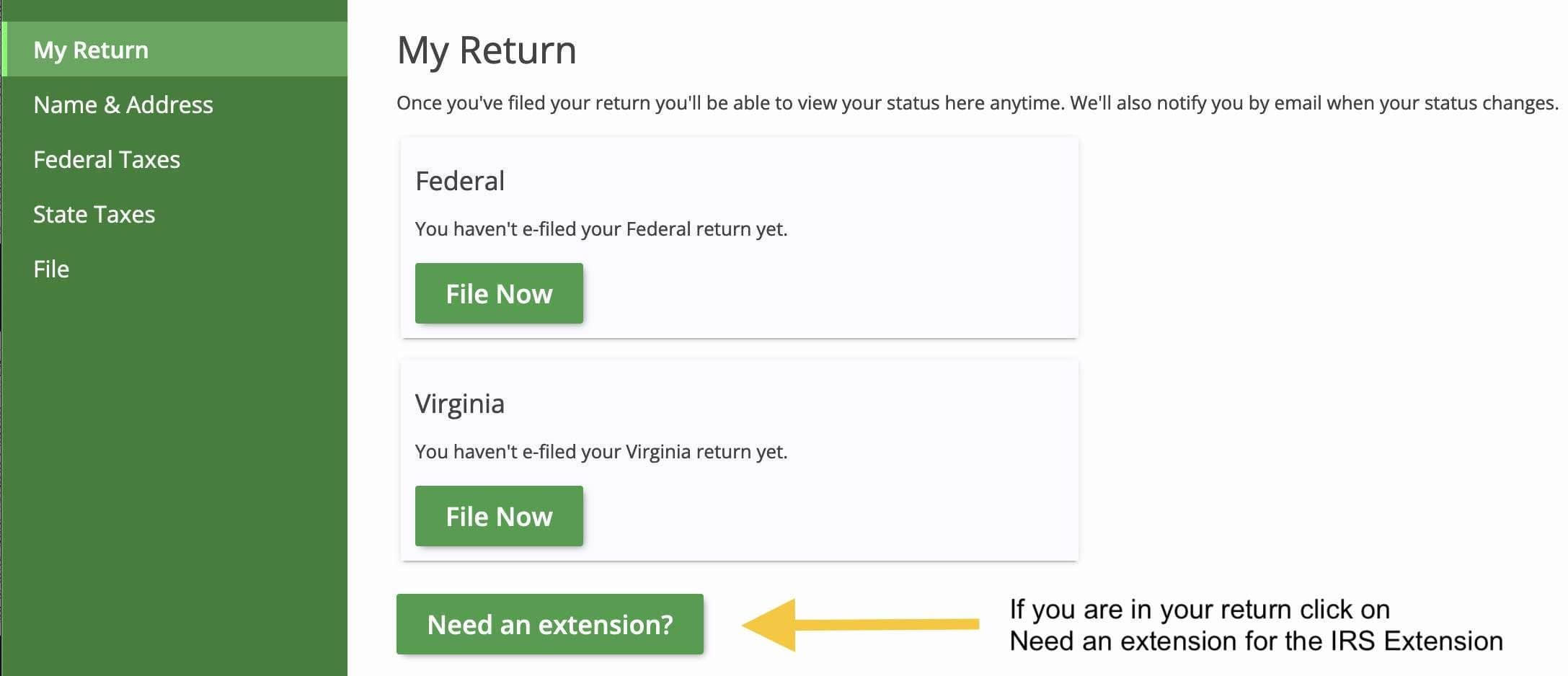

From the view below, you can switch back to your tax extension by clicking on Need an extension?

Step 2: Additional Extension Questions

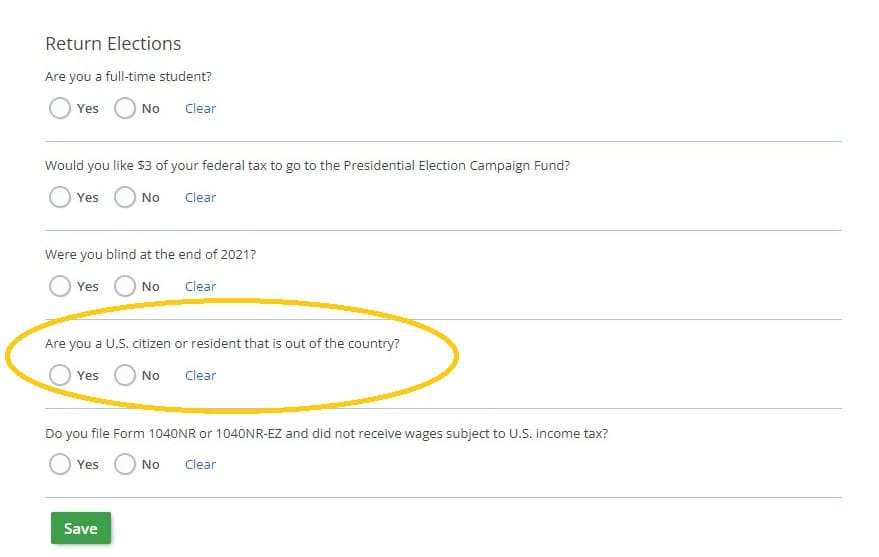

Answer these questions honestly based on your situation. The circled question is very important: only answer "Yes" to this if you are a U.S. Citizen that is currently or is going to be out of the country. If you are not leaving the country and are just filing a 6 month extension, answer "No."

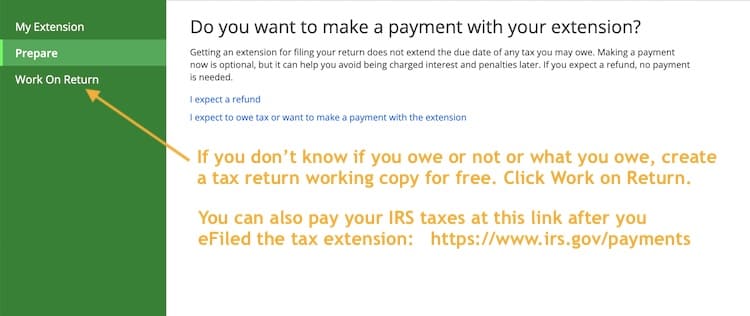

Step 3: IRS Tax Payment

If you owe taxes, you can click on the second link or you can pay directly to the IRS via this link: https://www.irs.gov/payments

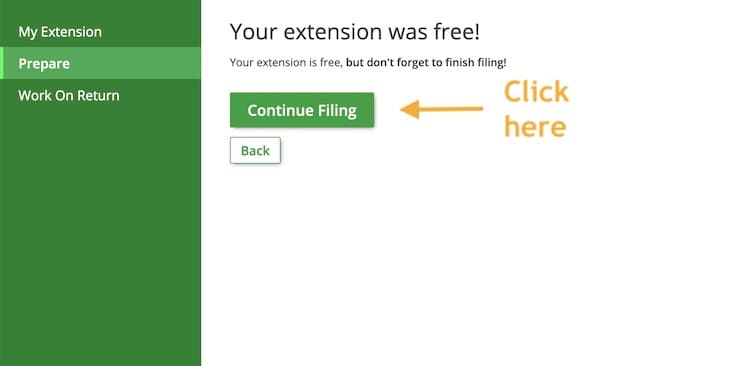

Step 4: IRS Tax Extension - Continue

Select Continue Filing - you are not finished until you complete all of these steps.

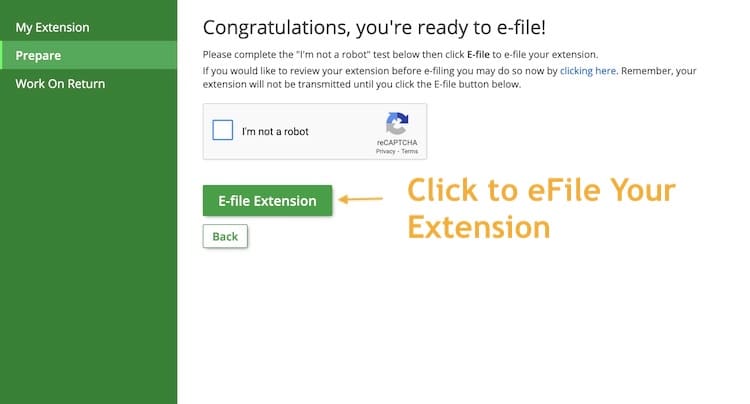

Step 5: Review Your Extension and e-File

If you need or want to review your extension, select the blue "clicking here" text to review your extension before you eFile it. Then, check the reCAPTCHA box. You must click e-File Extension in order for it to be e-filed.

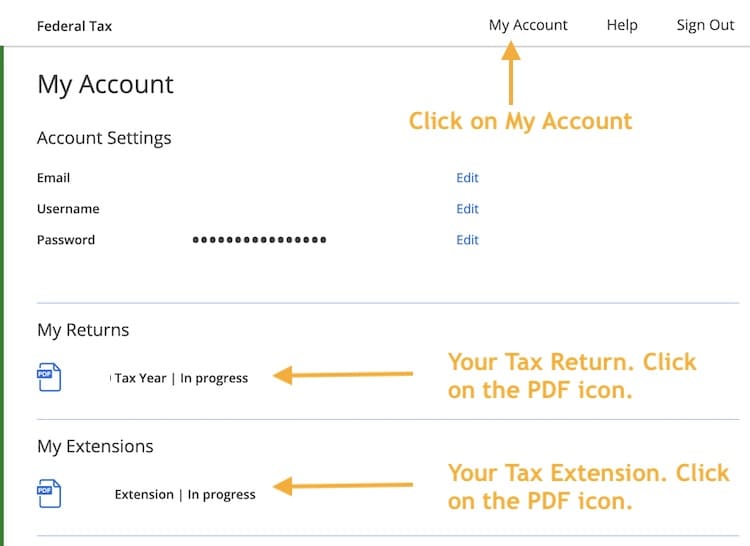

Step 6: Download a Copy

Once your IRS extension has been e-filed, select My Account and then select the PDF icon to download a copy of your IRS extension.

Step 7: Verify that the IRS Accepted Your Extension

You will receive an email once the IRS processes your extension request. Be sure to monitor your email and eFile account to see if it is accepted by the IRS. If the IRS rejects it for any reason, you can generally re-file, but you will need to do so by Tax Day.

Step 8: State Tax Extension

For most states, if you pay the state taxes you owe by the due date, that payment also serves as a state tax extension. If you do not know what you owe, create a free working copy tax return - select My Account and review the state return - pay the state tax amount, then pay your taxes by state online here.

Attention: Once your Tax Extension is accepted by the IRS, select

My Account and download your tax extension file. Once you have e-filed your tax return by

October 15,

download your Tax Return as well.

Step 9: Filing your Tax Return after the Extension

After the IRS (and applicable state) has accepted your tax extension, you have been granted time to prepare. Between now and Oct. 15, get your forms together and pay any taxes due - as much or little as you can. Return to your eFile.com account and click the Work on Return item on the menu. Here, you will see the usual preparation and filing screen. Report all of your information here and go over any forms you may have reported previously. Once everything is present, click File to see your return.

Once you are satisfied with your tax return, have reported all of your tax forms, and are ready to file, go through the eFile checkout process and use promo code ext40efile to save 40% when you complete and e-file your tax return(s) - IRS and states - by October 15.

How to Pay IRS Taxes: If you know the amount of IRS taxes you owe, click the link below to either pay via bank direct transfer, credit card, wire, check/money order or by cash.

Pay Taxes Online: IRS or Federal | State(s)

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.