Charitable Contributions

How to enter charitable contributions on eFile.com? How do I report donations to charity on my taxes?

The tax interview will take you through reporting your tax information like income, deductions, and credits. You can follow this process to report your charitable donations when you reach the Deductions & Credits section. Otherwise, you can report this information manually.

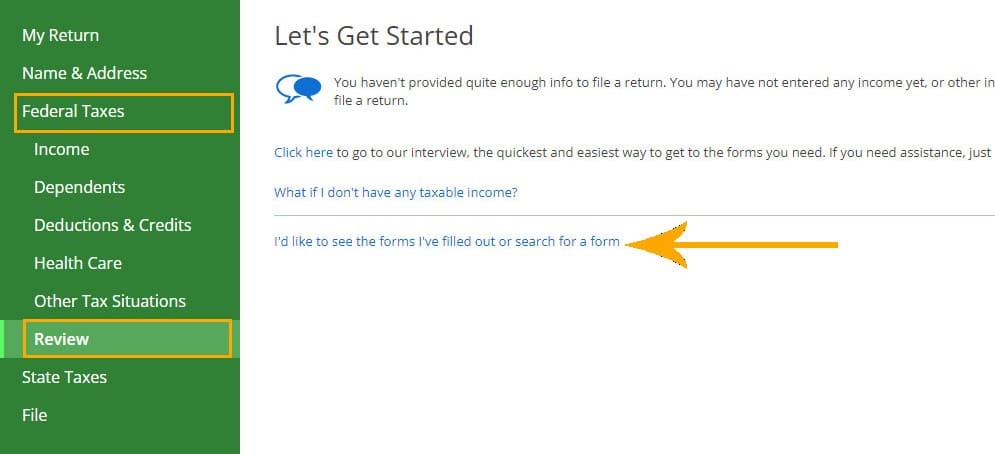

2. Select Federal Taxes -> Review

On the left side, select Federal Taxes -> Review

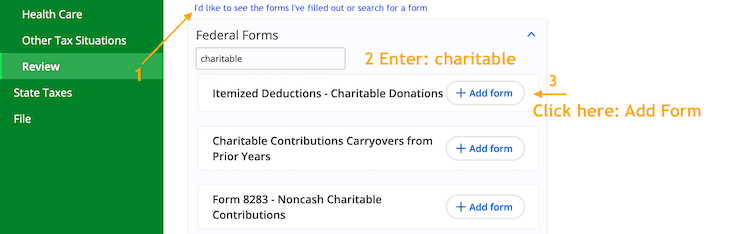

3. Add Charitable Donations form

Select the link on the right: I'd like to see the forms I've filled out or search for a form.

In the search box, enter charitable.

Select one of the charitable contribution options and select Add Form.

Start with the Itemized Deductions - Charitable Donations to enter your charitable contribution amount. You will need to answer Yes to the question: Do you have any cash contributions that you want to treat as a qualified contribution? You can enter cash and noncash contributions - if you enter noncash contributions over a certain amount, you will be directed to enter these on Form 8283 which eFile will help you fill out.

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. Be sure that you complete the Deductions & Credits section and eFile will generate itemized deductions for you if you qualify to do so. eFile claims the standard deduction for you by default so you always get the most tax savings.

Read more about charitable contributions.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.