How to Add Form 8862 to My Return

How do I add Form 8862 to file taxes after credit disallowance in prior year?

If you e-filed your return and it was rejected by the IRS - not eFile.com - due to disallowance of a tax credit in a previous year, follow the instructions below.

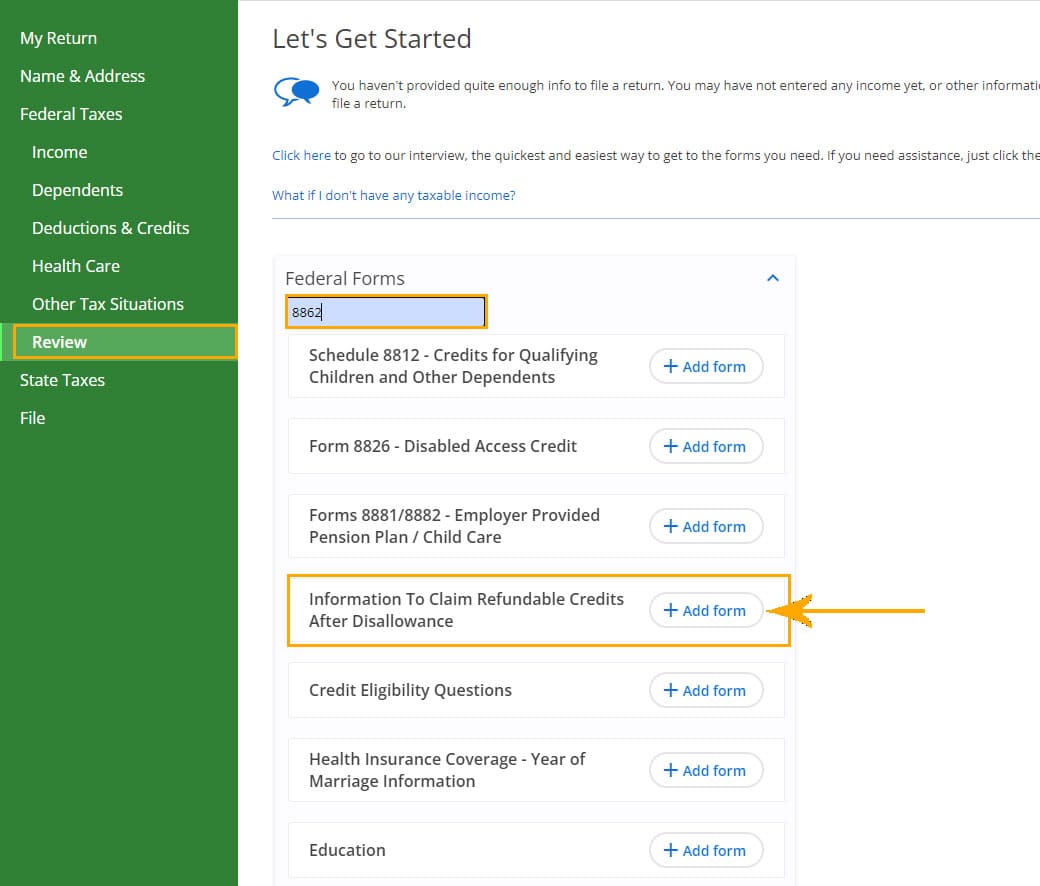

The links will provide you with instructions to re-file your returns, but you can also follow these simple steps:

2. Add Certain Credit

Select the green button to add information to claim a certain credit after disallowance. This will bring you to the needed form for your situation based on the IRS' rejection.

3. Credit Information

Fill in the applicable credit information (Earned Income Credit, Child Tax Credit, etc.). Select the credit(s) in Part 1, then answer all applicable questions to generate the form.

4. Form 8862

Save the form; when you review your return, the Form 8862 will now be included with your return.

5. eFile Your Tax Return

Select File and re-file your return by following these

checkout instructions. Be sure that you go through all of the prompts to re-send the return.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.