Coronavirus-Related Distributions; Disaster Distributions

How to file Form 8915? How to File for Disaster Treatment of Withdrawals for 2020 and 2021 tax returns? Is there still relief for up to $100,000 of coronavirus-related distributions?

For 2020 Returns, the IRS gave favorable tax treatment for up to $100,000 of coronavirus-related distributions from eligible retirement plans (certain employer retirement plans, such as section 401(k) and 403(b) plans, and IRAs) to qualified individuals, as well as special rollover rules with for such distributions. It also increases the limit on the amount a qualified individual may borrow from an eligible retirement plan (not including an IRA) and permits a plan sponsor to provide qualified individuals up to an additional year to repay their plan loans.

This treatment is not continued for COVID distributions for 2021, 2022, or any future returns. If you took a COVID-related distribution in 2020, you would have to have reported this on your 2020 Return. In 2023, use eFile.com to generate Form 8915-F to report repayment information about your 2020 distribution as applicable. This information is found on the 2020 Form 8915-E and the 2021 Form 8915-F if you repaid some of this last year.

If you took a distribution due to a qualified disaster, read below.

If you have a 1099-R reporting a distribution due to a qualified disaster, after you have added your 1099-R form reporting your distribution under Federal Taxes > Income > Retirement, on the 1099-R form in your account, click the "Advanced Options" blue link at the bottom of the screen. Then, check the box saying that you want to use Form 8915 (other forms are listed in the checkbox text too) to determine taxable amount - do not double on line 4 (but it also applies to line 5). This will calculate the taxable portion based on other factors, calculated by the app. This form may help exempt the 10% early withdrawal penalty, if applicable.

Then, be sure the 8915-F is present:

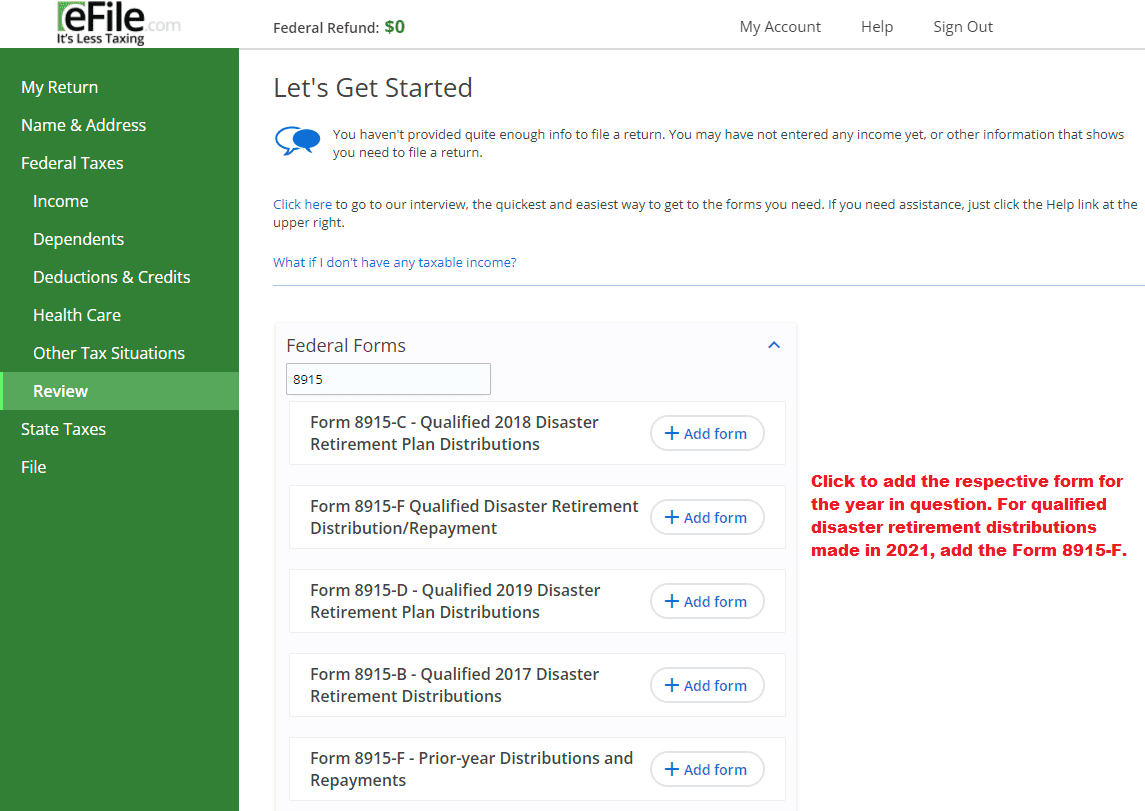

Step 1: Sign into your eFIle account.

Step 2: Click on Federal Taxes on the left, then on Review, then on I'd like to see the forms I've filled out or search for a form on the right side.

Step 3: Enter 8915 and search.

Step 4: For Form 8915-F, click on + Add Form

Step 5: Enter the total amount from your 1099-R forms and other information on the 8915 form. Save or Continue.

Report your 2020 COVID-related distribution

After adding the Form 8915-F, follow these instructions:

Do not enter the prior year distribution on 1099, ROTH, 8608 or 5329. Only add this information:

- Whose form - Taxpayer

- Select State

- Disaster calendar year - 2020

- Coronavirus checkbox

- Do not complete Parts I, II, III, and IV of Form 8915-F Qualified Disaster Retirement Distribution/Repayment

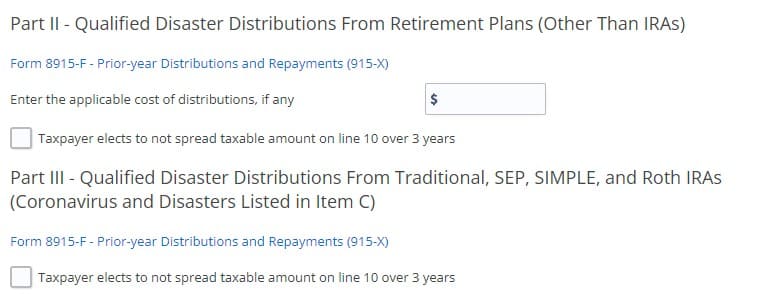

- Add Form 8915-F - Prior-year Distributions and Repayments (915-X) and complete with prior year 8915-E and 8915-F information and repayment amounts.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.