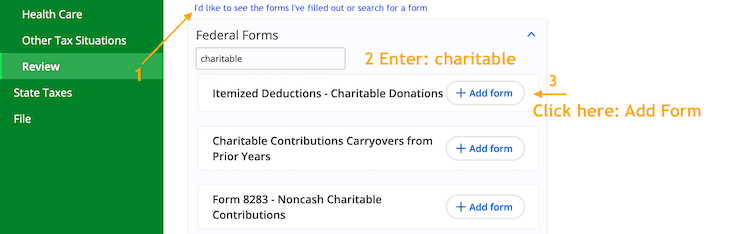

Select the link on the right: I'd like to see the forms I've filled out or search for a form

In the search box, enter charitable

Select one of the charitable contribution options and click Add Form.

Select the Itemized Deductions - Charitable Donations form and Add form as shown below to enter your charitable contribution amount. You will need to answer Yes to the question: Do you have any cash contributions that you want to treat as a qualified contribution?

Read more about charitable contributions.

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. For 2020 and 2021 returns, individuals who do not itemize their deductions may deduct up to $300 (or $600 if filing jointly) from their gross income for qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments. This does not apply to 2022 Returns or to any other year.