Recovery Rebate Credit 2021 Tax Return

This page is archived as you can no longer e-file a return to claim any 2020 or 2021 stimulus payments. See how to claim Stimulus payment 1, 2, and/or 3.

The Recovery Rebate Credit on Your 2021 Tax Return as the adjustment to the 3rd stimulus payments

If you did not get either the stimulus one or stimulus two payments, you can only paper file your 2020 return. If you did not receive the Third Stimulus Payment in 2021, you can report this on eFile.com and the Recovery Rebate Credit. If you’re eligible to claim the 2021 Recovery Rebate credit, you must file a tax return by April 15, 2025, to claim the credit. Before you do this, check one last time the status of your stimulus payment(s).

Get Your Stimulus Payment Status and/or Track Stimulus Payment by EIP Card.

Recovery Rebate Credit

The Recovery Rebate Credit is a new line item on the 2020 Tax Return and is in the same place on the 2021 Return, listed on line 30 on the 2021 1040 form.

- Attention: It's very important to know that the 2021 Tax Return is NOT TO BE SOLELY used to only receive the 3rd stimulus payment via the Recovery Rebate Credit. You must also report and e-File all your 2021 taxable income, deductions, credits, etc. as any additional 2021 Tax Return(s) would get rejected. See this page if you are only filing to claim the 3rd stimulus payment.

If you did not receive your 3rd stimulus payment, add all of your tax information (income, dependents, etc.) and work through the entire tax interview. At the end, you will be asked if you received the third stimulus payment. If you did not receive it, just enter "0" (zero, no quotes) on the recovery rebate page. Otherwise, enter the amounts you received for the third stimulus payments. Important: Use this tool to see if you were eligible for the third stimulus.

To add the information manually:

- Sign Up OR Sign In your eFile.com account and complete the initial required steps. Then copy and paste the link below into the browser when in your account

- Once you are logged in, copy and paste or click: https://mytaxes.efile.com/1040/federal/per/form/fdx100-1

- Or, navigate to Federal Taxes > Other Tax Situations and answer the applicable Recovery Rebate question.

- Or, follow these instructions on your screen.

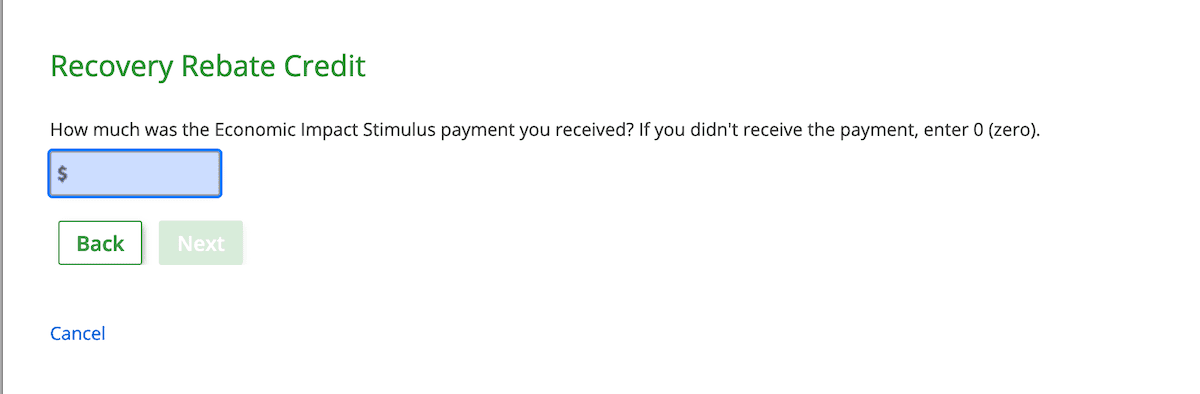

Recovery Rebate Entry Screen for the 3rd Stimulus Payment

If you received the 3rd Stimulus Payment or Economic Impact Payment in 2021, enter the amount you received or the amount listed on Notice 1444-C and mailed to you from the IRS. If you DID NOT receive the stimulus payment, enter "0" (zero). If you did not get notice 1444-C or have since discarded it, enter the amount you received as your 3rd stimulus payment.

Below are the screen steps about the Recovery Rebate Credit which are followed by the Advance Child Tax Credit screens.

1. Click on the link Other Tax Situation.

2. Click Yes if you received Stimulus 3 payments.

4. Enter your stimulus 3 payment.

Enter your stimulus 3 payment. The IRS will compare your entry with the payment they made or not. If you should have received an higher amount than paid to you, you will receive the Recovery Rebate Credit.

5. Recovery Rebate entry.

You can Edit your Recovery Rebate entry or remove it via the link: I'd like to remove this information. Or click on Let's move forward e Recovery Rebate Credit.

7. Notice 1444-C.

Make sure you keep and save the letter from the IRS with your 2021 Tax Return records. You will need the Economic Impact Payment amount you received as stated in the letter from the IRS Notice 1444-C for your 3rd Stimulus payment. If you DID NOT receive, for any reason, the third stimulus payment, enter a 0 - as in number zero - on the Recovery Rebate Page on your 2021 Tax Return.

8. Attention.

If you have already reported the Recovery Rebate Credit (RRC) on your e-Filed 2021 Return and have since received the stimulus payment, the IRS will most likely adjust or remove the Recovery Rebate Credit from your 2021 Tax Return if the IRS has record that the stimulus payment was indeed issued to anyone claiming the Recovery Rebate Credit. As the IRS has to coordinate this internally, this might be one of the reasons for the delay to the start of the 2022 tax filing season.

However, we do recommend that you monitor the refund you receive from your return and if you get the stimulus payment in error, then you should contact the IRS before you take any other steps, e.g. file a tax amendment to your 2021 Tax Return.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.