IRS Tax Audit Appeals and Protests, Statistics

Just the thought of a tax audit notice (called an "examination" by the IRS) terrifies most taxpayers. Even the mention of the IRS can evoke strong emotions from people suspecting that an IRS auditor is there to increase their tax liability rather than give an accurate assessment of their taxes.

During fiscal year 2022, the Internal Revenue Service, IRS, completed 708,309 individual audits, up from 659,012 in 2021. This is about 0.43% of the roughly 164 million individual income tax returns filed. According to the IRS: “Some people play the audit lottery, meaning they’ll do whatever they want and know that the chances of getting caught are slim.”

This 2022 IRS Audit Report shows that 2019 audit rates doubled in 2022 in every income category above $100,000. Audit rates for income categories between $500,000 and $1 million doubled to 0.6%. Audit rates for the $1 million to $5 million category more than doubled to 1.3% and taxpayers earning more than $10 million jumped four times – reaching 8%.

If you disagree with the results or contents of an audit, you have the right to file an appeal. In addition, you may also file an income tax appeal in response to a tax lien, a tax levy, a rejection of an offer in compromise, a penalty, or if you otherwise disagree with a tax liability adjustment made by the IRS. We offer free audit assistance if needed once you prepare and e-file your tax return on eFile.com. Learn more about how to appeal an audit notice and IRS audit statistics below.

Question: What's the difference between an ambitious tax auditor and a Rottweiler? A Rottweiler eventually lets go.

Taxpayer Stories of Painful IRS Audits

How a Tax Audit is Determined by the IRS

Tax audits are selected by computer programs that calculate which tax returns are most likely to be in error. The auditor then approaches the individual and conducts a line-by-line analysis of their personal finances. Other signals that might trigger an IRS audit include high tax deductions compared to income, erroneous tax items, or failure to include proper proof or explanation for major one-time losses.

Appealing an IRS Audit Notice

Here are ten things you need to know about IRS audits and appealing to them:

- The IRS Sends Most Audits by Correspondence: In most cases, you file a tax return and later receive a notice from the IRS stating that you did not report specific information on your return (such as additional income you received). Such notices usually ask you to sign the form included with the notices and mail it back if you agree or will ask you for an explanation of why the information you reported is incorrect. If done promptly, you can inform the IRS that you disagree with it.

- Look Out for an Examination Report If You Don't Respond to the 1st Notice: Be aware that the first IRS notice is not a notice of proposed deficiency, but you should still answer it by the date listed in the notice. The IRS may send you an Examination Report and letter (otherwise called a "30-day letter") if you fail to respond to the first notice. It will usually say that you have 30 days to respond via a written and mailed protest letter.

- Write and Submit a Protest on Time: If you received an Examination Report from the IRS, write a protest letter, sign it, and mail it to the IRS before the deadline listed in the Report. Provide a complete explanation and attach relevant documents to your protest. Make sure that you keep a copy of your submitted protest (as well as proof of mailing). If you reply to the Report in a timely matter, you will usually receive a response from the IRS stating that they will transfer your case to the IRS Appeals Division (a separate part of the IRS).

- The IRS Appeals Division is Nationwide: Most tax cases are assigned and resolved by your closest Appeals Office. However, you can usually request a different office where your tax lawyer is located (if you have one) to handle the Appeal. The IRS Appeals Division's mission statement is to help taxpayers resolve cases. Most cases involve the auditor recommending additional tax information, and the taxpayer disagrees with the recommendation. Therefore, the process of working out compromises in the Appeals office can work for you. You can either employ a tax lawyer, accountant, or an IRS-enrolled agent authorized to practice before the IRS to help you with the appeal. Alternatively, you can do the appeal yourself, but be aware that it's generally less effective (though it may be less expensive).

- You'll Receive a Notice of Deficiency if You Don't Reply to IRS or Appeal Your Case: Referred to as a "90-day letter" by tax practitioners, the IRS mails you a Notice of Deficiency requesting you to respond to the notice within 90 days (the IRS is required to list the actual deadline on a page of the notice). The IRS requires you to respond to the notice by filing a Tax Court petition in the U.S. Tax Court clerk's office in Washington, D.C. Though it's best to hire a tax lawyer to handle these notices, some taxpayers decide to handle it on their own. If you choose to handle the notice on your own, a small tax case procedure is available where you can represent yourself in cases where less than $25,000 in tax is in dispute. Unfortunately, the U.S. Court cannot hear your case if you miss the 90-day deadline.

- Tax Court Judges Travel to Your Area: Though the Tax Court building and clerks are located in Washington, D.C., the judges travel to federal courthouses across the country to conduct trials. When you file your Tax Court petition, you can pick the city where your case will be heard. The Tax Court rules and procedure are streamlined with relaxed rules of evidence, so no jury is present at these types of trials. However, you can call witnesses, and many cases are presented based on a "stipulated record" (which means you and the government agree on certain facts about the case).

- You Can Go Back to IRS Appeals After Responding to a Notice of Deficiency: Though the only way to respond to a Notice of Deficiency is to file a timely petition U.S. Tax Court, it does not mean that your case will be decided in court. After an IRS lawyer responds to your Tax Court petition (usually denying whatever your petition says), you can request that the lawyer transfers your case to IRS Appeals.

- You May Be Able to Get an Extension of Time to Respond: The IRS will grant extensions of time to respond to many notices, but there are some types of notices (such as Notices of Deficiency) that you will not be able to extend your time to respond to time. Request and confirm your extension request via a written reply (you may want to confirm everything you do with the IRS in writing).

- Some IRS Actions Can Be Undone: It's still possible to undo some IRS actions after responding to IRS notices on time (such as liens on property or levies on a bank account). However, undoing these actions is usually more expensive and harder, so it usually requires professional help.

- You Can Pay the Taxes the Notice of Deficiency Says You Owe, Then Sue for a Refund: If you don't respond to a Notice of Deficiency within 90 days but have an assessment, you can still appeal against your taxes owed amount in the federal district court or the U.S. Claims Courts. Usually, you're required to pay the taxes first and then file a refund claim. If your refund request is not granted, then you can sue for a refund. You can still go to court, and sometimes you're only required to pay a portion of the tax liability.

If the IRS makes an adjustment to the taxes owed amount you reported on your tax return, you will receive a letter containing instructions on how to begin the appeals process. You will generally have to make a Small Case Request by filling out Form 12203, Request for Appeals Review, and/or a Request for Appeal via Form 12203-A and mailing it to the address indicated in the letter you received. In certain cases, such as owing more than $25,000, you may be required to draft a Formal Written Protest and send it to the IRS. For more details about how to make an appeal through a Small Case Request or a Formal Written Protest, see IRS Publication 5: Your Appeal Rights and How to Prepare a Protest if You Disagree.

The IRS Appeals Office is independent of the IRS office whose action you are appealing. Once your appeals request is granted, you will be asked to attend an informal conference with an appeals officer. At this conference, you may represent yourself or be accompanied and represented by an attorney, certified public accountant, or other tax professional enrolled to practice before the IRS. You should bring to the conference any documentation which supports your position. You may also bring witnesses to support you.

If you disagree with the results of the Appeals process, your only recourse is the court system. Certain claims may be heard by the United States Tax Court, but only after you have gone through the appeals process. If you choose not to make an official appeal to the IRS, you may still be able to make a claim with the United States District Court or the United States Court of Federal Claims.

For more information about your rights of appeal and why the IRS might examine (audit) your tax return in the first place, please see Publication 556: Examination of Returns, Appeal Rights, and Claims for Refund.

What Is an Audit Reconsideration?

Audit reconsideration is an informal process through which tax disputes can be resolved without having to take the issue to a tax court. You may request audit reconsideration in two cases:

- The IRS audited your tax return, and you disagree with the assessment.

- The IRS created a tax return for you (because you did not file but were required to), and you disagree with the results.

The IRS may only accept an Audit Reconsideration Request if:

- You submit new information affecting the amount of tax you owe.

- You were denied tax credits you believed you deserved.

- You believe the IRS made errors assessing your tax or processing your return.

- You filed a tax return after the IRS created one for you.

Note: Remember that even if the IRS accepts your request, they may not change their original assessment.

The IRS will NOT accept an audit reconsideration request if:

Here is how to begin the audit reconsideration process:

- File a tax return if you have not already done so.

- Write the IRS a letter informing them of the changes you wish them to consider.

- Include as much documentation that supports your position as possible and your examination report (generally a Form 4549).

- Include your daytime and evening telephone numbers and indicate the best time to reach you.

- Mail the letter and documentation to the IRS campus indicated on your examination report.

Once your request has been considered, or if more information is needed, the IRS will contact you. Whether they have reduced the tax they initially assessed or not, you can now pay your tax liability or make an Appeal. If you decide to pay your taxes, you may pay the bill in full, make an Installment Agreement Request, or make an Offer-in-Compromise.

Tax Audit History and Statistics

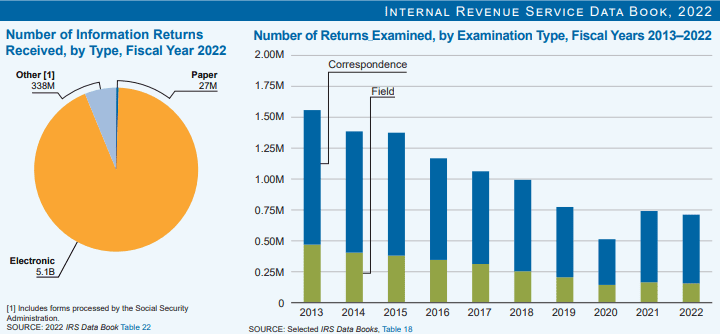

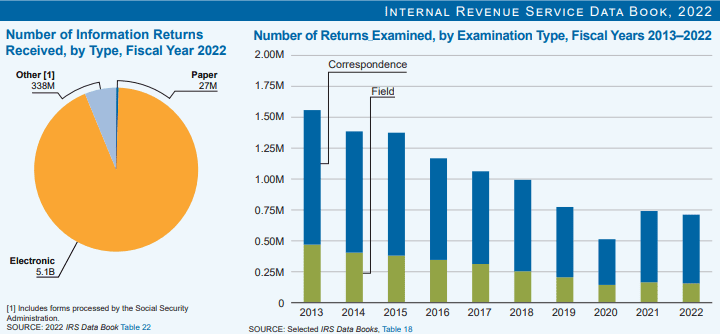

Though the IRS sends examination notices every year, the good news is that they do not send as many notices compared to previous years. Read on to learn more about the latest tax audit statistics and history.

In Fiscal Year (FY) 2021, the IRS audited 738,959 tax returns, resulting in nearly $12.9 billion in recommended additional tax.

Audit Rates from 2013 - 2020

No Income

3,631,912

10,829

0.3%

Less $25,000

49,787,775

197,912

0.4%

$25,001-$50,000

39,516,857

83,361

0.2%

$50,001-$75,000

23,041,847

29,672

0.1%

$75,001-$100,000

14,726,736

16,132

0.1%

$100,001-$200,000

23,403,399

29,272

0.1%

$200,001-$500,000

8,165,629

29,272

0.2%

$500,001-$1,000,000

1,385,407

5,572

0.4%

$1,000,001-$5,000,000

622,329

2,618

0.4%

$5,000,001-$10,000,000

46,254

301

10.7%

$10,000,001 above

30,646

744

2.4%

No Income

822,945

6,441

0.80%

Less $25,000

49,276,854

184,216

0.40%

$25,001-$50,000

37,980,961

68,426

0.20%

$50,001-$75,000

22,635,798

24,612

0.10%

$75,001-$100,000

14,507,318

14,673

0.10%

$100,001-$200,000

22,850,934

27,270

0.10%

$200,001-$500,000

7,784,215

7,980

0.10%

$500,001-$1,000,000

1,298,420

3,850

0.20%

$1,000,001-$5,000,000

574,713

3,464

0.60%

$5,000,001-$10,000,000

40,191

408

1.00%

$10,000,001 above

24,457

492

2.00%

No Income

688,753

13,965

2.00%

Less $25,000

49,364,340

194,390

0.40%

$25,001-$50,000

36,664,872

76,127

0.20%

$50,001-$75,000

21,730,391

26,712

0.10%

$75,001-$100,000

13,988,214

15,452

0.10%

$100,001-$200,000

22,077,272

26,821

0.10%

$200,001-$500,000

7,377,133

8,620

0.10%

$500,001-$1,000,000

1,249,264

2,925

0.20%

$1,000,001-$5,000,000

566,107

3,525

0.60%

$5,000,001-$10,000,000

41,434

420

1.00%

$10,000,001 above

26,517

1,412

5.30%

No Income

691,967

27,279

3.90%

Less $25,000

51,853,559

294,299

0.60%

$25,001-$50,000

36,111,731

84,567

0.20%

$50,001-$75,000

21,252,437

65,068

0.30%

$75,001-$100,000

13,630,981

53,868

0.40%

$100,001-$200,000

20,929,068

90,249

0.40%

$200,001-$500,000

6,721,305

26,806

0.40%

$500,001-$1,000,000

1,140,173

9,007

0.80%

$1,000,001-$5,000,000

511,640

8,598

1.70%

$5,000,001-$10,000,000

36,895

1,022

2.80%

$10,000,001 above

23,475

1,160

4.90%

No Income

677,256

39,183

5.80%

Less $25,000

52,677,494

339,318

0.60%

$25,001-$50,000

35,816,063

130,582

0.40%

$50,001-$75,000

20,578,233

68,236

0.30%

$75,001-$100,000

13,199,129

49,115

0.40%

$100,001-$200,000

19,755,417

85,979

0.40%

$200,001-$500,000

6,051,639

31,977

0.50%

$500,001-$1,000,000

1,017,244

11,397

1.10%

$1,000,001-$5,000,000

449,500

9,992

2.20%

$5,000,001-$10,000,000

31,232

1,302

4.20%

$10,000,001 above

18,947

1,137

7.00%

No Income

701,594

31,329

4.47%

Less $25,000

54,135,898

357,410

0.66%

$25,001-$50,000

35,589,401

141,727

0.40%

$50,001-$75,000

20,312,858

108,219

0.53%

$75,001-$100,000

13,063,770

64,324

0.49%

$100,001-$200,000

19,459,846

92,124

0.47%

$200,001-$500,000

5,788,644

31,804

0.55%

$500,001-$1,000,000

962,481

10,898

1.13%

$1,000,001-$5,000,000

428,082

10,244

2.39%

$5,000,001-$10,000,000

31,159

1,367

4.39%

$10,000,001 above

19,531

1,593

8.16%

No Income

662,876

49,829

7.52%

Less $25,000

54,956,300

390,799

0.71%

$25,001-$50,000

35,090,262

147,805

0.42%

$50,001-$75,000

19,676,659

82,822

0.42%

$75,001-$100,000

13,130,657

49,717

0.38%

$100,001-$200,000

18,405,264

73,729

0.40%

$200,001-$500,000

5,324,980

29,884

0.56%

$500,001-$1,000,000

910,977

10,362

1.14%

$1,000,001-$5,000,000

401,634

10,651

2.65%

$5,000,001-$10,000,000

28,847

1,512

5.24%

$10,000,001 above

18,122

1,572

8.67%

No Income

619,694

78,573

12.68%

Less $25,000

56,181,555

464,856

0.83%

$25,001-$50,000

34,753,396

121,841

0.35%

$50,001-$75,000

19,532,032

63,700

0.33%

$75,001-$100,000

12,787,903

52,852

0.41%

$100,001-$200,000

17,451,788

90,236

0.52%

$200,001-$500,000

4,844,782

40,290

0.83%

$500,001-$1,000,000

800,121

11,802

1.48%

$1,000,001-$5,000,000

342,605

10,782

3.15%

$5,000,001-$10,000,000

23,413

1,499

6.40%

$10,000,001 above

14,009

1,689

12.06%

1) No Income refers to returns that do not show positive income. 2) Total received tax returns. 3) Returns examined or audited, both closed and in progress.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.