Health Insurance Marketplace Form 1095-A

Since there is no longer an individual mandate, you will not pay a penalty if you did not have health insurance this year. However, some states have a health insurance requirement. If you received health insurance through the Health Insurance Marketplace (also known as an Exchange), your coverage will be reported on a 1095-A and you will need to file with the information from that form with your tax return for the Premium Tax Credit. The eFile.com tax app lets you add the information from your Form 1095-A during the online tax return interview.

Forms 1095-B and 1095-C are not required with your tax return. You are no longer required to report your health insurance on your federal return UNLESS you or a family member were enrolled in health insurance through the Marketplace and you received a Form 1095-A, regardless of if advance payments of the Premium Tax Credit were made to your insurance company to reduce your monthly premium payment. When you prepare your tax return on eFile.com, you can easily report and e-file your healthcare information with your return. When you start a tax return on eFile.com, we will report the required information regarding your health insurance and the Premium Tax Credit on the correct tax forms.

Premium Tax

Credit

Qualifications

Report Health Insurance on your Tax Return

At eFile.com, we cover all the health care tax forms in the following pages:

- Form 1095-A-Health Insurance Marketplace Statement (this page)

- Form 1095-B-Health Coverage

- Form 1095-C-Employer-Provided Health Insurance Offer and Coverage

- Form 8962-Premium Tax Credit

- Form 8965-Health Coverage Exemptions.

When you prepare your tax return on eFile.com, answer a few simple tax questions and your health insurance information is automatically reported on your return. There's no need to mail any of the forms above to the IRS.

Form 1095-A

A 1095-A, Health Insurance Marketplace Statement, is a form you receive from the Health Insurance Marketplace (or Health Insurance Exchange) at Healthcare.gov if you and any of your family member(s) purchased health insurance through the Marketplace for some or all of the year. On eFile.com, it's easy to report your 1095-A information. The eFile tax app will automatically select the tax form(s) for you to complete in order to report your 1095-A information for the Premium Tax Credit.

This form lists the following information about a Health Insurance Marketplace policy:

- Who is enrolled in the policy

- Details about the coverage

- Months when the individual was covered by the policy.

You can possibly receive more than one 1095-A form if any of the following situations apply to you:

- All the members of your household were not enrolled in the same health plan

- You updated your healthcare information and/or your family's healthcare information during the year (i.e. switched from one plan to another)

- You and/or your family members are enrolled in plans from different states.

When you Should Receive Form 1095-A

You should receive Form 1095-A from the Marketplace by the end of January of the tax year. If you do not receive your 1095-A by then, visit the Marketplace's website (Healthcare.gov) for information on how to request a copy of your form online from the Marketplace. The IRS does not issue nor provide you a copy of your 1095-A.

How to Use Form 1095-A

You use the information from that form to report your advance payments of the Premium Tax Credit on Form 8962. The payments are listed on your Form 1095-A. When you prepare your tax return on eFile.com, the tax app will help you report your payment information in the right section based on your answers to several tax questions.

Reporting Your 1095-A

You will need to file a tax return reporting the advance Premium Tax Credit amounts from that form (even if you are not required to file a return otherwise). When you prepare your return, you will include the advance payment amounts from your Form 1095-A, and then we will prepare Form 8962 to eFile with your return. Not filing your return will cause an IRS rejection, a delay in your refund, and may affect your future advance credit payments. On eFile.com, it's easy to report your advance payment amounts correctly on your tax return and eFileIT. We will do the calculations and generate the necessary forms to report your insurance for the Premium Tax Credit. You do not need to attach Form 1095-A to your return, so you can keep it with your tax records after you use the information from the form to prepare and e-file your tax return on eFile.com.

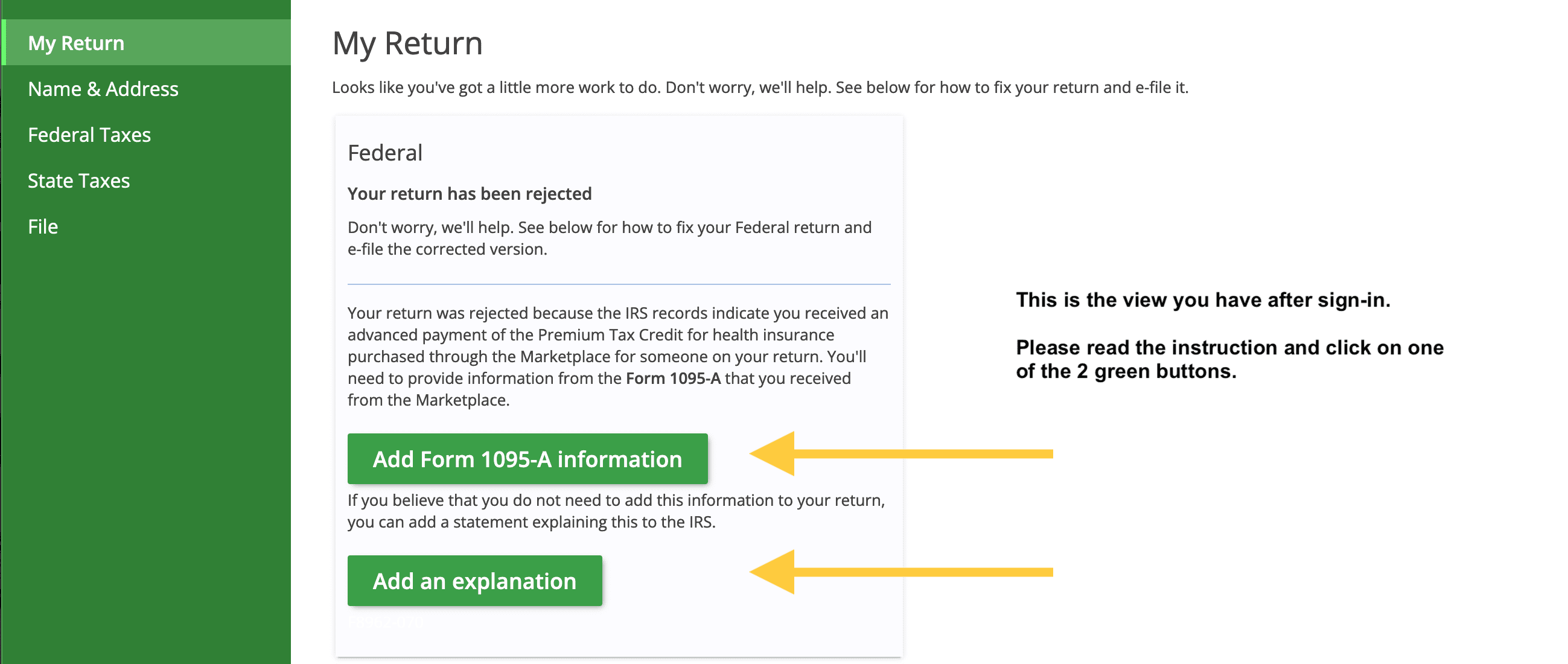

If you have not received your 1095-A, the IRS recommends that you wait until you receive the form before preparing and filing your tax return. If you file your return before you receive the form, the IRS might delay your refund or even reject your return. If your return is rejected for not including 1095-A, you can retrieve this form and re-file through your eFile.com account.

How to add the 1095-A on eFile.com - review the linked instructions for step-by-step help.

Premium Tax Credit

The Premium Tax Credit is a refundable tax credit you can claim on your tax return if you and/or your family has a low or moderate income (between 100% and 400% of the federal poverty line) to help you afford health insurance purchased through the Marketplace.

To find out if you qualify for the Premium Tax Credit, prepare and e-file your tax return on eFile.com! After you answer a few simple tax questions, eFile.com will determine your eligibility and calculate your credit amount.

Important: If you still need to file your 2020 Return, there was a change made due to the way the Advance Premium Tax Credit was handled because of the American Rescue Plan Act. If you claimed an advance payment of the PTC, you are not required to report this on your return. If you have already filed and reported this, then the IRS will issue you a refund for the portion you paid back, if applicable (if you claimed too much of the credit and thus owed a portion back). See our Premium Tax Credit page for more details.

More Information on Health Insurance and Taxes

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.